What is the story about?

Government bond prices remained firm, supported by strong liquidity conditions in the banking system. The surplus liquidity, along with a decline in the 10-year US Treasury yield and a fall in the five-year overnight index swap (OIS) rate, helped keep bond prices steady.

However, gains were somewhat limited as markets stayed cautious ahead of a large state government bond auction worth nearly ₹486 billion scheduled for today.

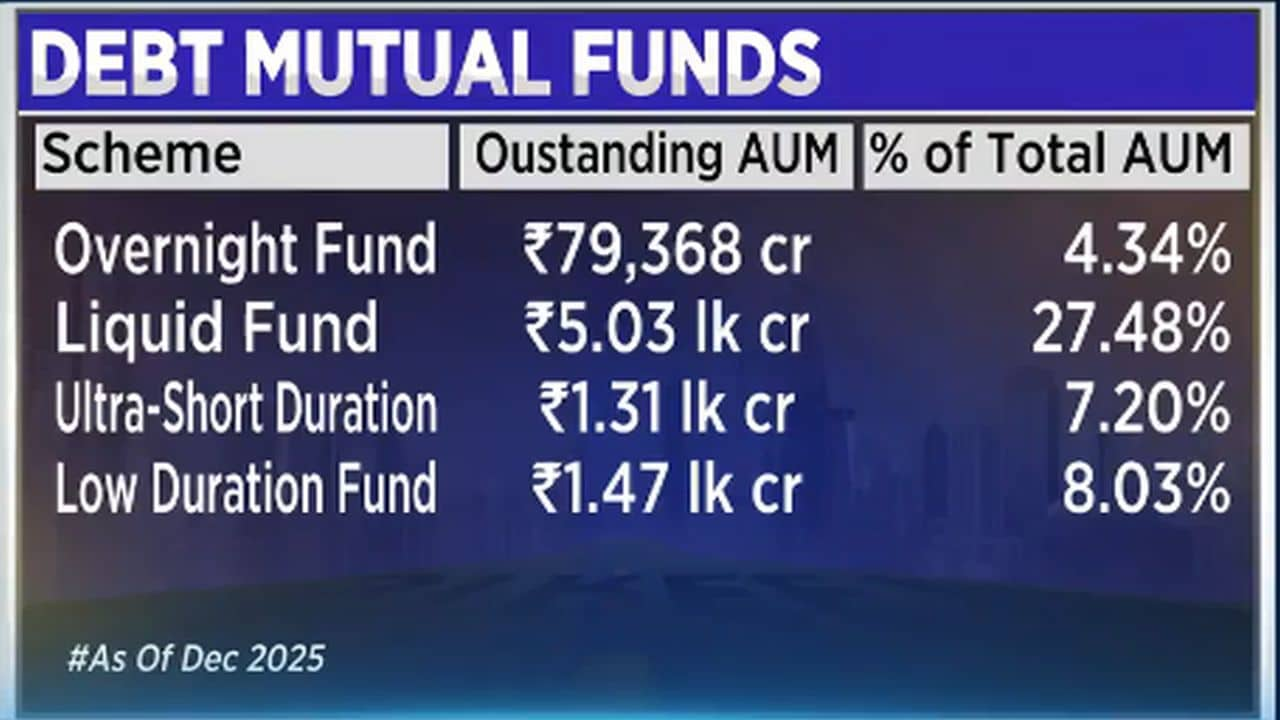

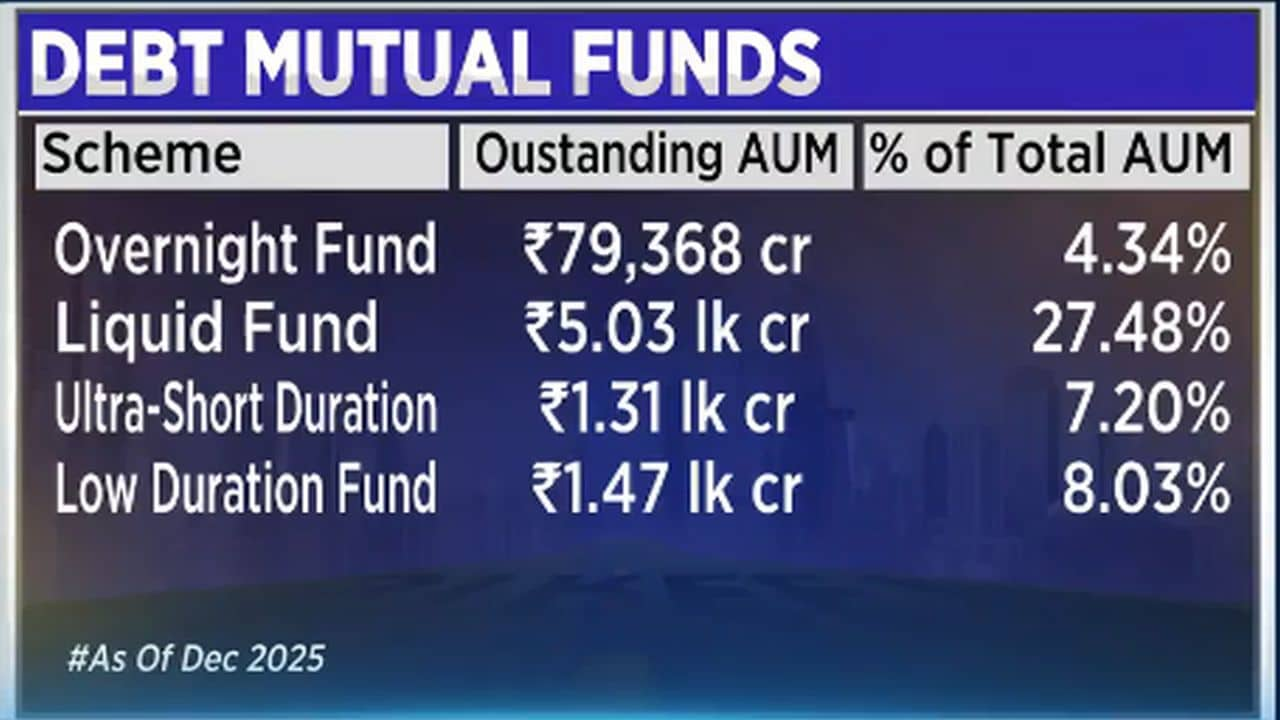

As of December 2025, the outstanding assets under management (AUM) of debt mutual fund schemes stood at around ₹79,368 crore, accounting for about 4.34% of the total mutual fund industry AUM.

Liquid funds remained the largest category, with AUM close to ₹5 lakh crore, making up nearly 27% of total debt fund holdings. This highlights investors’ continued preference for safety and liquidity.

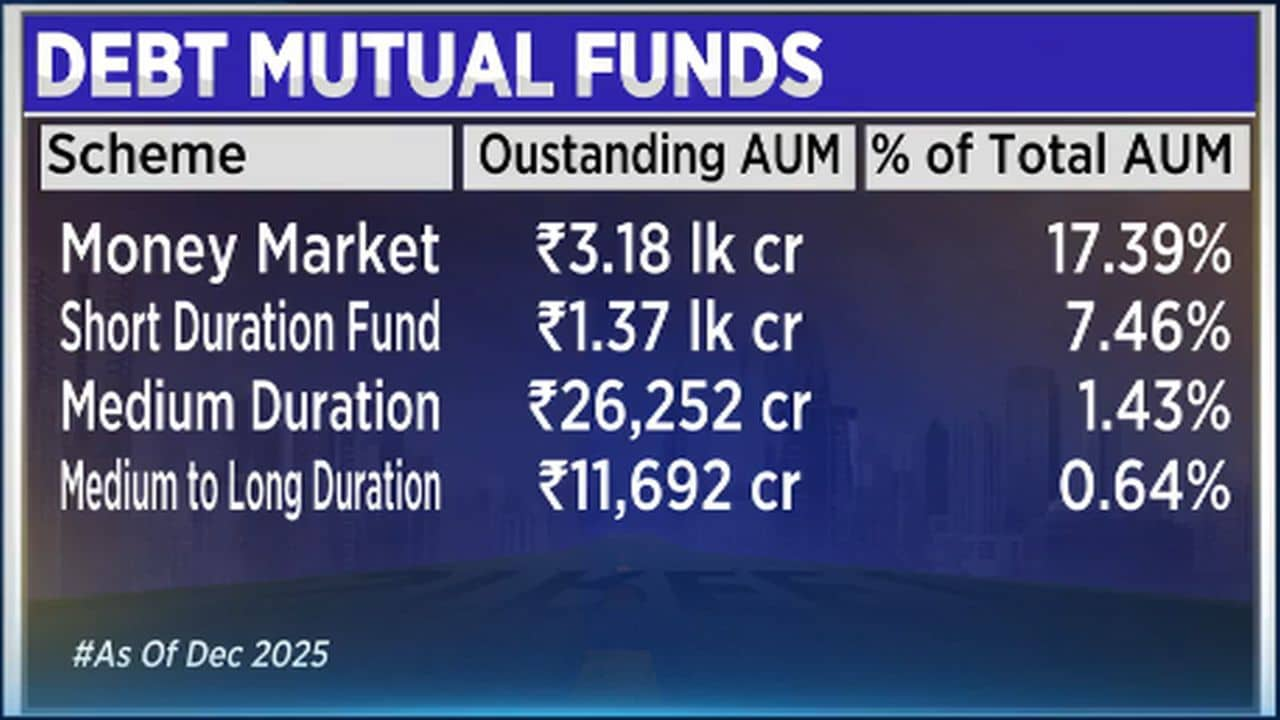

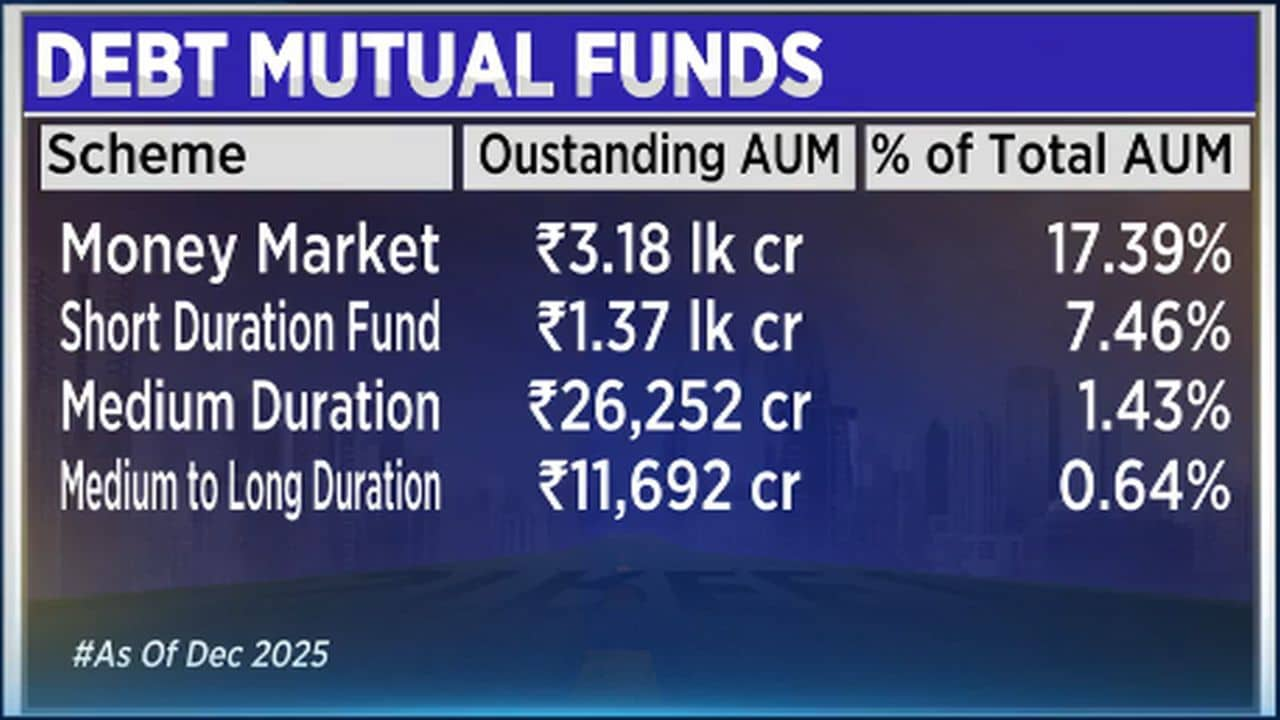

Money market funds also saw strong participation, with AUM of around ₹3.18 lakh crore. Low-duration funds held assets worth about ₹1.47 lakh crore, accounting for roughly 8% of total debt fund AUM.

Short-duration funds had AUM of approximately ₹1.37 lakh crore, contributing about 7.5% to the overall debt fund pool.

Read Here | Bonds weaken as states step up borrowing, RBI rolls out credit derivatives reform draft

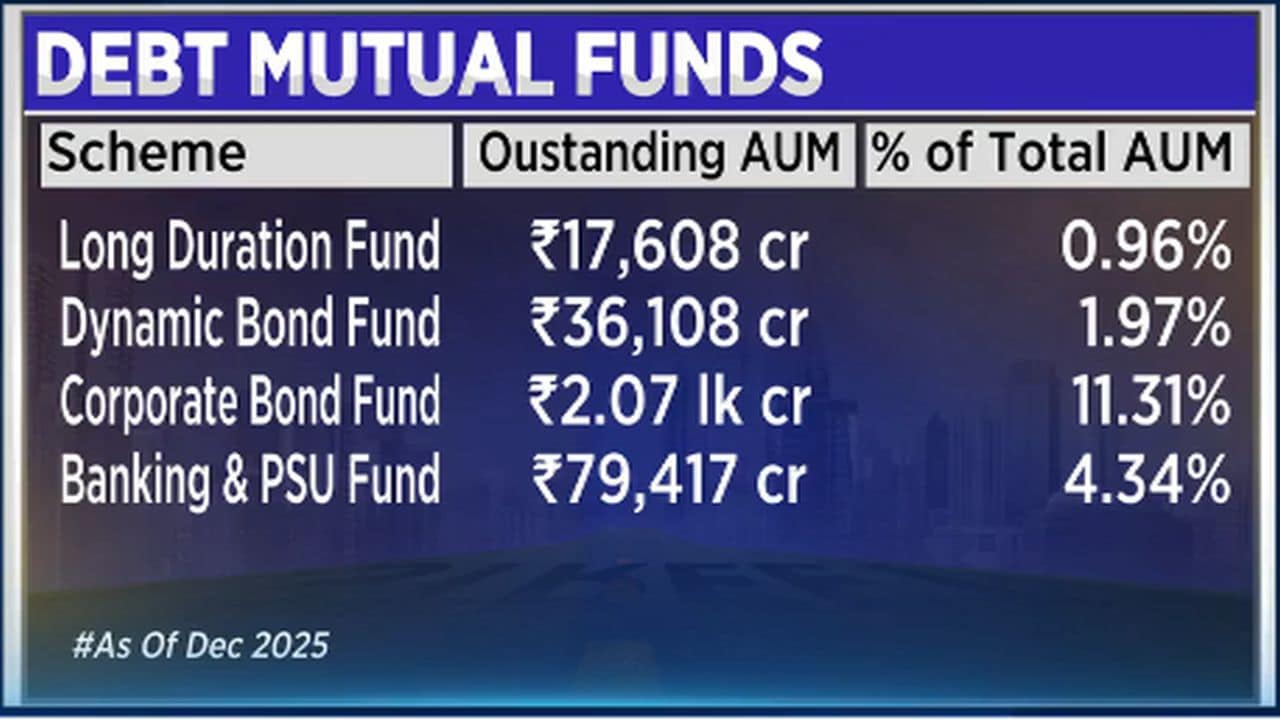

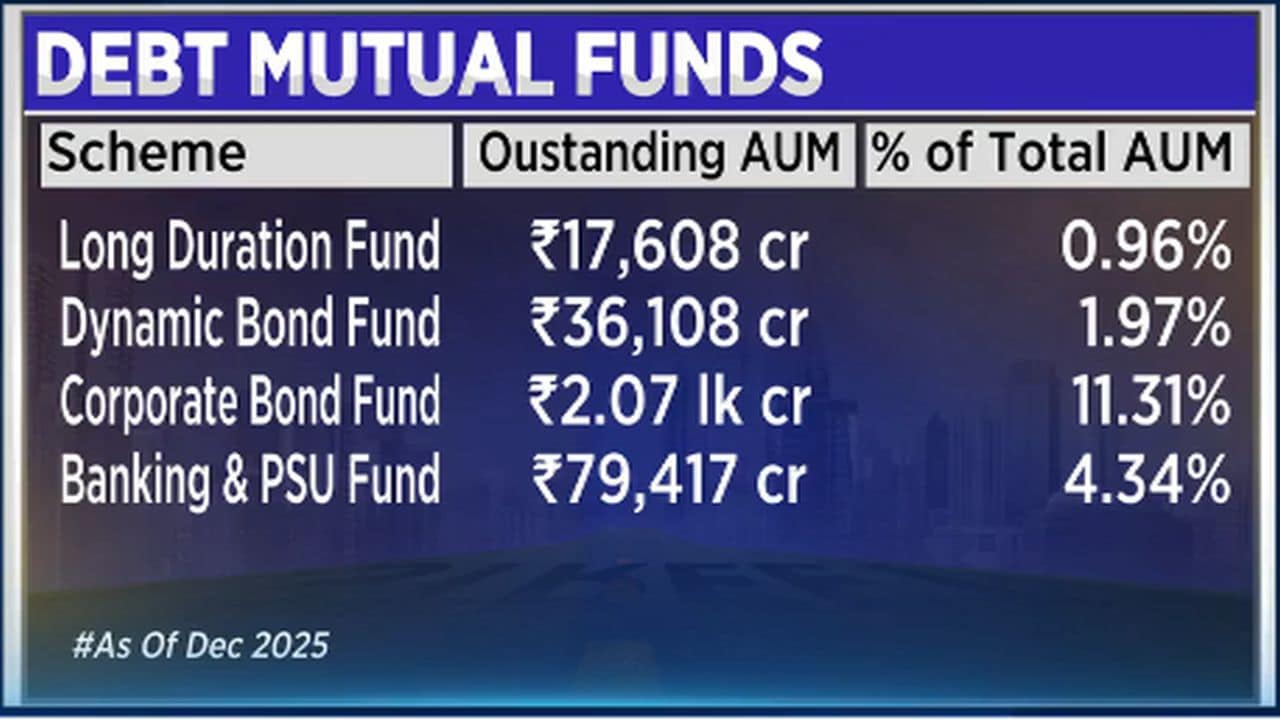

Medium-duration funds stood at around ₹26,000 crore, while medium-to-long duration funds were lower at about ₹11,000 crore. Long-duration funds had assets of nearly ₹17,000 crore, indicating relatively limited appetite for interest-rate risk.

Dynamic bond funds reported AUM of about ₹36,000 crore.

Corporate bond funds saw some outflows during the period, but total AUM remained sizeable at around ₹2 lakh crore. This category accounted for nearly 11% of the total debt mutual fund market.

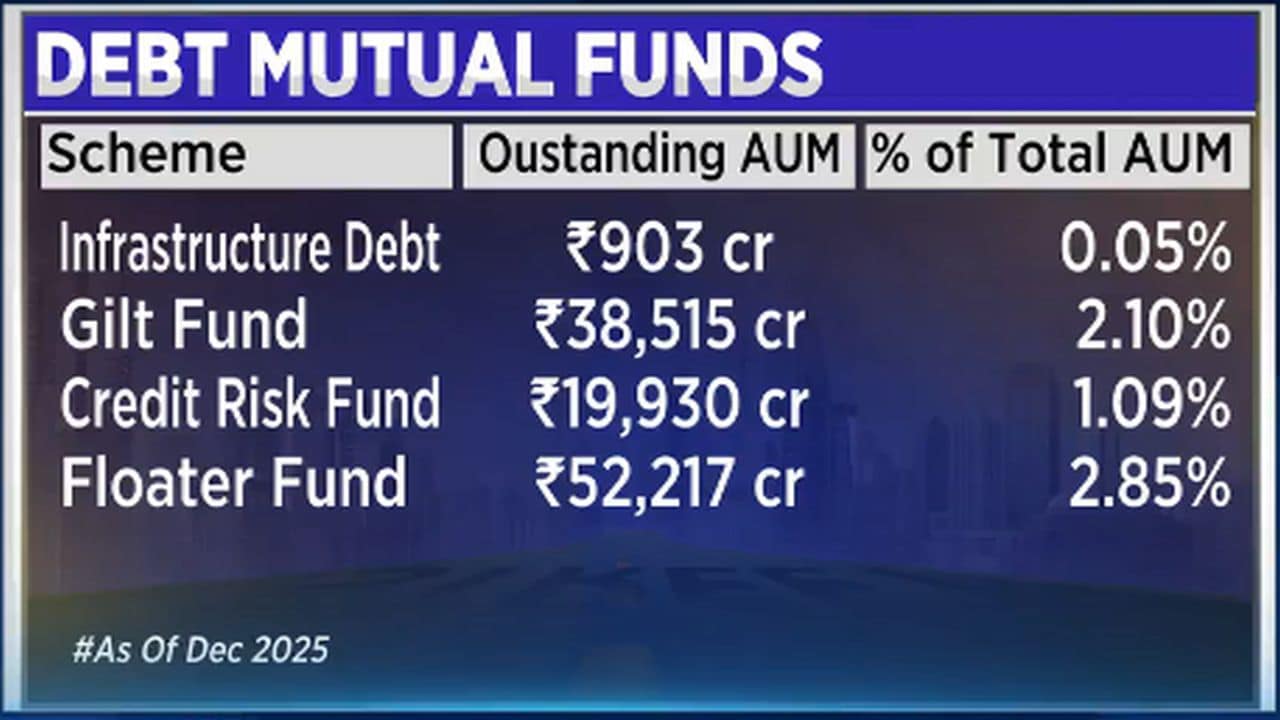

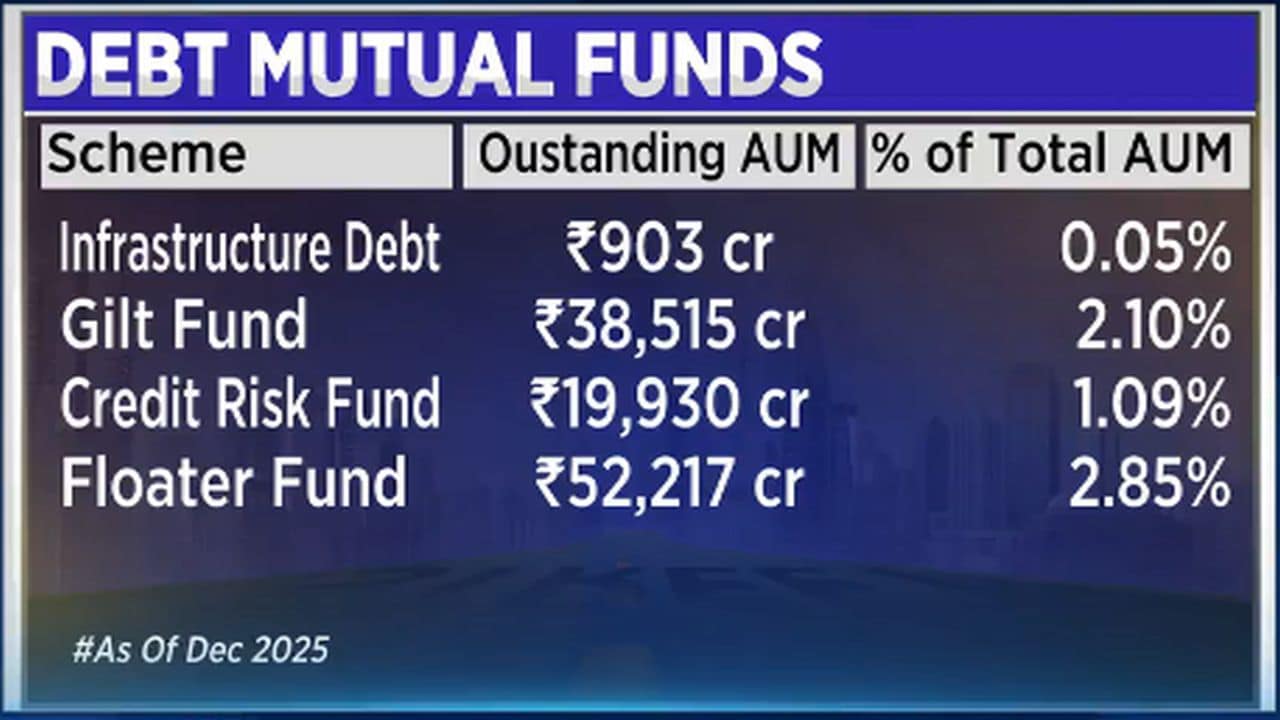

Gilt funds stood at about ₹38,000 crore, while credit risk funds were at approximately ₹19,000 crore.

Floater funds held assets worth around ₹52,000 crore, translating to nearly 3% market share.

Infrastructure debt funds showed some improvement in recent months, though AUM remained relatively small at around ₹900 crore.

While more recent data is awaited, the December numbers provide a clear picture of where investor money is currently moving within the debt mutual fund space.

Live stock market updates—follow our blog

However, gains were somewhat limited as markets stayed cautious ahead of a large state government bond auction worth nearly ₹486 billion scheduled for today.

As of December 2025, the outstanding assets under management (AUM) of debt mutual fund schemes stood at around ₹79,368 crore, accounting for about 4.34% of the total mutual fund industry AUM.

Liquid funds remained the largest category, with AUM close to ₹5 lakh crore, making up nearly 27% of total debt fund holdings. This highlights investors’ continued preference for safety and liquidity.

Money market funds also saw strong participation, with AUM of around ₹3.18 lakh crore. Low-duration funds held assets worth about ₹1.47 lakh crore, accounting for roughly 8% of total debt fund AUM.

Short-duration funds had AUM of approximately ₹1.37 lakh crore, contributing about 7.5% to the overall debt fund pool.

Read Here | Bonds weaken as states step up borrowing, RBI rolls out credit derivatives reform draft

Medium-duration funds stood at around ₹26,000 crore, while medium-to-long duration funds were lower at about ₹11,000 crore. Long-duration funds had assets of nearly ₹17,000 crore, indicating relatively limited appetite for interest-rate risk.

Dynamic bond funds reported AUM of about ₹36,000 crore.

Corporate bond funds saw some outflows during the period, but total AUM remained sizeable at around ₹2 lakh crore. This category accounted for nearly 11% of the total debt mutual fund market.

Gilt funds stood at about ₹38,000 crore, while credit risk funds were at approximately ₹19,000 crore.

Floater funds held assets worth around ₹52,000 crore, translating to nearly 3% market share.

Infrastructure debt funds showed some improvement in recent months, though AUM remained relatively small at around ₹900 crore.

While more recent data is awaited, the December numbers provide a clear picture of where investor money is currently moving within the debt mutual fund space.

Live stock market updates—follow our blog

/images/ppid_59c68470-image-177071522121761927.webp)

/images/ppid_a911dc6a-image-177071307920887358.webp)

/images/ppid_a911dc6a-image-177071303076331213.webp)

/images/ppid_a911dc6a-image-177071443822834480.webp)

/images/ppid_a911dc6a-image-177071443569946022.webp)