What is the story about?

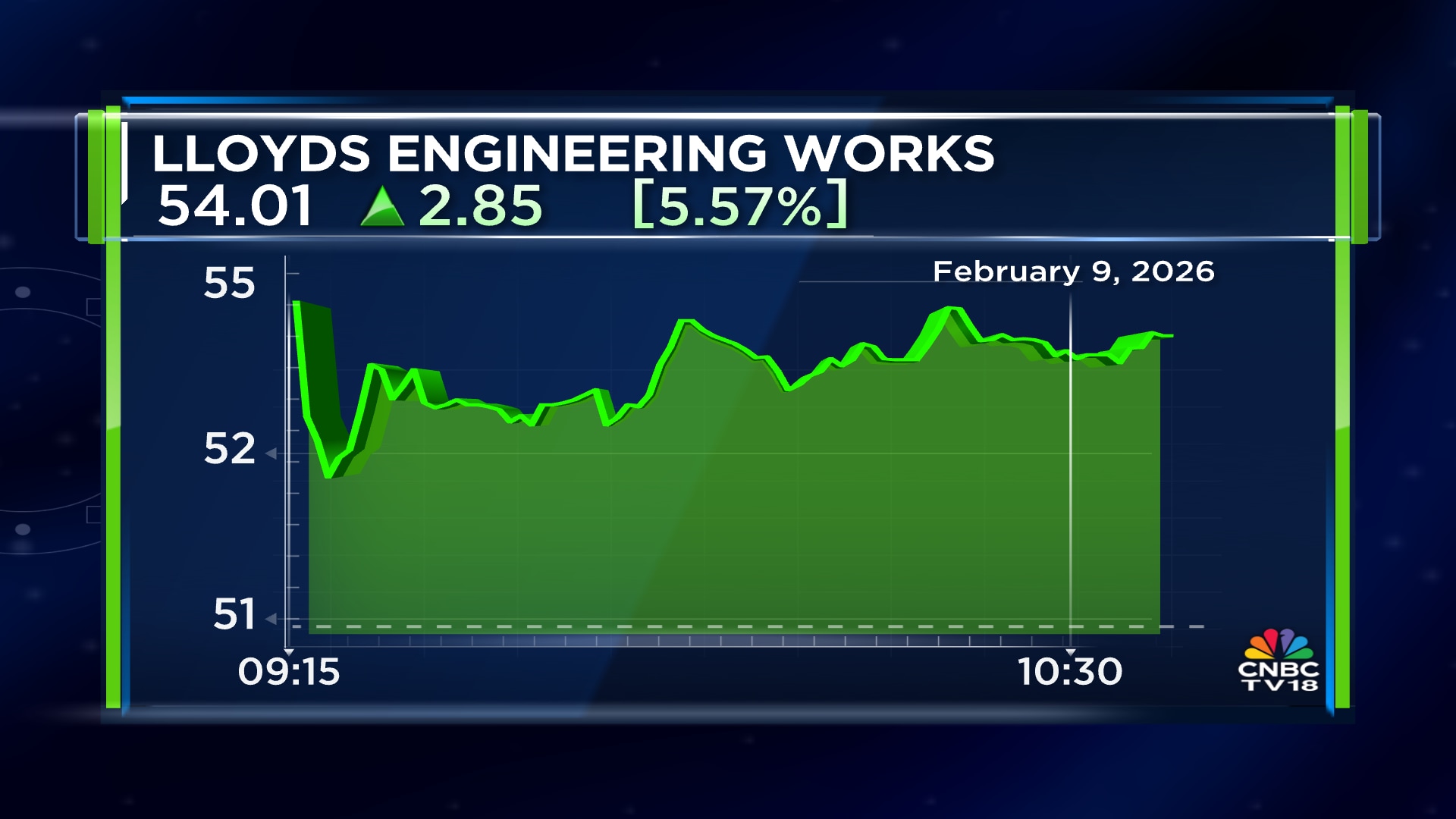

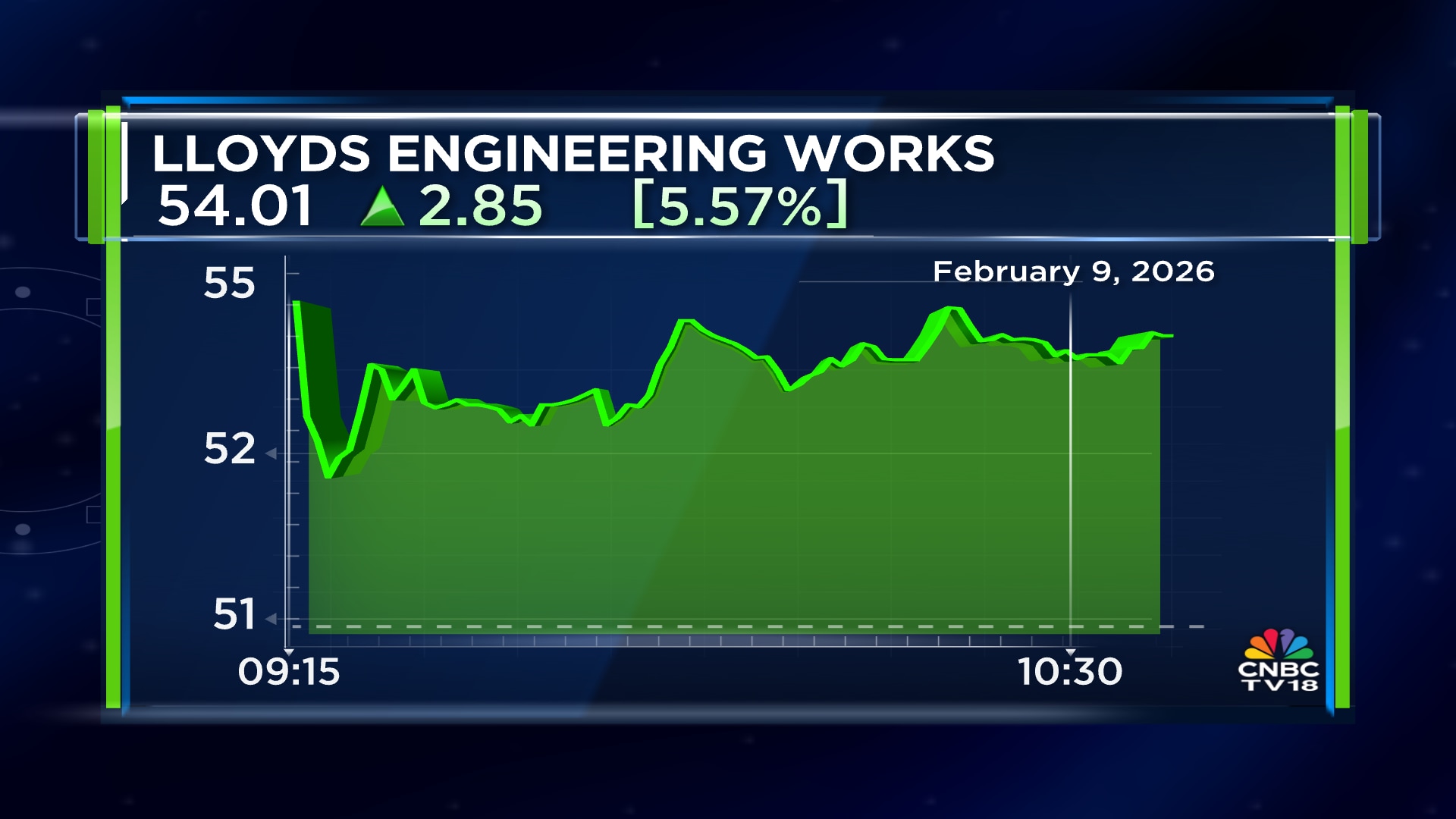

Shares of Lloyds Engineering Works Ltd. gained over 6% on Monday, February 9, after sources indicated that the promoter group likely sold about 9% stake via block deals.

As many as 10.57 crore shares, or 9.1% equity of Lloyds Engineering, worth ₹550 crore changed hands in block deals on Monday.

Sources told CNBC-TV18 that the company's promoter group has likely to have sold 9% of its stake via block deal. Triveni Earth Movers has likely to have bought 9% in Monday's block deal, sources added.

As per data available on the stock exchanges, at the end of the December quarter, promoter

Lloyds Enterprises Ltd. held 33.19% stake in the company. Meanwhile, promoter groups Lloyds Metals and Minerals Trading LLP and Aeon Trading LLP held 8.02% stake each in the firm.

Lloyds Engineering reported its third quarter earnings last week .

The company's net profit increased 69.5% to 61 crore in the third quarter from 36 crore in the third quarter of the previous year. Its revenue increased 2.3% to ₹272.4 crore. The company's earnings before interest, tax, depreciation and amortisation (EBITDA) increased 20% to ₹52.9 crore from the previous year, while its margin expanded to 19.4% from 16.6% in the year-ago period.

Shares of Lloyds Engineering gained 6.2% to hit an intraday high of ₹54.39 in trade on Monday. The stock was up 5% at ₹53.79 apiece around 10.35 am. It has declined 17% in the past year.

Also Read: JK Tyre shares jump 5% after healthy Q3, management guides margin above 13%

As many as 10.57 crore shares, or 9.1% equity of Lloyds Engineering, worth ₹550 crore changed hands in block deals on Monday.

Sources told CNBC-TV18 that the company's promoter group has likely to have sold 9% of its stake via block deal. Triveni Earth Movers has likely to have bought 9% in Monday's block deal, sources added.

As per data available on the stock exchanges, at the end of the December quarter, promoter

Lloyds Engineering reported its third quarter earnings last week .

The company's net profit increased 69.5% to 61 crore in the third quarter from 36 crore in the third quarter of the previous year. Its revenue increased 2.3% to ₹272.4 crore. The company's earnings before interest, tax, depreciation and amortisation (EBITDA) increased 20% to ₹52.9 crore from the previous year, while its margin expanded to 19.4% from 16.6% in the year-ago period.

Shares of Lloyds Engineering gained 6.2% to hit an intraday high of ₹54.39 in trade on Monday. The stock was up 5% at ₹53.79 apiece around 10.35 am. It has declined 17% in the past year.

Also Read: JK Tyre shares jump 5% after healthy Q3, management guides margin above 13%

/images/ppid_59c68470-image-177061511575549100.webp)

/images/ppid_a911dc6a-image-177061302968174841.webp)

/images/ppid_59c68470-image-177061266794829466.webp)

/images/ppid_59c68470-image-177061258826182519.webp)

/images/ppid_a911dc6a-image-177061362959192727.webp)