What is the story about?

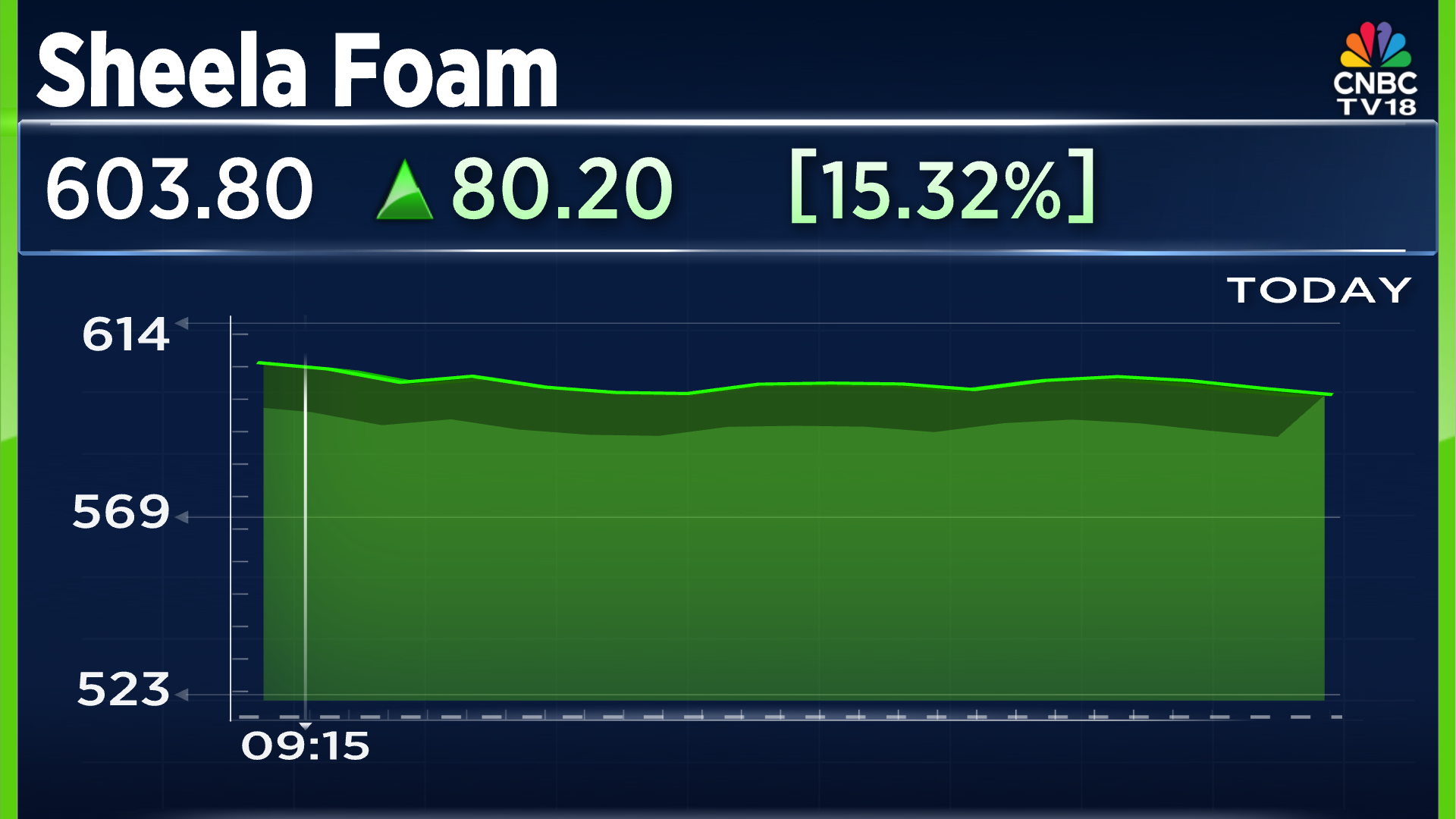

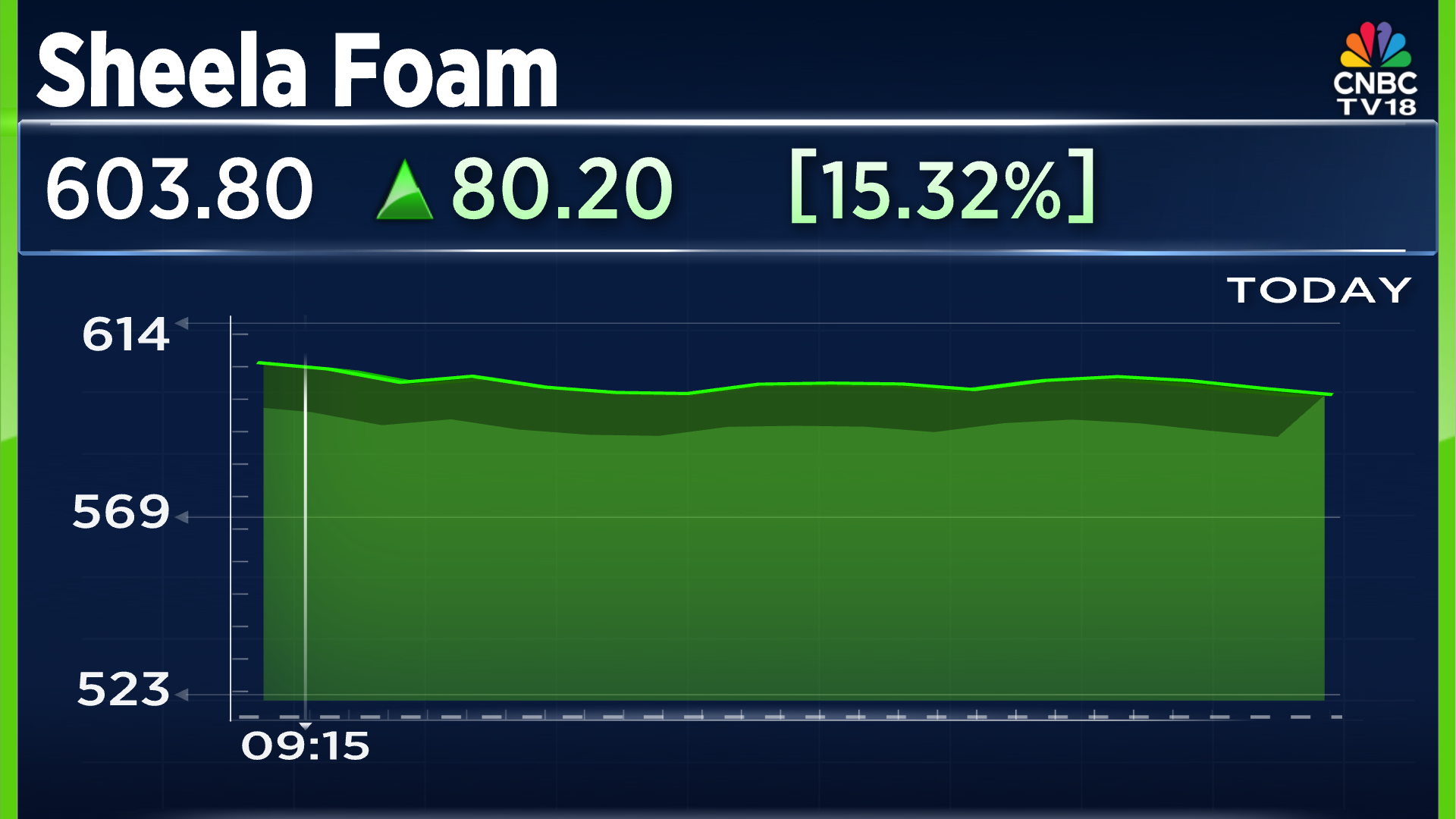

Shares of Sheela Foam Ltd. surged past 16% on Wednesday, February 4, reacting to their third quarter earnings. This is the biggest single-day gain that the stock has seen since its listing back in December 2019.

The company reported positive earnings across all parameters, with its net profit jumping over three times.

Its net profit increased to ₹52.57 crore, up 213% from ₹16.8 crore in the third quarter of the last year.

Its revenue increased 11.1% to ₹1,075 crore from ₹967 crore in the previous year.

The company's earnings before interest, tax, depreciation and amortisation (EBITDA) increased 30% to ₹115 crore from ₹88 crore in the December quarter of the previous fiscal.

Its margins expanded as well to 11% from 9.11% in the year-ago period.

The company said its 'mattress' volume continues to grow by 11% in the third quarter and in the first nine months of the financial year 2026. Its 'foam' value grew by 20% in the third quarter and 12% in the first nine months of FY26.

It also launched 607 new new showrooms in the first nine months of the fiscal, nearing its target of 700 showrooms for FY26.

Only three analysts have coverage on Sheela Foam, of which two have a "buy" rating and the other has a "hold" rating.

Shares of Sheela Foam were up 16.2% at ₹608.15 apiece around 9.30 am. The stock has declined 30.9% in the past year.

Also Read: Varun Beverages share price target cut by Citi, Jefferies but no analyst has a 'sell' rating

The company reported positive earnings across all parameters, with its net profit jumping over three times.

Its net profit increased to ₹52.57 crore, up 213% from ₹16.8 crore in the third quarter of the last year.

Its revenue increased 11.1% to ₹1,075 crore from ₹967 crore in the previous year.

The company's earnings before interest, tax, depreciation and amortisation (EBITDA) increased 30% to ₹115 crore from ₹88 crore in the December quarter of the previous fiscal.

Its margins expanded as well to 11% from 9.11% in the year-ago period.

The company said its 'mattress' volume continues to grow by 11% in the third quarter and in the first nine months of the financial year 2026. Its 'foam' value grew by 20% in the third quarter and 12% in the first nine months of FY26.

It also launched 607 new new showrooms in the first nine months of the fiscal, nearing its target of 700 showrooms for FY26.

Only three analysts have coverage on Sheela Foam, of which two have a "buy" rating and the other has a "hold" rating.

Shares of Sheela Foam were up 16.2% at ₹608.15 apiece around 9.30 am. The stock has declined 30.9% in the past year.

Also Read: Varun Beverages share price target cut by Citi, Jefferies but no analyst has a 'sell' rating

/images/ppid_59c68470-image-177018003620112580.webp)

/images/ppid_59c68470-image-177017768335930490.webp)

/images/ppid_59c68470-image-177017764698093665.webp)

/images/ppid_59c68470-image-177017778635112020.webp)

/images/ppid_59c68470-image-17701800380268003.webp)

/images/ppid_a911dc6a-image-177017962860626253.webp)

/images/ppid_59c68470-image-177017774038319914.webp)