What is the story about?

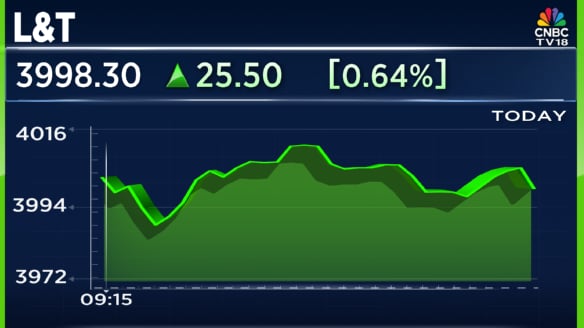

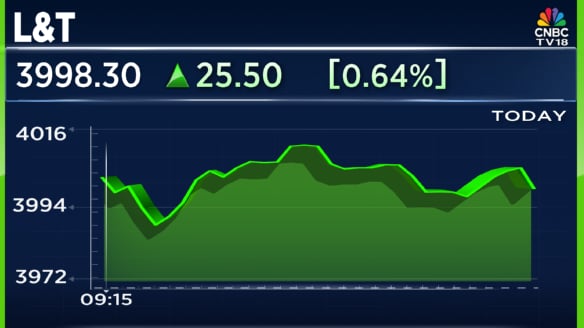

Shares of Larsen & Toubro Ltd

. gained around 1% to hit a 52-week high of ₹4,016.70 on Wednesday, October 29, ahead of the engineering and infrastructure conglomerate's September quarter earnings announcement.

The company also announced that it has secured grid infrastructure orders for the construction of a 380 kV substation and transmission lines in Saudi Arabia.

The order has been classified as "large," implying a value between ₹2,500 crore and ₹5,000 crore.

The first project involves setting up a 380/33 kV Gas Insulated Substation, which includes hybrid GIS elements, 380 kV transformers and reactors, as well as systems for power protection, control, automation, telecommunication, HVAC, and firefighting.

The second set of contracts covers the construction of 380 kV overhead transmission links spanning more than 420 kilometres in total.

L&T's second quarter revenue is seen at around ₹69,950 crore, a growth of 13.6% year-on-year, while EBITDA is seen rising 9.7% to ₹6,980 crore.

Margins are expected at 10%, compared to 10.4% in the same quarter last year, and net profit is estimated at ₹3,990 crore, up 17% year-on-year.

Brokerage firm JM Financial expects core revenue (excluding services and development projects) to grow 20%, with a core EBITDA margin of 7.9%.

It estimates order inflows of about ₹2 lakh crore in the first half of FY26 and said L&T is well positioned to win another ₹43,000 crore worth of projects in Kuwait.

The company is also on track to exceed its FY26 order inflow growth guidance of 10%

For FY26, L&T has guided for 15% topline growth, a core margin of 8.5% versus 8.3% in FY25, and 10% order inflow growth. The company's consolidated order book has now crossed ₹6 lakh crore.

Shares of Larsen & Toubro are currently trading 0.66% higher at ₹3,999. The stock has risen 10% so far in 2025.

The company also announced that it has secured grid infrastructure orders for the construction of a 380 kV substation and transmission lines in Saudi Arabia.

The order has been classified as "large," implying a value between ₹2,500 crore and ₹5,000 crore.

The first project involves setting up a 380/33 kV Gas Insulated Substation, which includes hybrid GIS elements, 380 kV transformers and reactors, as well as systems for power protection, control, automation, telecommunication, HVAC, and firefighting.

The second set of contracts covers the construction of 380 kV overhead transmission links spanning more than 420 kilometres in total.

L&T Q2 preview

L&T's second quarter revenue is seen at around ₹69,950 crore, a growth of 13.6% year-on-year, while EBITDA is seen rising 9.7% to ₹6,980 crore.

Margins are expected at 10%, compared to 10.4% in the same quarter last year, and net profit is estimated at ₹3,990 crore, up 17% year-on-year.

Brokerage firm JM Financial expects core revenue (excluding services and development projects) to grow 20%, with a core EBITDA margin of 7.9%.

It estimates order inflows of about ₹2 lakh crore in the first half of FY26 and said L&T is well positioned to win another ₹43,000 crore worth of projects in Kuwait.

The company is also on track to exceed its FY26 order inflow growth guidance of 10%

For FY26, L&T has guided for 15% topline growth, a core margin of 8.5% versus 8.3% in FY25, and 10% order inflow growth. The company's consolidated order book has now crossed ₹6 lakh crore.

Shares of Larsen & Toubro are currently trading 0.66% higher at ₹3,999. The stock has risen 10% so far in 2025.

/images/ppid_59c68470-image-176171512839918099.webp)

/images/ppid_a911dc6a-image-177105952513238219.webp)

/images/ppid_a911dc6a-image-177105952399574919.webp)