A big focus this year is boosting domestic manufacturing. Key sectors—pharmaceuticals, semiconductors, rare-earth magnets, chemicals, capital goods, textiles and sports goods—get special attention. Electronics manufacturing outlay has doubled to ₹40,000 crore, and the next phase of the semiconductor mission aims to deepen India’s supply chain footprint. The Budget also earmarks ₹10,000 crore for biopharma, and proposes rare‑earth corridors, chemical parks, textile hubs and revival of 200 industrial clusters.

One of the most eye-catching announcements is a 20‑year tax holiday for global data centre operators, along with a 15% safe harbour on related‑party services—moves likely to pull in major cloud investments.

Other highlights include a simplified customs regime, lower duties for green‑energy components, and targeted support for agriculture, tourism and MSMEs. Markets will feel the impact of higher securities transaction tax on derivatives, while new tax rules continue nudging companies toward the simplified corporate regime. The fiscal deficit is pegged to fall to 4.3%, underlining the government’s focus on long-term stability.

Here are the top 10 stories shaping business and policy today.

India sets FY27 fiscal deficit target at 4.3%; debt-to-GDP seen at 55.6%

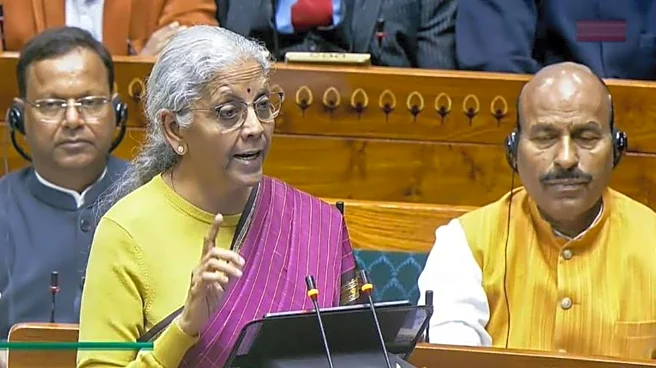

Finance Minister Nirmala Sitharaman on Sunday, February 1, 2026, outlined a calibrated glide path for fiscal consolidation, projecting the Centre’s fiscal deficit at 4.3% of GDP in 2026-27, marginally lower than the 4.4% budgeted for the current financial year.

Read more

Budget 2026: FM Sitharaman allocates ₹12.2 lakh crore for capex in FY27

The Union Budget 2026 has pegged capital expenditure (capex) at ₹12.2 lakh crore, up from the revised estimate of ₹10.9 lakh crore for FY 2025–26, reaffirming the government’s focus on infrastructure-led growth and public investment as a key demand anchor for the economy. The allocation represents a 9% increase over the previous year’s budgeted capital outlay.

Read more

Budget 2026: FM Nirmala Sitharaman announces STT hikes of up to 150% on F&O trading

Finance Minister Nirmala Sitharaman on Sunday, February 1 proposed to raise Securities transaction tax (STT) on both, futures and options, by up to 150%.

The Securities Transaction Tax on Futures has been raised to 0.05% from 0.02% earlier and for options has been raised to 0.15% from the previous 0.1%. The STT hike on futures is 150% and on options is 50%.

Read more here

Also Read: Budget 2026: BSE, Angel One, Groww shares tank up to 15% after STT on futures hiked

Also Read: STT hike aimed at curbing speculation, not higher revenue, says Finance Ministry

Defence budget rises to ₹7.85 lakh crore, capex hits ₹2.31 lakh crore

India stepped up its defence spending in the Union Budget 2027, with Finance Minister Nirmala Sitharaman announcing an outlay of ₹7.85 lakh crore, up 15.2% from FY26’s Budgeted ₹6.81 lakh crore allocation. The increase includes a 20.1% rise in overall defence capital expenditure to ₹2.31 lakh crore, underlining the government’s emphasis on long-term capability building.

Read more here

Union Budget 2026: FM announces high-speed rail on 7 routes including Mumbi–Pune, Delhi–Varanasi

Union Finance Minister Nirmala Sitharaman on Sunday (February 1) announced the introduction of high-speed corridors across seven routes as part of plans to expand faster inter-city rail connectivity.

Read more here

Union Budget 2026: Finance Minister announces ₹10,000 crore for Biopharma Shakti over 5 years

Union Finance Minister Nirmala Sitharaman on Sunday (February 1) announced ₹10,000 crore for Biopharma Shakti for the next 5 years. For FY2026–27, Nirmala Sitharaman has allocated ₹500 crore.

Read more here

Budget 2026: India boosts electronic component manufacturing with ₹40,000 crore outlay

Finance Minister Nirmala Sitharaman on Sunday, February 1, proposed to increase the outlay for the Electronic Components Manufacturing Scheme to ₹40,000 crore, in a push to strengthen India’s domestic electronics supply chain.

Read more here

Budget 2026: India's healthcare budget crosses ₹1 lakh crore for the first time

The country's healthcare budget was hiked by 10% in the Union Budget 2026 as compared to last year's Budget. Union Finance Minister Nirmala Sitharaman allocated ₹1,06,530.42 crore to the Ministry of Health and Family Welfare, with the government proposing a scheme to support states in establishing five regional medical hubs, NIMHANS and others.

Sitharaman said five medical tourism hubs will be established in partnership with the private sector. These hospitals are Apollo, Max, Fortis, Dr Lal Pathlabs, and Metropolis.

Read more here

Budget 2026: No capital gains exemption on Sovereign Gold Bonds bought from secondary market

In the Union Budget 2026, the government has proposed changes to the capital gains tax exemption available on Sovereign Gold Bonds (SGBs) issued by the Reserve Bank of India (RBI).

Read more here

Budget 2026 | Personal imports to get cheaper with revised baggage clearance rules

Finance Minister Nirmala Sitharaman holds a folder bearing the Government of India's emblem, as she poses with her officials while leaving her office to present the annual federal budget in parliament, in New Delhi. (Reuters)

In a move aimed at easing costs for international travellers and simplifying customs procedures, Finance Minister Nirmala Sitharaman on Sunday, February 1, proposed a reduction in tariff rates on personal imports and announced revisions to baggage clearance rules in the Union Budget 2026-27.

Read more here

We'll see you on Monday with another engaging 'Top 10@10’

/images/ppid_59c68470-image-176996503075479363.webp)