JK Tyre & Industries Ltd delivered a strong and broad-based performance in the third quarter ended December 31, 2025, with profitability rising sharply on the back of healthy automobile demand, operating leverage and benign raw material prices.

Net profit for the quarter stood at ₹207 crore, a significant jump from ₹52.6 crore in the year-ago period. Revenue grew 15% year-on-year to ₹4,223 crore, compared with ₹3,673 crore in the corresponding quarter last year, reflecting strong traction across segments.

Operating performance was particularly robust, with EBITDA rising 82% YoY to ₹571.3 crore from ₹313.8 crore. EBITDA margin expanded sharply to 13.5% from 8.5% a year ago, supported by product premiumisation, execution excellence and favourable raw material costs.

Ahead of the earnings announcement, shares of JK Tyre & Industries Ltd closed 0.74% higher at ₹540 on the NSE.

Domestic strength, resilient exports

The company said domestic business recorded healthy double-digit growth of 16% YoY, driven by a 12% rise in the replacement segment and a strong 27% growth in the OEM segment. Exports remained resilient despite geopolitical uncertainties impacting global markets.

Also Read: Crompton Greaves Q3 Results: Profit, margin beat estimates but slip YoY; revenue rises

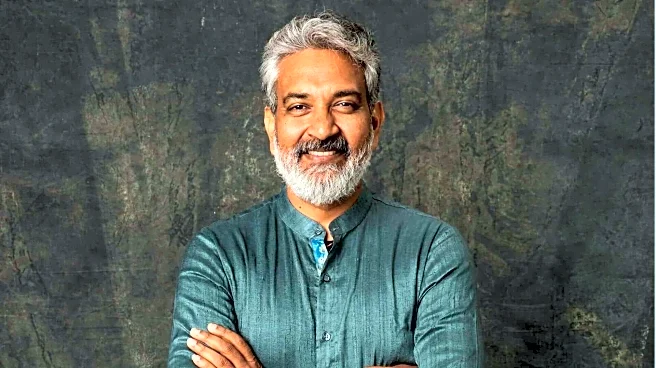

Commenting on the results, Chairman & Managing Director, Raghupati Singhania said JK Tyre delivered a robust Q3 performance, supported by festive season momentum, GST-led reforms and positive rural sentiments. He noted that strong traction across both OEM and replacement segments reflected customers’ continued trust in the brand.

Merger milestone and international performance

During the quarter, JK Tyre successfully completed the merger of Cavendish Industries Limited (CIL) with the company, following receipt of all statutory approvals. Acquired in 2016, CIL’s capacity utilisation has been scaled up from around 30% to over 95%, marking another successful turnaround for JK Tyre after Vikrant Tyres and JK Tornel, Mexico.

JK Tyre’s international subsidiary, JK Tornel (Mexico), also delivered a significant improvement in financial performance, further strengthening consolidated results.

Looking ahead, Singhania said the company enters Q4 with confidence, supported by healthy demand across segments, positive consumer sentiment and lower interest rates, and remains optimistic about sustaining the momentum into FY27.

/images/ppid_59c68470-image-177038256380387875.webp)

/images/ppid_59c68470-image-177038015613117967.webp)

/images/ppid_59c68470-image-177038012175022833.webp)

/images/ppid_59c68470-image-177038008121129198.webp)

/images/ppid_a911dc6a-image-177038123690899402.webp)

/images/ppid_a911dc6a-image-17703812300185342.webp)