What is the story about?

The Reserve Bank of India (RBI) not only cut the benchmark interest rates, as expected by many, the central bank also promised a $1.5 trillion liquidity boost via open market operations and a currency swap window.

The ₹1 lakh crore ($11 billion) open market operation, the process of purchase or sale of government bonds by the central bank to manage money supply, will start in December. The move is not intended to influence the yields on government bonds, Governor Sanjay Malhotra insisted in his address right after the latest monetary policy review.

The regulator aims to inject another $500 billion through a dedicated window for banks to swap US dollars for Indian rupees.

Over the next three years, the RBI would buy US dollars from banks, in exchange for rupees, with an agreement to sell the original currency back to the banks at a specified future date, at a higher price.

The added money supply is expected to push borrowing rates down. "There was some pressure on bond yields and government securities, especially the state development loans, whose auctions will be coming up in the last quarter. They were kind of pushing up the rates a little. That will now be corrected, hopefully, because of all this," Ashwini Kumar Tewari, Managing Director at State Bank of India (SBI), told CNBC-TV18.

Further, the RBI Governor presented a rather dovish view of where the inflation is headed. The latest projection shows the consumer price index at 4% or less until September 2026. If not for the pressure from sky-high gold prices, core inflation would have been 2.6% in October, he added.

With such a benign view of the inflation risk, the central bank may have given itself room for more cuts in interest rates as well as another $500 billion liquidity infusion by March 2026, according to Kaushik Das, Chief Economist at Deutsche Bank.

While borrowers may benefit from the downward pressure on lending rates, the banks may have to bear the cost of it.

Competitive pressures have brought interest on outstanding deposits down by only 32 basis points since February this year, whereas lending rates have tumbled nearly twice as fast.

The fall in the weighted average lending rate for outstanding deposits has been 63 basis points in the same period, as per the latest RBI data.

Tewari, who heads the country's largest bank, believes the pressure on profitability will be temporary and ease, hopefully, by the end of next year when the maturing deposits are repriced.

Interest rates on new deposits are already down 105 basis points since February this year.

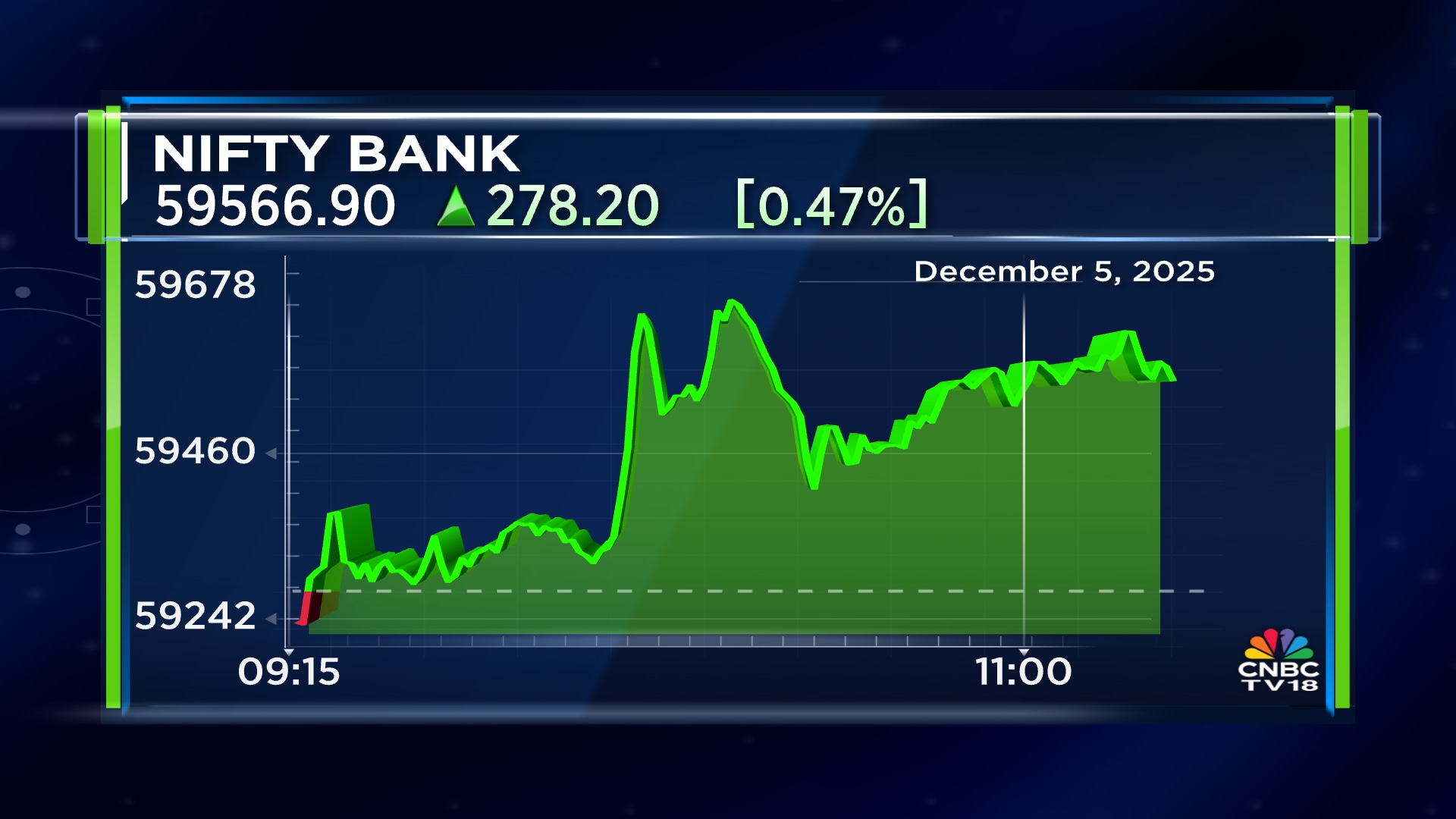

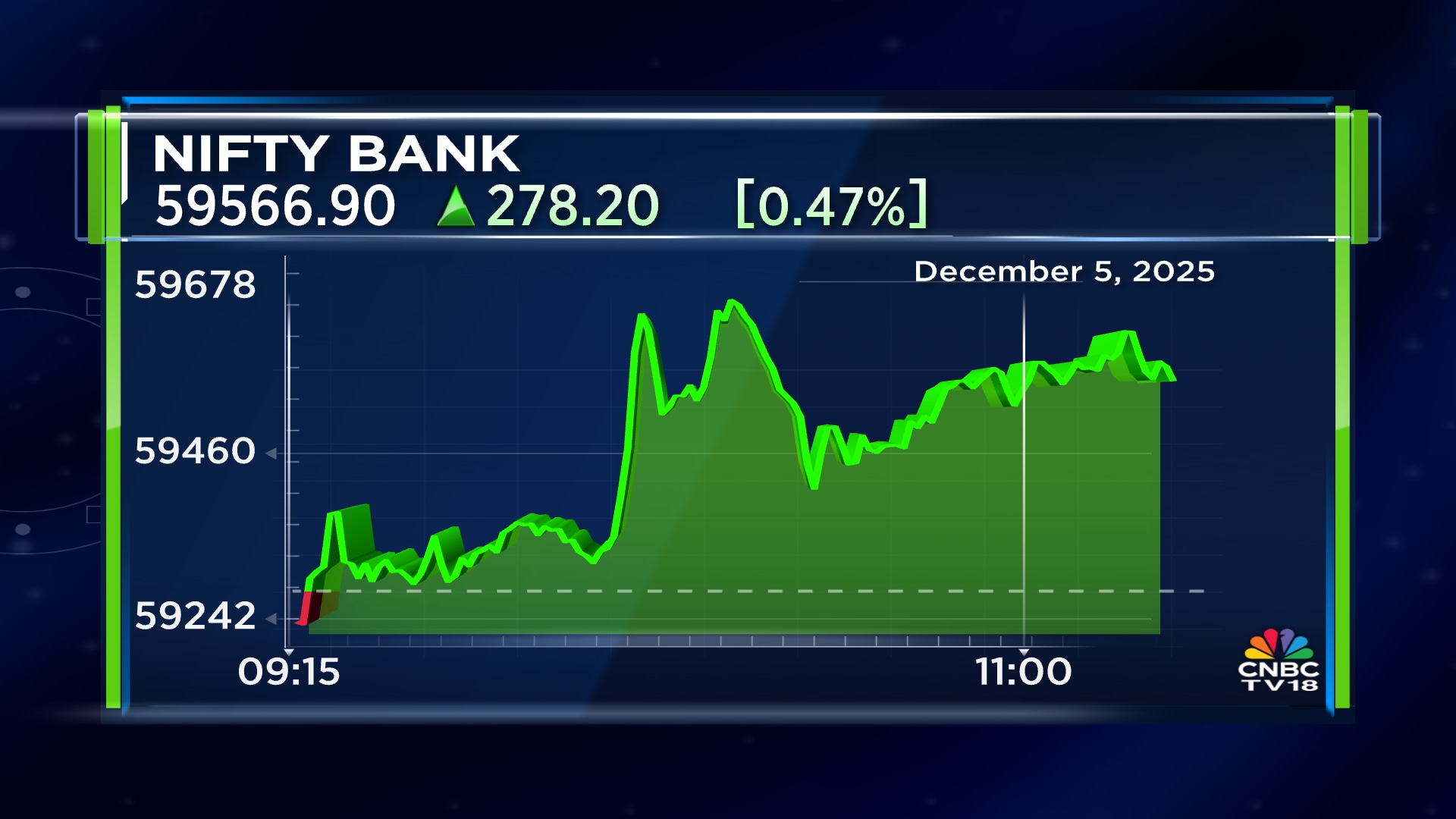

Check out the latest market updates here.

The ₹1 lakh crore ($11 billion) open market operation, the process of purchase or sale of government bonds by the central bank to manage money supply, will start in December. The move is not intended to influence the yields on government bonds, Governor Sanjay Malhotra insisted in his address right after the latest monetary policy review.

The regulator aims to inject another $500 billion through a dedicated window for banks to swap US dollars for Indian rupees.

Over the next three years, the RBI would buy US dollars from banks, in exchange for rupees, with an agreement to sell the original currency back to the banks at a specified future date, at a higher price.

The added money supply is expected to push borrowing rates down. "There was some pressure on bond yields and government securities, especially the state development loans, whose auctions will be coming up in the last quarter. They were kind of pushing up the rates a little. That will now be corrected, hopefully, because of all this," Ashwini Kumar Tewari, Managing Director at State Bank of India (SBI), told CNBC-TV18.

Further, the RBI Governor presented a rather dovish view of where the inflation is headed. The latest projection shows the consumer price index at 4% or less until September 2026. If not for the pressure from sky-high gold prices, core inflation would have been 2.6% in October, he added.

With such a benign view of the inflation risk, the central bank may have given itself room for more cuts in interest rates as well as another $500 billion liquidity infusion by March 2026, according to Kaushik Das, Chief Economist at Deutsche Bank.

While borrowers may benefit from the downward pressure on lending rates, the banks may have to bear the cost of it.

Competitive pressures have brought interest on outstanding deposits down by only 32 basis points since February this year, whereas lending rates have tumbled nearly twice as fast.

The fall in the weighted average lending rate for outstanding deposits has been 63 basis points in the same period, as per the latest RBI data.

Tewari, who heads the country's largest bank, believes the pressure on profitability will be temporary and ease, hopefully, by the end of next year when the maturing deposits are repriced.

Interest rates on new deposits are already down 105 basis points since February this year.

Check out the latest market updates here.

/images/ppid_59c68470-image-176491504328390994.webp)

/images/ppid_a911dc6a-image-177088864928744173.webp)

/images/ppid_a911dc6a-image-177088805007765911.webp)

/images/ppid_a911dc6a-image-177088803864211353.webp)

/images/ppid_59c68470-image-177088756453137106.webp)