What is the story about?

Mahindra & Mahindra Ltd

., the manufacturer and distributor of passenger and commercial vehicles and tractors, reported its September quarter earnings on Tuesday, November 4, which were a beat on analyst expectations on most parameters.

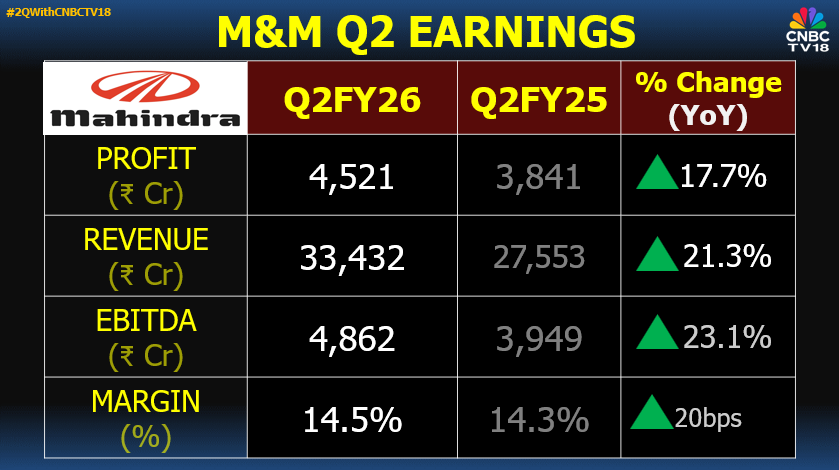

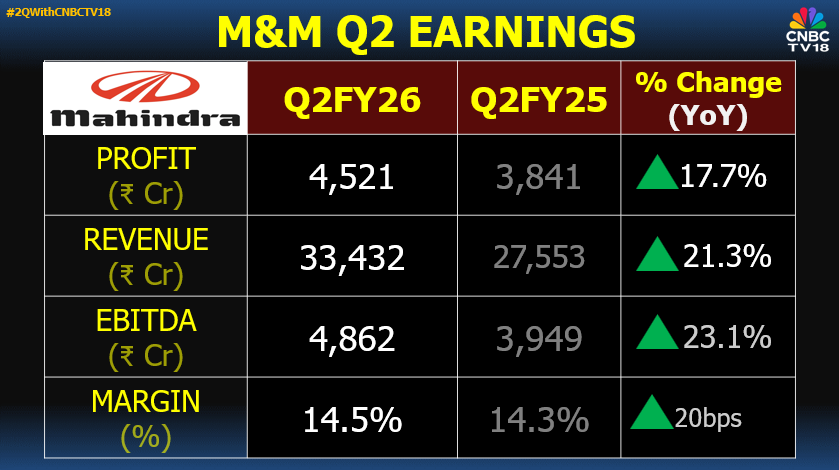

M&M's consolidated revenue for the quarter rose by 21.3% from last year to ₹33,422 crore, which was lower than the CNBC-TV18 poll of ₹34,294 crore.

Net profit for the quarter stood at ₹4,521 crore, which was higher than the CNBC-TV18 poll of ₹4,044 crore. On a year-on-year basis, net profit went up by 18%.

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), increased by 23% from last year to ₹4,862 crore. A CNBC-TV18 poll was working with a estimate of ₹4,759 crore.

EBITDA margin for the second quarter stood at 14.5% from 14.3% last year. The figure is also higher than the CNBC-TV18 poll of 13.9%.

The auto and farm businesses continued to gain market share and improve profitability. SUV revenue share rose 390 basis points year-on-year, while the light commercial vehicle (LCV, <3.5T) segment gained 100 basis points.

In tractors, M&M's market share increased by 50 basis points to 43%. The auto standalone PBIT margin (excluding eSUV contract manufacturing) improved by 80 basis points to 10.3%, while core tractor PBIT margin expanded by 190 basis points to 20.6%.

M&M reported strong cash generation in the first half, delivering over ₹10,000 crore in operating cash flow.

Shares of Mahindra & Mahindra are trading 1.49% higher post the results announcement at ₹3,601.90. The stock has risen 17% so far this year.

M&M's consolidated revenue for the quarter rose by 21.3% from last year to ₹33,422 crore, which was lower than the CNBC-TV18 poll of ₹34,294 crore.

Net profit for the quarter stood at ₹4,521 crore, which was higher than the CNBC-TV18 poll of ₹4,044 crore. On a year-on-year basis, net profit went up by 18%.

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), increased by 23% from last year to ₹4,862 crore. A CNBC-TV18 poll was working with a estimate of ₹4,759 crore.

EBITDA margin for the second quarter stood at 14.5% from 14.3% last year. The figure is also higher than the CNBC-TV18 poll of 13.9%.

The auto and farm businesses continued to gain market share and improve profitability. SUV revenue share rose 390 basis points year-on-year, while the light commercial vehicle (LCV, <3.5T) segment gained 100 basis points.

In tractors, M&M's market share increased by 50 basis points to 43%. The auto standalone PBIT margin (excluding eSUV contract manufacturing) improved by 80 basis points to 10.3%, while core tractor PBIT margin expanded by 190 basis points to 20.6%.

M&M reported strong cash generation in the first half, delivering over ₹10,000 crore in operating cash flow.

Shares of Mahindra & Mahindra are trading 1.49% higher post the results announcement at ₹3,601.90. The stock has risen 17% so far this year.

/images/ppid_59c68470-image-176224504366128059.webp)

/images/ppid_a911dc6a-image-17708809495098817.webp)

/images/ppid_a911dc6a-image-177088087230274978.webp)

/images/ppid_a911dc6a-image-177088105837360575.webp)

/images/ppid_a911dc6a-image-177088102480749256.webp)

/images/ppid_a911dc6a-image-177088109440221446.webp)

/images/ppid_a911dc6a-image-177088108433540521.webp)

/images/ppid_a911dc6a-image-177088105408391550.webp)