What is the story about?

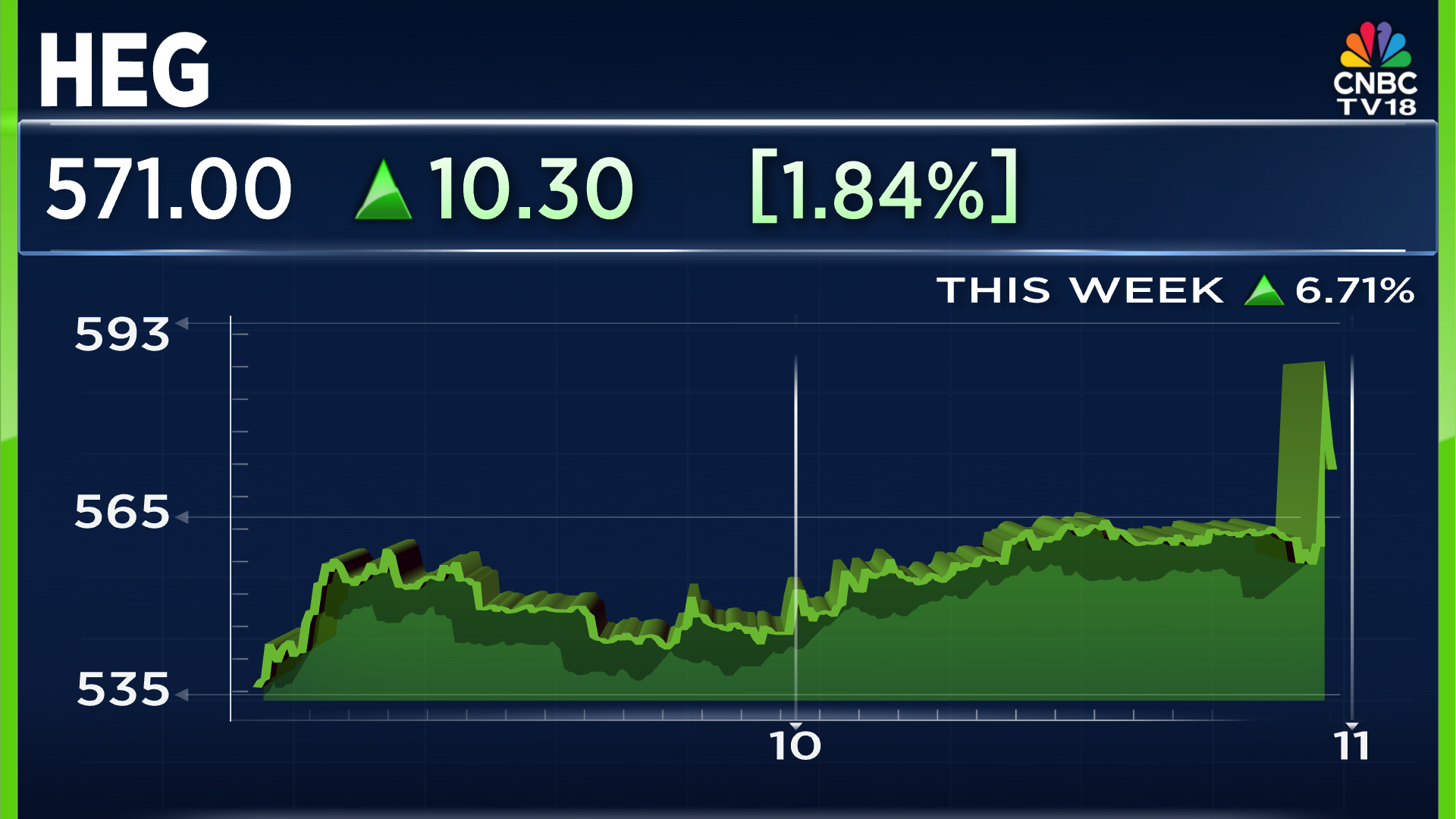

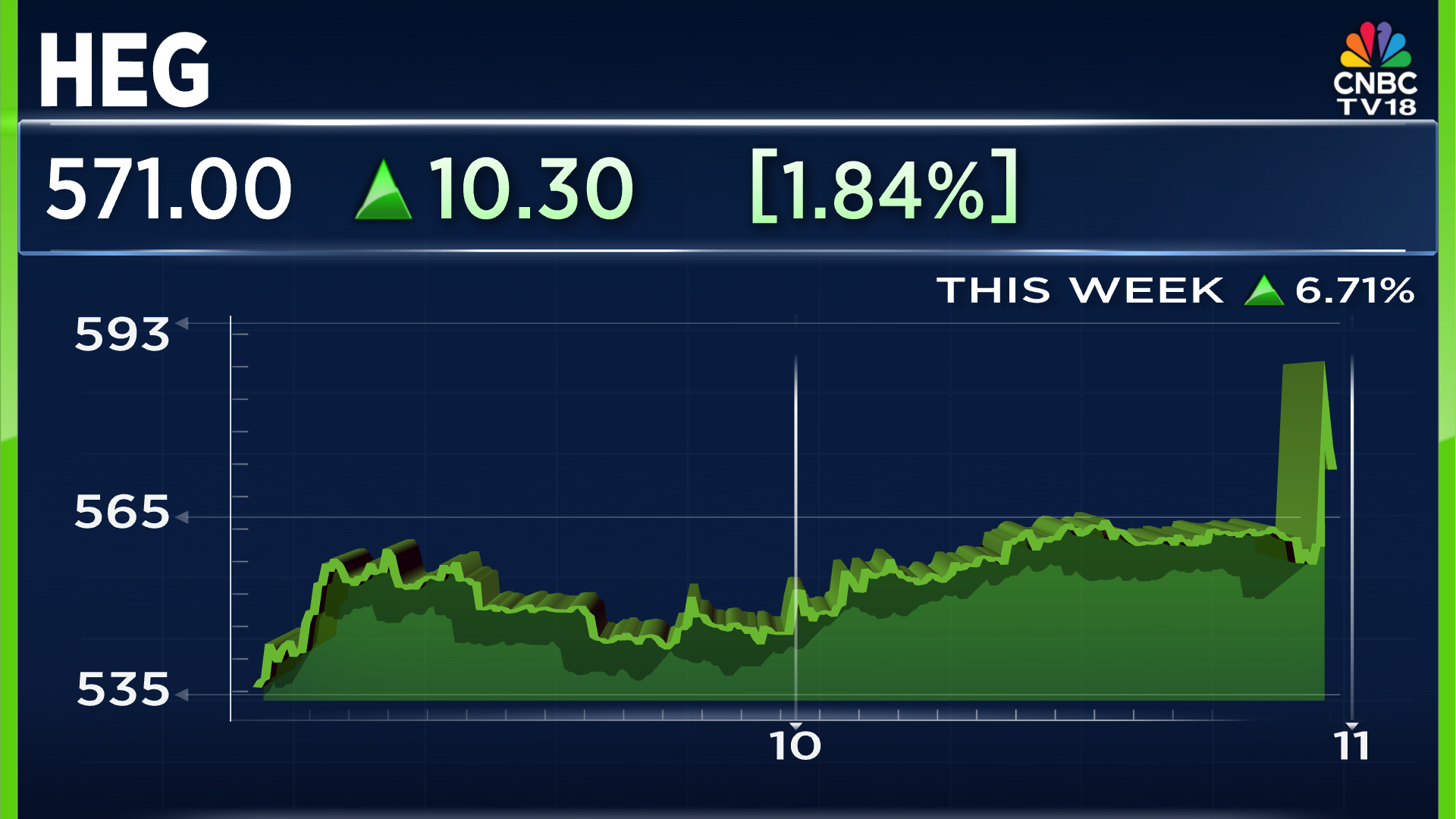

Shares of HEG Ltd. gave up early gains on Wednesday, February 11, slipping nearly 10% from the intraday high and turning negative.

After a strong start, the stock reversed course and was trading around 4% lower.

HEG shares are down over 5% over the past month and are currently trading about 20% below their 52-week high of ₹672 per share.

On the earnings front, HEG reported a strong December quarter.

Revenue rose 37% year-on-year to ₹656 crore. Operating margins expanded to 21.7% from 16.7% a year ago, marking the highest margin level since June 2023.

Profit after tax surged 148% year-on-year to ₹207 crore from ₹83 crore, aided by a sharp increase in profit from associates, which rose to ₹65 crore from ₹7 crore on a quarter-on-quarter basis.

Management had earlier indicated that prices were likely to remain largely flat, making the margin expansion and 20% plus margin print a positive surprise.

After a strong start, the stock reversed course and was trading around 4% lower.

HEG shares are down over 5% over the past month and are currently trading about 20% below their 52-week high of ₹672 per share.

On the earnings front, HEG reported a strong December quarter.

Revenue rose 37% year-on-year to ₹656 crore. Operating margins expanded to 21.7% from 16.7% a year ago, marking the highest margin level since June 2023.

Profit after tax surged 148% year-on-year to ₹207 crore from ₹83 crore, aided by a sharp increase in profit from associates, which rose to ₹65 crore from ₹7 crore on a quarter-on-quarter basis.

Management had earlier indicated that prices were likely to remain largely flat, making the margin expansion and 20% plus margin print a positive surprise.

/images/ppid_59c68470-image-177078512573843468.webp)

/images/ppid_59c68470-image-177078266477088748.webp)

/images/ppid_a911dc6a-image-177078462754791366.webp)

/images/ppid_a911dc6a-image-177078442745915794.webp)

/images/ppid_a911dc6a-image-177078359587862411.webp)

/images/ppid_59c68470-image-177078266899342502.webp)

/images/ppid_59c68470-image-177078257727351100.webp)