The currency has depreciated by over a rupee against the US Dollar since November 3, according to data available.

The fall in the currency comes just days ahead of the RBI policy and despite a strong GDP print of 8.2% for the second quarter reported on Friday.

Anindya Banerjee of Kotak Securities said that so far, there has been no major intervention that has been observed by the Reserve Bank of India (RBI).

Banerjee said that there was a large Non-Deliverable Forward (NDF) expiry over the last few days, which needed to be rolled over or covered. He went on to add that in case the USD-INR breaches the mark of 90, stop losses will get triggered and there could be a swift move further down towards the 91 mark.

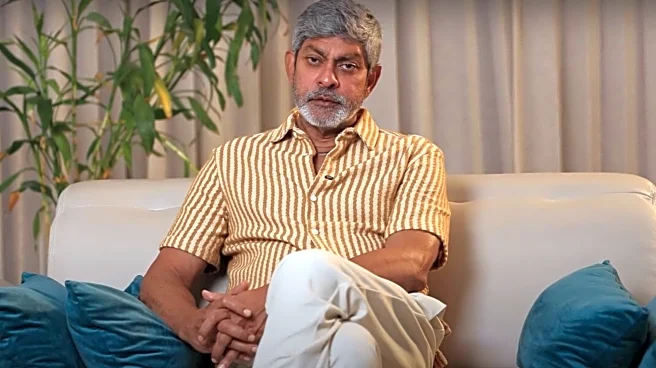

Jayesh Mehta of DSP Finance also attributed the fall in the currency to the daily selling from Foreign Portfolio Investors (FPIs) without any support from the RBI, and NDF expiry covering.

Mehta believes that the RBI should cut interest rates on Friday and should also announce Open Market Operations (OMOs) worth ₹2 lakh crore till March 2026.

According to Reuters reports, the RBI is likely to have sold dollars to prevent the currency to weaken past the mark of 90.

After the initial weakness, the USD-INR currently trades at 89.76.

Also Read: Why the currency of one of the fastest growing economies is under pressure

/images/ppid_59c68470-image-176465007500133468.webp)

/images/ppid_a911dc6a-image-177089662715993601.webp)