What is the story about?

The sell-off in the American Depository Receipts (ADR), listed in the US markets, continued as the global fear of AI dismounting traditional software services gained ground.

Infosys ADR fell 5%, Cognizant was down 4.9%, and Wipro ADR fell 4.5% in Tuesday's trade on Wall Street. Indian markets may reflect some of that fear in trade today. Accenture has now extended the drawdown to about 43%. The stock is back to the levels last seen in November 2020, according to Emkay Global, a Mumbai-based broking firm.

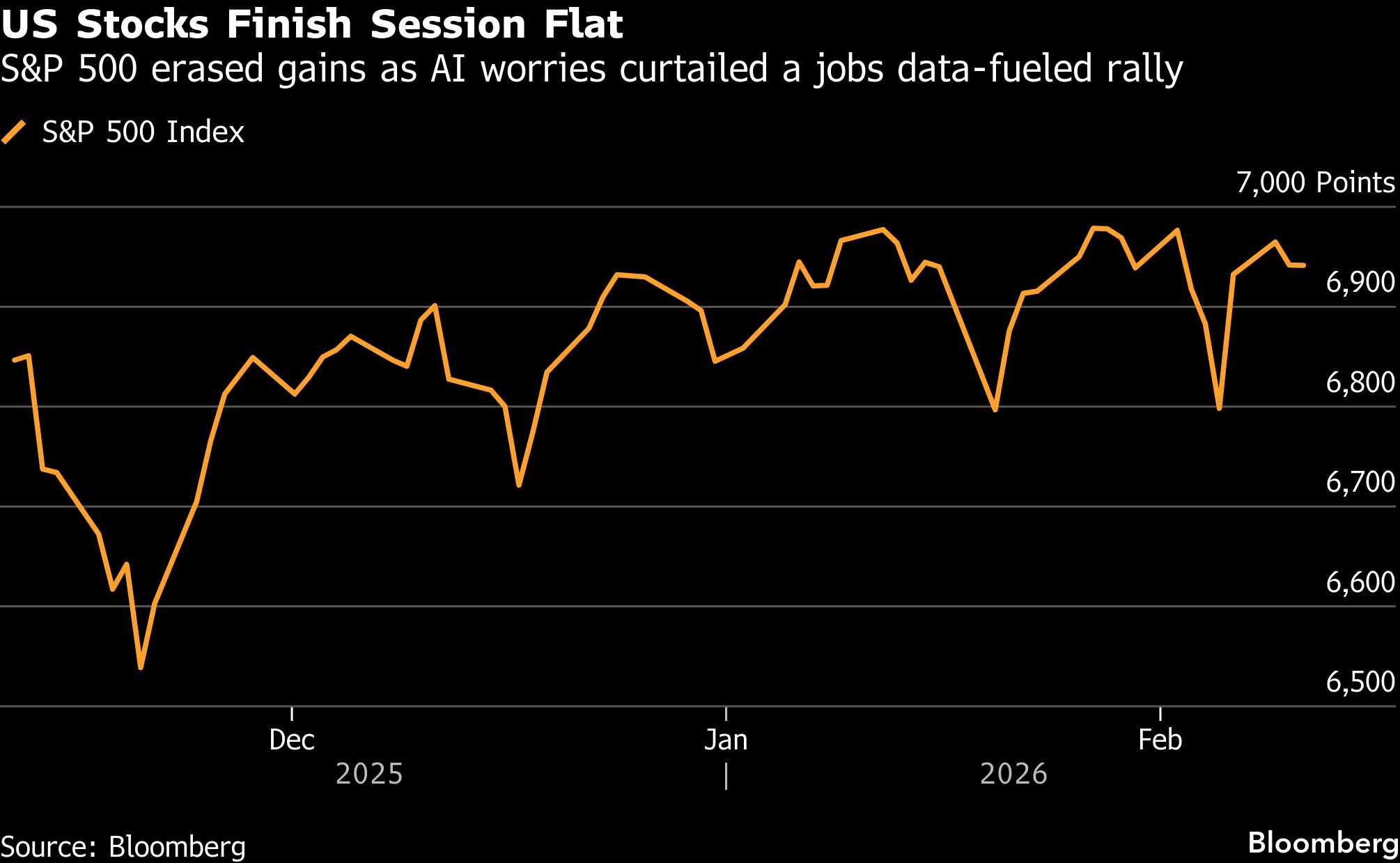

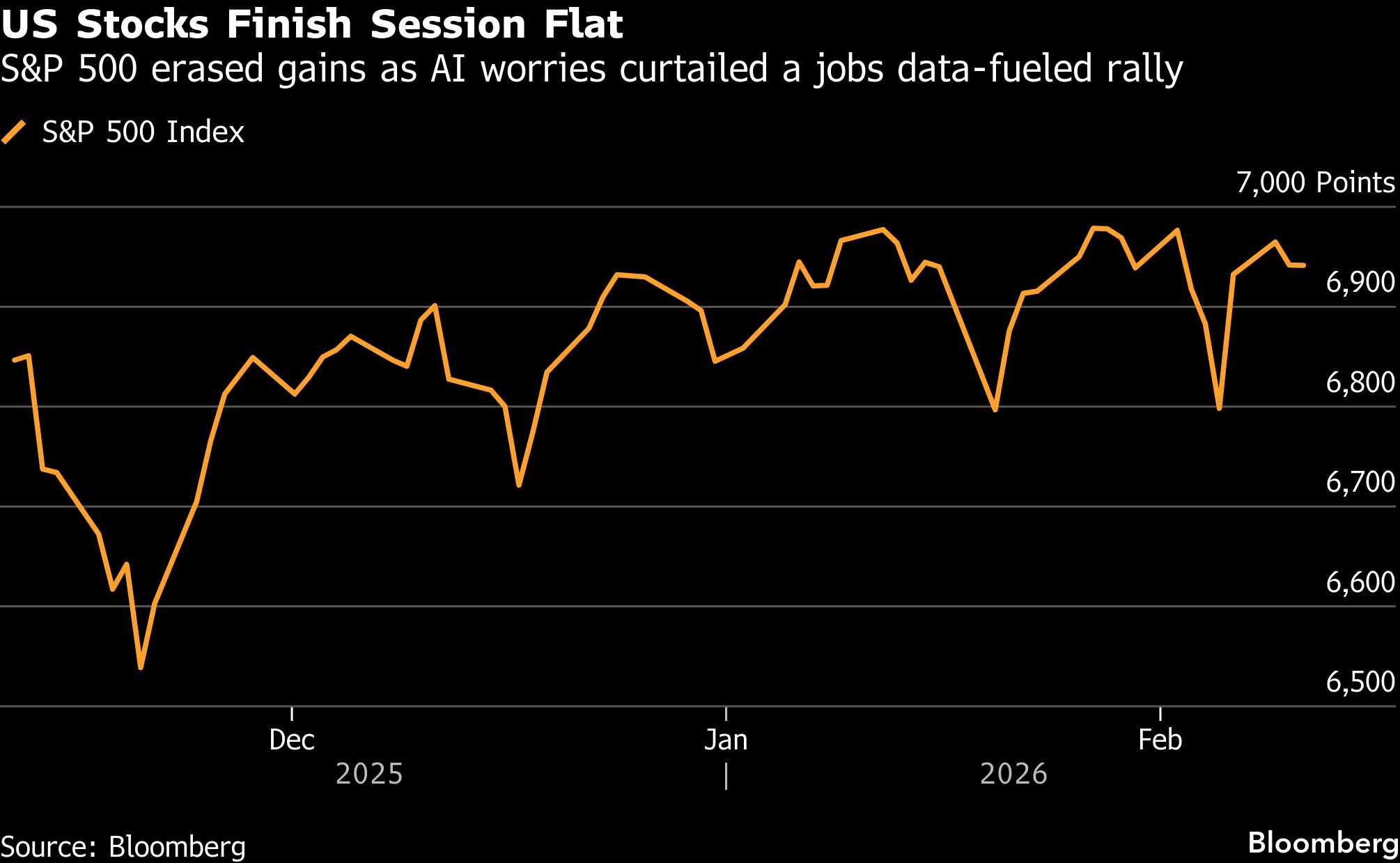

The technology-heavy Nasdaq 100 Index pared most of its gains by end of trade on Feb 11, and the CBOE Volatility Index hovered at around 18.

The fear around the future of software was enough to offset much of the optimism triggered by a stronger-than-expected jobs data in the US.

The impact of the latest bout of sell-off may also spill over to smaller IT stocks like Persistent Systems, Oracle Financial, Coforge, L&T Technology, Mphasis, which were among the losers in trade yesterday.

The sell-off in traditional software makers and IT services companies started with a leap in the Google-owned Anthropic's artificial intelligence , which released 11 new plug-ins for its Claude Cowork agent, an agentic, no-code AI assistant designed for enterprise users.

The new plugins could now help companies automate tasks across legal, sales, marketing and data analysis functions, potentially breaking the current software business models.

“It's not about the near-term earnings. Financials looked really good during earnings season. Software stocks before that looked good during earnings season, and had numbers revised up for the full year and even next year. When we have a disruption, when there's new tech and innovation in any industry, it's a problem for the future. It is what we call a terminal multiple problem,” explained Drew Pettit, Director - US Equity Strategy / ETF Analysis & Strategy Research at Citi, in a conversation with CNBC-TV18 on Wednesday.

You can watch the whole conversation here:

The fear around the future of the current software companies continues to overwhelm the street even a week after Anthropic's latest revelation.

Read more: After insurance and tech stocks, these shares become the next AI casualty

Infosys ADR fell 5%, Cognizant was down 4.9%, and Wipro ADR fell 4.5% in Tuesday's trade on Wall Street. Indian markets may reflect some of that fear in trade today. Accenture has now extended the drawdown to about 43%. The stock is back to the levels last seen in November 2020, according to Emkay Global, a Mumbai-based broking firm.

The technology-heavy Nasdaq 100 Index pared most of its gains by end of trade on Feb 11, and the CBOE Volatility Index hovered at around 18.

The fear around the future of software was enough to offset much of the optimism triggered by a stronger-than-expected jobs data in the US.

The impact of the latest bout of sell-off may also spill over to smaller IT stocks like Persistent Systems, Oracle Financial, Coforge, L&T Technology, Mphasis, which were among the losers in trade yesterday.

The sell-off in traditional software makers and IT services companies started with a leap in the Google-owned Anthropic's artificial intelligence , which released 11 new plug-ins for its Claude Cowork agent, an agentic, no-code AI assistant designed for enterprise users.

The new plugins could now help companies automate tasks across legal, sales, marketing and data analysis functions, potentially breaking the current software business models.

“It's not about the near-term earnings. Financials looked really good during earnings season. Software stocks before that looked good during earnings season, and had numbers revised up for the full year and even next year. When we have a disruption, when there's new tech and innovation in any industry, it's a problem for the future. It is what we call a terminal multiple problem,” explained Drew Pettit, Director - US Equity Strategy / ETF Analysis & Strategy Research at Citi, in a conversation with CNBC-TV18 on Wednesday.

You can watch the whole conversation here:

The fear around the future of the current software companies continues to overwhelm the street even a week after Anthropic's latest revelation.

Read more: After insurance and tech stocks, these shares become the next AI casualty

/images/ppid_59c68470-image-177086506429093532.webp)

/images/ppid_59c68470-image-177086012892069950.webp)

/images/ppid_59c68470-image-177086006108692667.webp)

/images/ppid_a911dc6a-image-177086002730792843.webp)

/images/ppid_a911dc6a-image-177086355446649864.webp)

/images/ppid_a911dc6a-image-177086352380239409.webp)

/images/ppid_59c68470-image-177086258246560927.webp)

/images/ppid_59c68470-image-177086254430548516.webp)

/images/ppid_59c68470-image-177086265857125048.webp)

/images/ppid_59c68470-image-177086262067478359.webp)

/images/ppid_59c68470-image-177086254645319037.webp)