What is the story about?

The year 2025 saw a high level of leadership churn in the fast-moving consumer goods (FMCG) sector, with several senior executives stepping down across Indian and global companies. The changes affected major firms, including Hindustan Unilever, Britannia Industries, Nestlé, Unilever, and PepsiCo, reflecting growing pressure on management to deliver results.

In India, Hindustan Unilever saw CEO Rohit Jawa step down after two years in the role, following a period of muted sales and flat volumes. He was succeeded by Priya Nair, a long-serving Unilever executive, who has been tasked with improving volume growth. At Britannia, CEO Rajneet Kohli resigned in March to join HUL and was replaced by Rakshit Hargave. Later in November, long-time Managing Director Varun Berry exited the company, after which the stock fell by over 5%.

Other leadership changes followed. Nestlé India announced a planned transition, with Manish Tiwary, formerly of Amazon India, taking over from Suresh Narayanan, who retired after a decade at the helm. Leadership changes were also seen at L'Oréal India and Diageo India.

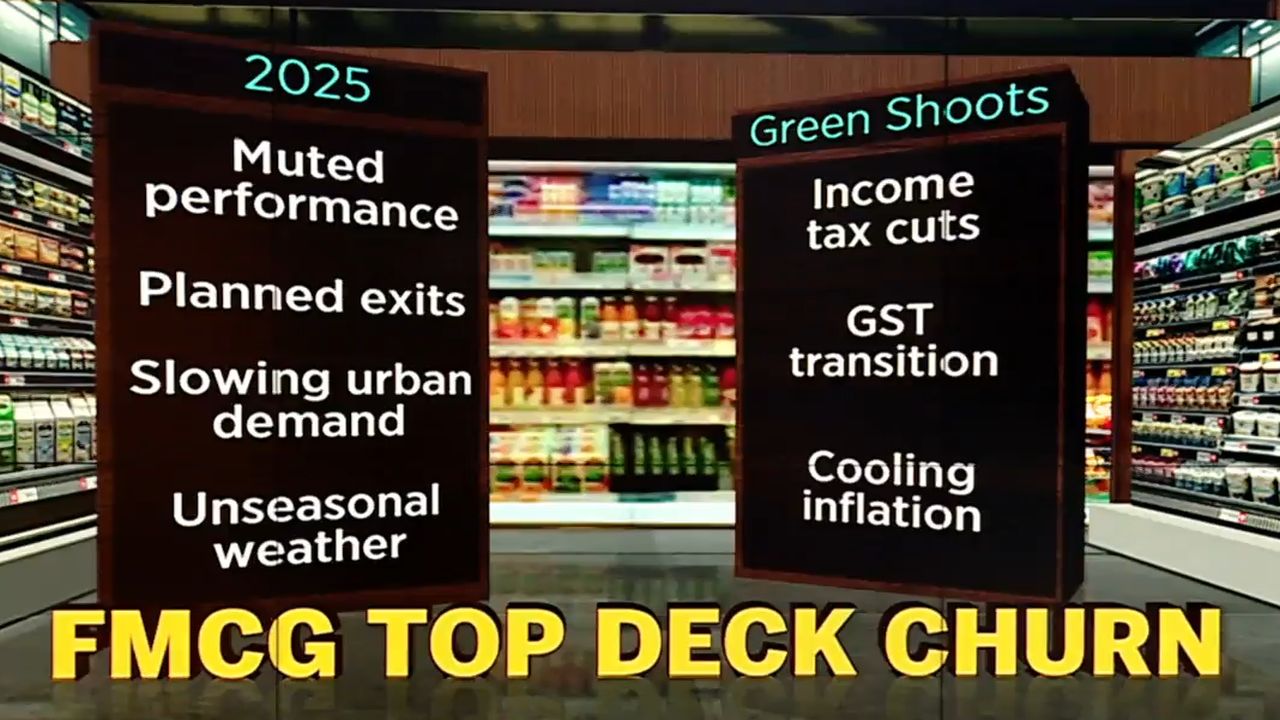

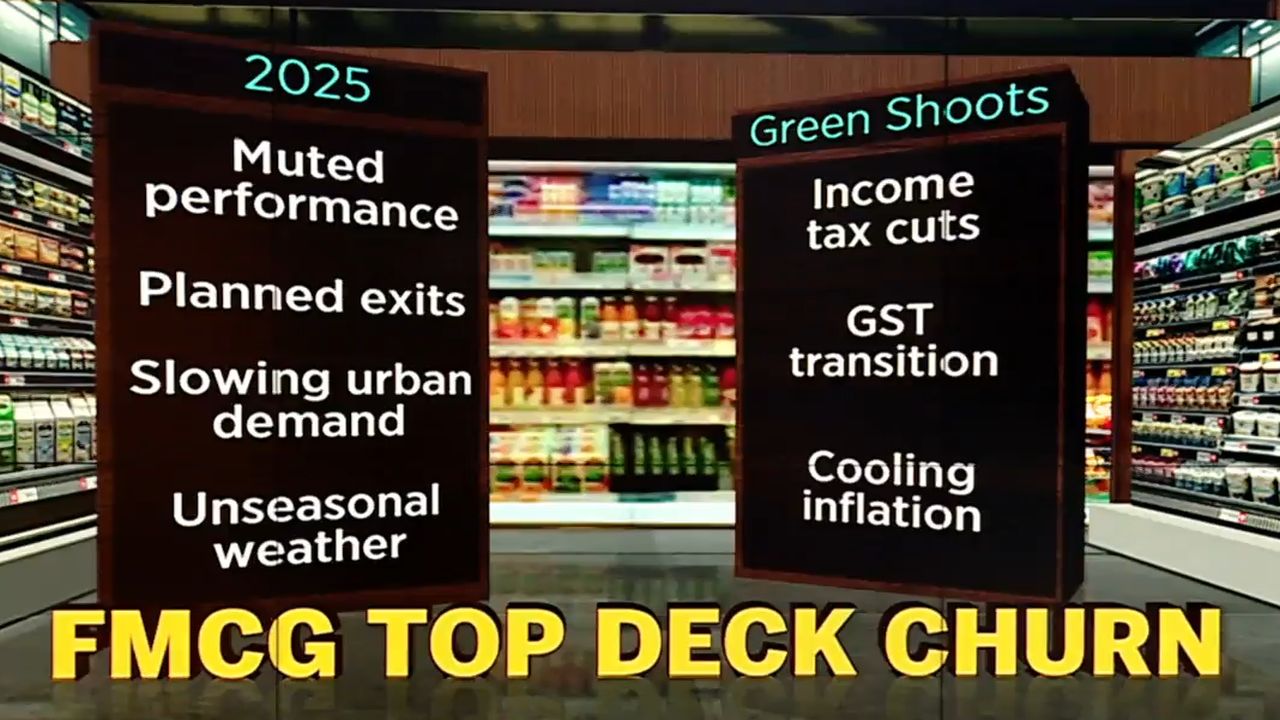

These shifts came during a year when the Indian FMCG sector faced inflation pressures, slow urban demand, and limited volume growth. While income tax cuts and easing inflation later in the year offered some relief, companies continued to face uncertainty linked to global trade and geopolitical developments.

Also Read | FMCG demand shows uptick post-GST; premiumisation and price elasticity emerging: ICICI Securities

Globally, the pace of leadership changes was faster. Nestlé went through three CEOs in less than 14 months as it dealt with its weakest growth in two decades. Chairman Paul Bulcke also exited earlier than planned. Unilever saw CEO Hein Schumacher leave in under two years, with the board appointing CFO Fernando Fernandez as his successor to drive a quicker turnaround.

Beverage companies also saw changes. Diageo announced the exit of CEO Debra Crew amid lower sales and higher debt levels, with Sir Dave Lewis set to take over in 2026. Coca-Cola is preparing for Henrique Braun to assume the CEO role, while PepsiCo has carried out a reorganisation to address weak demand in its global beverage business.

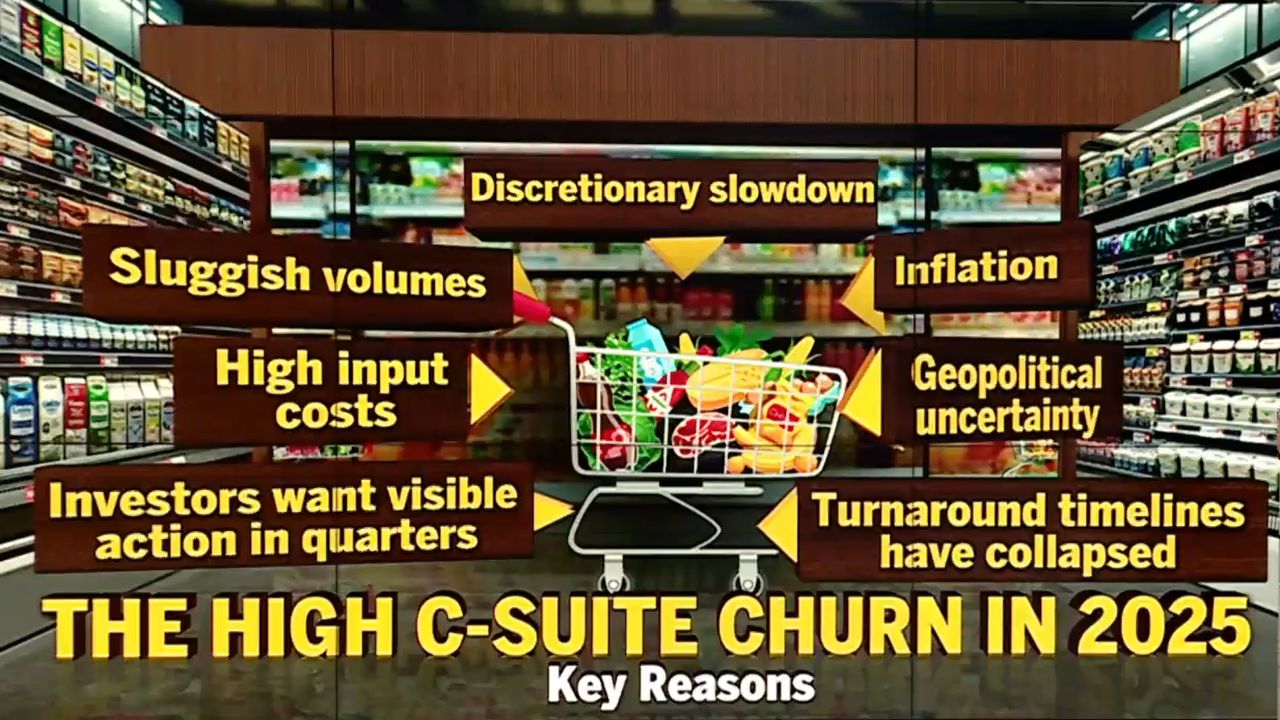

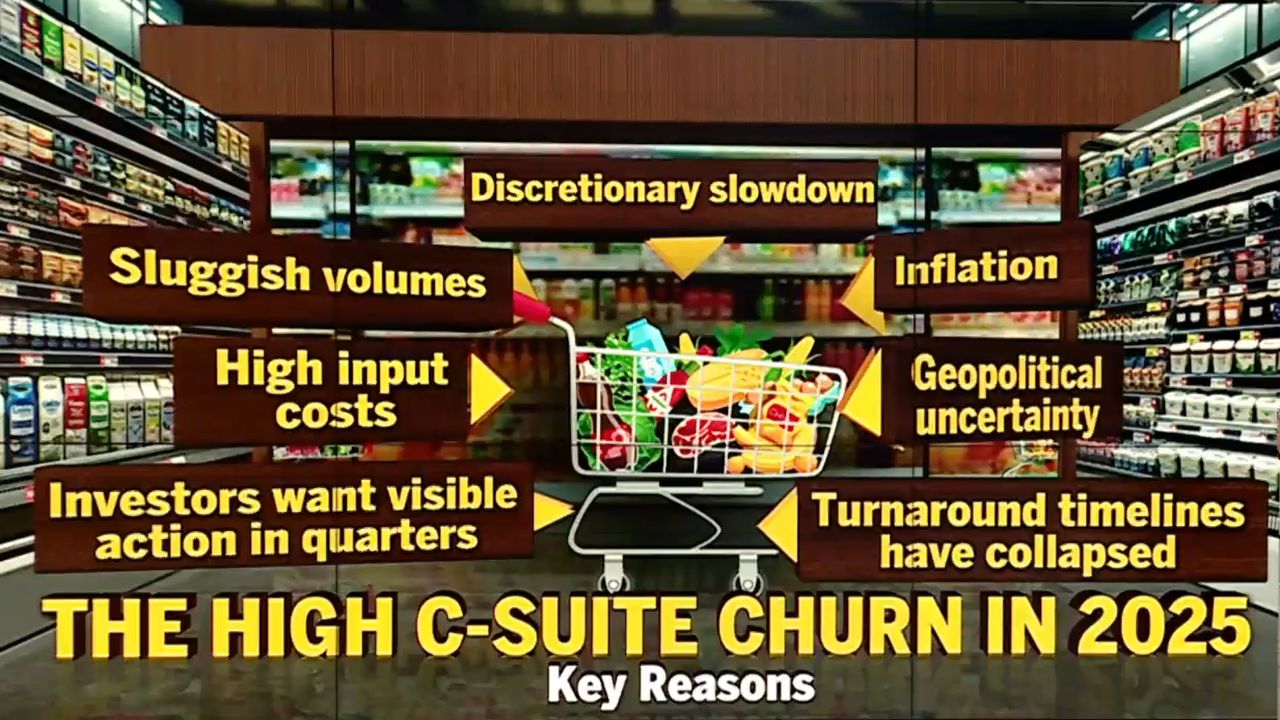

Industry watchers point to slow volume growth, pressure on discretionary spending, higher input costs, and rising competition as key drivers behind the churn. However, a decline in investor patience has played a central role. Boards are seeking quicker outcomes and are less willing to wait for long-term strategies to play out. The message from FMCG boardrooms in 2025 has been clear: focus on delivery, or leadership will change.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

In India, Hindustan Unilever saw CEO Rohit Jawa step down after two years in the role, following a period of muted sales and flat volumes. He was succeeded by Priya Nair, a long-serving Unilever executive, who has been tasked with improving volume growth. At Britannia, CEO Rajneet Kohli resigned in March to join HUL and was replaced by Rakshit Hargave. Later in November, long-time Managing Director Varun Berry exited the company, after which the stock fell by over 5%.

Other leadership changes followed. Nestlé India announced a planned transition, with Manish Tiwary, formerly of Amazon India, taking over from Suresh Narayanan, who retired after a decade at the helm. Leadership changes were also seen at L'Oréal India and Diageo India.

These shifts came during a year when the Indian FMCG sector faced inflation pressures, slow urban demand, and limited volume growth. While income tax cuts and easing inflation later in the year offered some relief, companies continued to face uncertainty linked to global trade and geopolitical developments.

Also Read | FMCG demand shows uptick post-GST; premiumisation and price elasticity emerging: ICICI Securities

Globally, the pace of leadership changes was faster. Nestlé went through three CEOs in less than 14 months as it dealt with its weakest growth in two decades. Chairman Paul Bulcke also exited earlier than planned. Unilever saw CEO Hein Schumacher leave in under two years, with the board appointing CFO Fernando Fernandez as his successor to drive a quicker turnaround.

Beverage companies also saw changes. Diageo announced the exit of CEO Debra Crew amid lower sales and higher debt levels, with Sir Dave Lewis set to take over in 2026. Coca-Cola is preparing for Henrique Braun to assume the CEO role, while PepsiCo has carried out a reorganisation to address weak demand in its global beverage business.

Industry watchers point to slow volume growth, pressure on discretionary spending, higher input costs, and rising competition as key drivers behind the churn. However, a decline in investor patience has played a central role. Boards are seeking quicker outcomes and are less willing to wait for long-term strategies to play out. The message from FMCG boardrooms in 2025 has been clear: focus on delivery, or leadership will change.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

/images/ppid_59c68470-image-176648753156523673.webp)

/images/ppid_59c68470-image-177073503438256591.webp)

/images/ppid_59c68470-image-177073504502237506.webp)

/images/ppid_59c68470-image-17707175370479328.webp)