What is the story about?

The Reserve Bank of India (RBI) is expected to keep policy rates unchanged in its upcoming February 6 meeting, even as the recently concluded US-India tariff deal significantly improves India’s near-term macro outlook.

Economists on CNBC-TV18’s Citizen Monetary Policy Committee (MPC) agreed that while the trade agreement eases several constraints for monetary policy, it does not yet warrant an immediate rate cut.

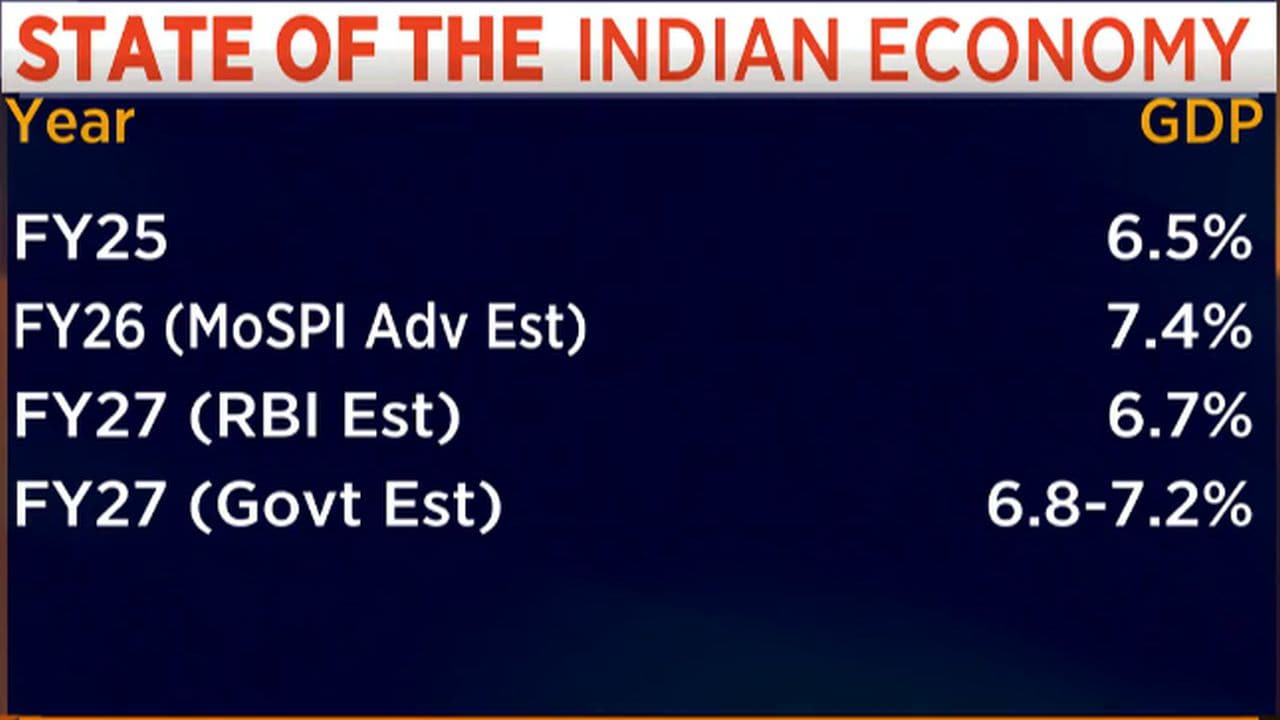

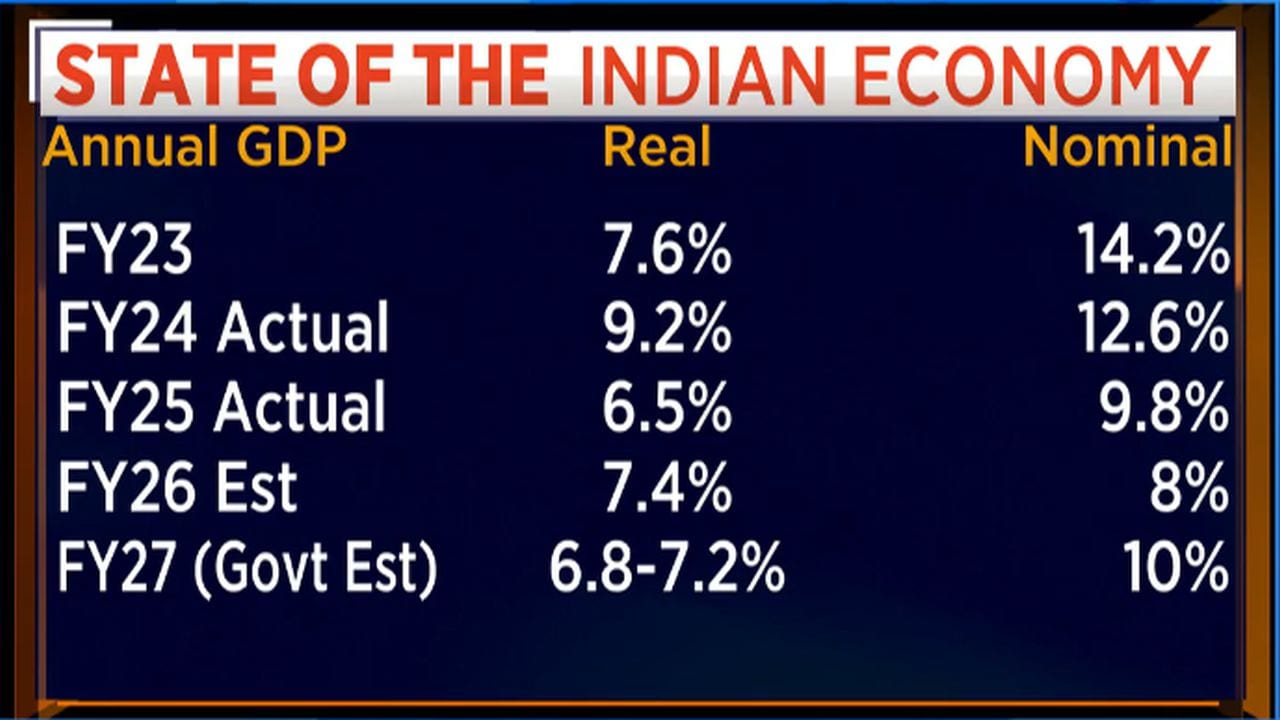

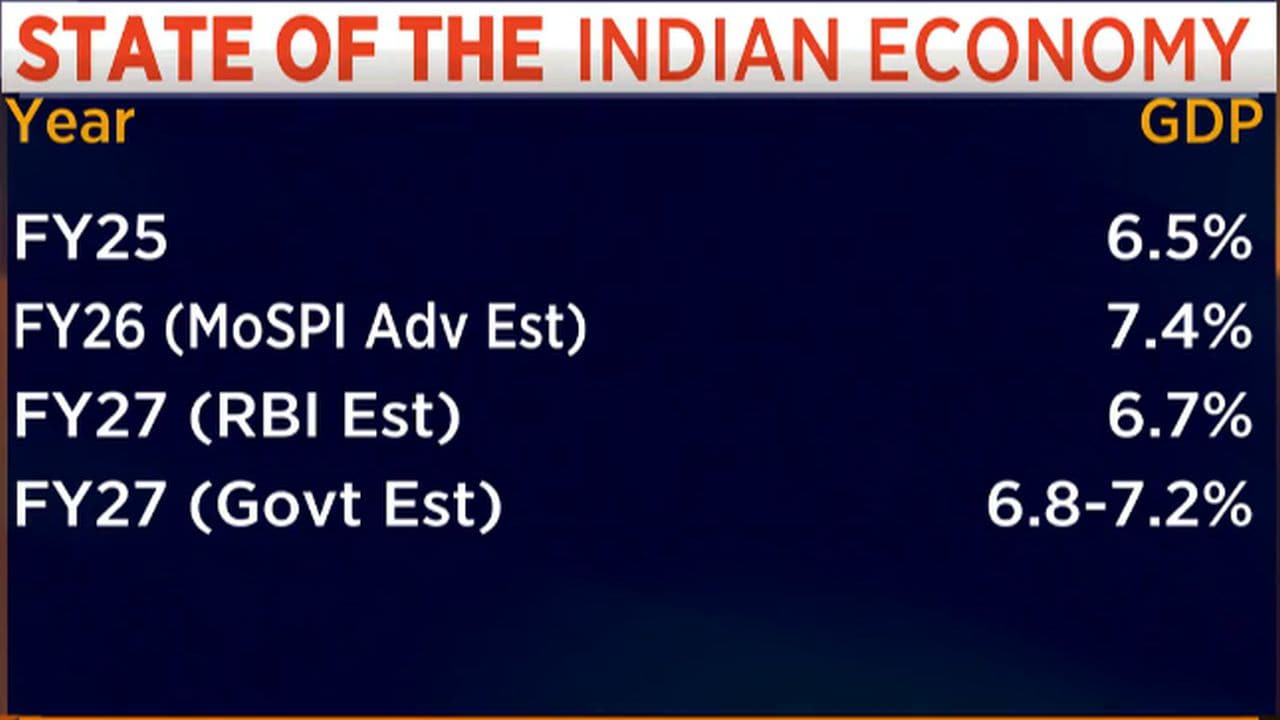

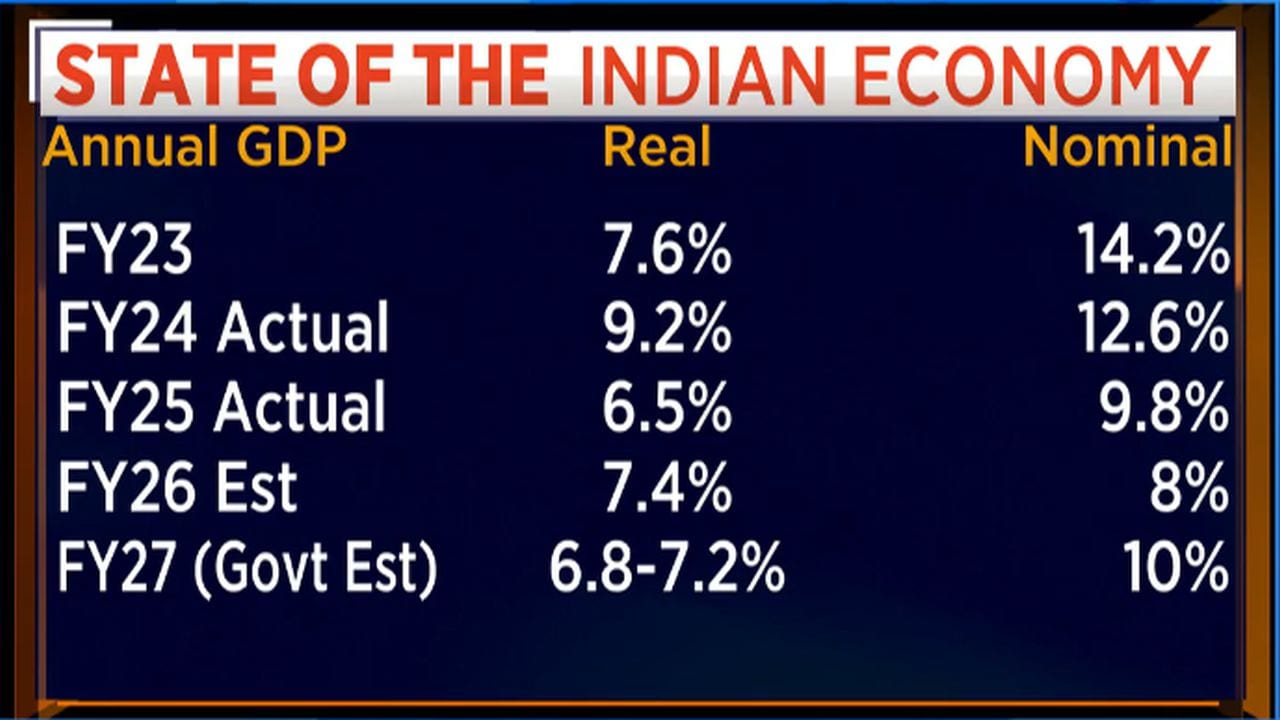

According to Sonal Varma, Managing Director and Chief Economist at Nomura, the trade deal materially strengthens India’s growth-inflation dynamics. “With this India US deal in place, it does add some upside risk to FY27 GDP growth projection. The biggest positive will be in terms of sentiment and flows into India, but also less trade policy uncertainty, improved exports. So, there is some upside on growth."

Just as importantly, currency stability following the deal improves liquidity conditions, enabling better monetary policy transmission—something that had been hindered in recent months.

Benign inflation, coupled with reduced risks of currency-led price pressures, gives the RBI more comfort on the macro front.

Samiran Chakraborty, Chief Economist at Citi India, argued that the trade deal allows the MPC to lean more dovish than it otherwise would have.

“From that perspective, the challenge for the bond market is twofold. One is that dovishness in the policy rate direction, might help the bond market. But on the other hand, this flows that are coming in would imply that

RBI will have to do less amount of OMO, which is a negative for the bond market.

This creates a policy balancing act for the RBI—supporting growth via guidance on rates while managing liquidity without overstimulating bond markets.

Despite the positive domestic impulse, panelists flagged heightened global uncertainty as a key reason for caution. Sajjid Chinoy, Head of Asia Economic Research at JPMorgan, pointed to a fragile global backdrop marked by volatile currency moves, commodity price swings, and questions around the sustainability of the global technology rally.

Chinoy said, “We have to be mindful here that the global backdrop is very precarious. If those Fed rate cuts get priced out and the dollar were to strengthen, that will put poor pressure on emerging market currencies. Conversely, if the dollar were to continue weakening, then commodity prices go up, and that creates pipeline inflation pressure. So, there is no free lunch here.”

On currency management, Soumya Kanti Ghosh, Group Chief Economic Adviser at SBI, said the tariff deal has improved sentiment around the rupee, but warned against reading too much into short-term appreciation. With global debt levels high and capital flows still uncertain, he argued that it is premature for the RBI to actively resist rupee strength.

Ghosh added that market volatility remains elevated and the central bank is likely to adopt a wait-and-watch approach rather than make abrupt liquidity or currency interventions.

Offering a more structural perspective, Pronab Sen, Economist and former Chief Statistician, cautioned that the trade deal’s impact on imports has not been sufficiently factored in. While exports to the US may benefit, India may also have to significantly rebalance its import basket toward US goods.

Such a shift could alter trade patterns, affect the current account, and introduce new uncertainties for monetary policy. Sen argued that, in this evolving global environment, India must rely more heavily on internal growth drivers, making growth considerations more important for the RBI than before—but not at the cost of policy prudence.

Despite the varied long-term outlooks, the panel reached a unanimous consensus on the immediate policy action. All members, including Sonal Varma, Samiran Chakraborty, Sajjid Chinoy, Soumya Kanti Ghosh, and Dr Sen, voted for the MPC to keep the repo rate on hold at its upcoming meeting on February 6th, with Chakraborty specifying the expectation of a "dovish pause."

For the entire show, watch the accompanying video

Economists on CNBC-TV18’s Citizen Monetary Policy Committee (MPC) agreed that while the trade agreement eases several constraints for monetary policy, it does not yet warrant an immediate rate cut.

According to Sonal Varma, Managing Director and Chief Economist at Nomura, the trade deal materially strengthens India’s growth-inflation dynamics. “With this India US deal in place, it does add some upside risk to FY27 GDP growth projection. The biggest positive will be in terms of sentiment and flows into India, but also less trade policy uncertainty, improved exports. So, there is some upside on growth."

Just as importantly, currency stability following the deal improves liquidity conditions, enabling better monetary policy transmission—something that had been hindered in recent months.

Benign inflation, coupled with reduced risks of currency-led price pressures, gives the RBI more comfort on the macro front.

Samiran Chakraborty, Chief Economist at Citi India, argued that the trade deal allows the MPC to lean more dovish than it otherwise would have.

“From that perspective, the challenge for the bond market is twofold. One is that dovishness in the policy rate direction, might help the bond market. But on the other hand, this flows that are coming in would imply that

This creates a policy balancing act for the RBI—supporting growth via guidance on rates while managing liquidity without overstimulating bond markets.

Despite the positive domestic impulse, panelists flagged heightened global uncertainty as a key reason for caution. Sajjid Chinoy, Head of Asia Economic Research at JPMorgan, pointed to a fragile global backdrop marked by volatile currency moves, commodity price swings, and questions around the sustainability of the global technology rally.

Chinoy said, “We have to be mindful here that the global backdrop is very precarious. If those Fed rate cuts get priced out and the dollar were to strengthen, that will put poor pressure on emerging market currencies. Conversely, if the dollar were to continue weakening, then commodity prices go up, and that creates pipeline inflation pressure. So, there is no free lunch here.”

On currency management, Soumya Kanti Ghosh, Group Chief Economic Adviser at SBI, said the tariff deal has improved sentiment around the rupee, but warned against reading too much into short-term appreciation. With global debt levels high and capital flows still uncertain, he argued that it is premature for the RBI to actively resist rupee strength.

Ghosh added that market volatility remains elevated and the central bank is likely to adopt a wait-and-watch approach rather than make abrupt liquidity or currency interventions.

Offering a more structural perspective, Pronab Sen, Economist and former Chief Statistician, cautioned that the trade deal’s impact on imports has not been sufficiently factored in. While exports to the US may benefit, India may also have to significantly rebalance its import basket toward US goods.

Such a shift could alter trade patterns, affect the current account, and introduce new uncertainties for monetary policy. Sen argued that, in this evolving global environment, India must rely more heavily on internal growth drivers, making growth considerations more important for the RBI than before—but not at the cost of policy prudence.

Despite the varied long-term outlooks, the panel reached a unanimous consensus on the immediate policy action. All members, including Sonal Varma, Samiran Chakraborty, Sajjid Chinoy, Soumya Kanti Ghosh, and Dr Sen, voted for the MPC to keep the repo rate on hold at its upcoming meeting on February 6th, with Chakraborty specifying the expectation of a "dovish pause."

For the entire show, watch the accompanying video

/images/ppid_59c68470-image-177019774574074446.webp)

/images/ppid_59c68470-image-17702050656233191.webp)

/images/ppid_59c68470-image-177020503142917104.webp)

/images/ppid_a911dc6a-image-177020561129444816.webp)

/images/ppid_a911dc6a-image-177020553238755347.webp)

/images/ppid_a911dc6a-image-177020570094574422.webp)

/images/ppid_a911dc6a-image-177020555678962538.webp)

/images/ppid_a911dc6a-image-177020552847367566.webp)