"If it's less than a 1,000-point rally (on Tuesday), it would be disappointing," Jayesh Mehta of Bank of America said.

As of 11:45 PM on Feb 2, GIFT Nifty was indicating a gap-up start, 694 points (2.76%) higher than the close on Monday.

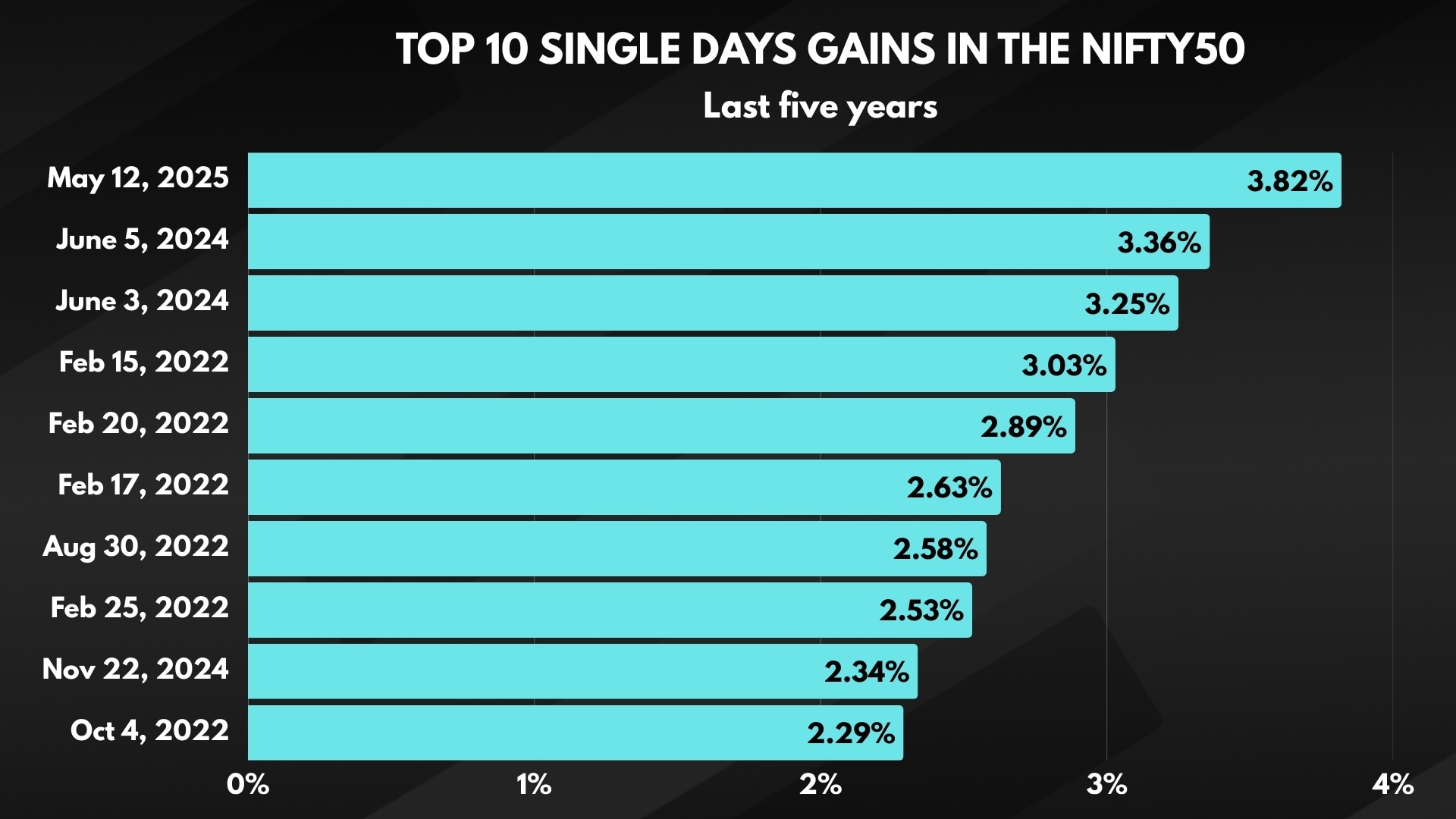

That would make Feb 3 one of the top 10 trading days for the Nifty 50 in the last five years.

The sentimental impact may be much wider, considering the agreement marks the end of a huge cap that had weighed on the Indian stock market in recent months, making India a massive underperformer among all emerging markets.

With a final tariff at 18%, India now faces the lowest US tariffs among all EMs after South Korea.

In the last month, the MSCI EM Index has gained 4.7% compared to a 4.6% fall in the Nifty 50. Moreover, foreign portfolio investors were reportedly caught in the most bearish position on the Indian stock market since the pandemic.

"I think there will be a short squeeze. Not only that, but I would argue that a lot of foreign investors who have been kind of selling their mood for some time, there could be a lot of foreign buying also coming into the Indian market," market veteran Madhu Kela told CNBC-TV18 in a conversation overnight.

From textiles players like Gokaldas Exportsand shrimp producers like Avanti Feeds and Apex Frozen Foods, to automobile makers like Bharat Forge, a whole host of stocks have their hopes pinned to this truce between India and the US. You can check out other stocks and sectors that would take the spotlight on Tuesday.

However, Kela believes even financials may be an indirect beneficiary of the overall sentiment. "Suppose people want to put $1-3 billion to work, it can only be deployed in company which are very large and liquid, right? And that is financials, NBFC is a large private bank, everything," the fund manager added.

While the fortunes of the software exporters like TCS, Infosys, and Wipro, aren't tied to the trade deal, the massive surge in the value of the rupee, after the trade deal, will definitely boost their dollar earnings.

Arvind Sanger, the founder of the New York-based Geosphere Capital see opportunity even in stocks like

/images/ppid_59c68470-image-177006003577034216.webp)

/images/ppid_59c68470-image-177006004229310789.webp)

/images/ppid_59c68470-image-17700601190757984.webp)

/images/ppid_59c68470-image-177006003434960459.webp)

/images/ppid_a911dc6a-image-177005922936485059.webp)