What is the story about?

A trade breakthrough between India and the United States is being seen as more than just a diplomatic win. Fund managers say it could shift market mood, bring foreign money back, and improve visibility on earnings after a long stretch of uncertainty.

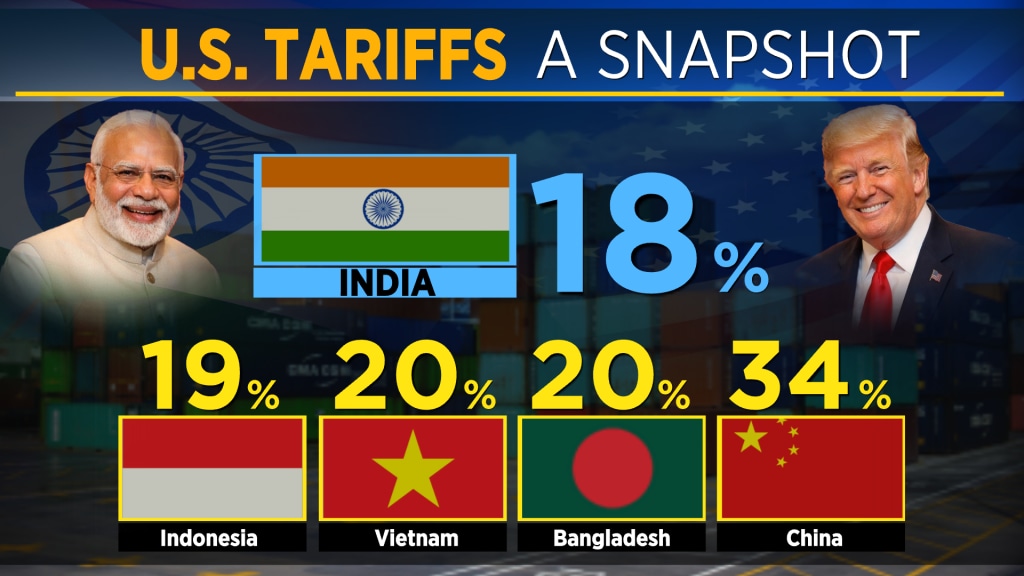

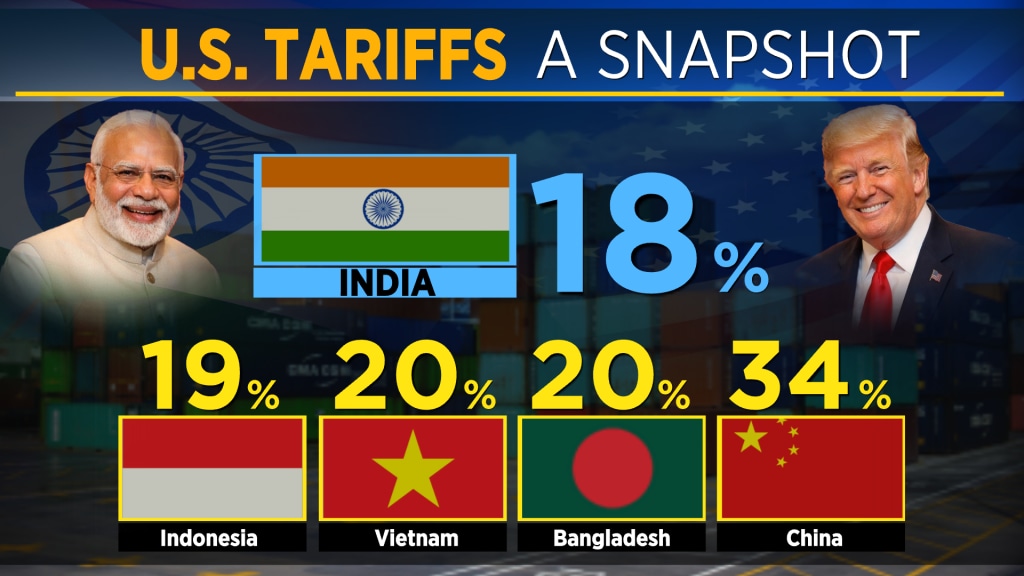

Equities rallied on February 3 after India and the US announced a long-awaited trade agreement the previous evening. The rally comes after a tough year, particularly for exporters, who were hit first by a 25% tariff imposed by US President Donald Trump in August, which was later raised to 50%, before being brought down to 18% under the new deal.

Several market veterans pointed out that markets had been struggling without a clear trigger. Now, that missing catalyst may have arrived. “I think the markets were lacking a catalyst. And this certainly comes as a catalyst,” said Sunil Singhania, Founder of Abakkus Asset Manager, which manages assets worth nearly $2.5 billion. He added that the development helps sentiment, corporate profit growth and even the currency outlook.

For many, the bigger change is psychological. After months of worry over tariffs and global trade friction, the removal of a key overhang could shift how investors view India. “There was a hanging sword on Indian equities and currency market because of uncertainty over US tariffs,” said

Nilesh Shah of Kotak Mahindra AMC. He said the deal first improves sentiment and then supports sectors that were directly affected by trade tensions.

Fund managers also see this as a moment that could bring foreign investors back in a more durable way. Currency stability, in particular, is seen as crucial. “The only issue was valuations. And valuations have also kind of cooled off,” said Harish Krishnan, CIO-Equity at Aditya Birla Sun Life AMC, which manages assets worth over $3 billion. The persistent slide in the rupee had been a bigger concern earlier, he added. The

rupee strengthened by 1.10 to 90.40 a dollar following the deal.

"2025 has been a year of extremes… FIIs sold out probably $20-odd billion which is a historic peak," noted Taher Badshah, CIO, Invesco Mutual Fund, which manages assets worth $15.5 billion.

Beyond the initial relief rally, some believe the implications could stretch into future earnings cycles. “It is a macro reset at one level. It is a policy reset at one level,” Badshah said. He expects the deal to improve visibility not just for the coming year but for earnings beyond that, as external demand and policy flexibility improve.

At a sector level, exporters are seen as early beneficiaries, especially areas that were directly hit by tariff uncertainty. Singhania said inventory levels with US buyers are low and that the deal could trigger restocking. That could help engineering exporters and textiles in the near term. Shah also pointed out that sectors such as textiles, aquaculture, handicrafts and gems and jewellery had faced pressure and could now see relief.

Singhania believes that any fresh deployment of capital would initially gravitate towards large-cap stocks. While smaller companies could witness sharp price moves, Singhania cautioned that such rallies may occur without meaningful volumes.

Domestic-focused sectors may gain more gradually as sentiment improves. Krishnan said Indian companies already have strong balance sheets and cash flows, and this could be the moment for corporate investment to pick up. Badshah added that a more stable currency and better policy room could support banks and financials, while improved global trade visibility may also help technology companies over time.

Even so, fund managers cautioned that details of the agreement still matter and the final impact will depend on which sectors benefit and what India gives in return.

Krishnan also sounded a note of caution. "The supply has been relentless," he said, pointing to the steady pipeline of initial public offerings (IPOs) and private equity stake sales. He expects this supply to absorb a large portion of incoming foreign capital, suggesting that the impact of a shift in FPI positioning may take time to fully reflect in the broader market.

Conrad Saldanha, MD and Portfolio Manager at Neuberger Berman, also noted that for a sustained economic recovery and a meaningful earnings inflection, the benefits of the deal must extend beyond a handful of industries to not just meaningfully attract foreign investment but also revive domestic private capital expenditure.

Saldanha also emphasised the need for continued bilateral negotiations, particularly on items covered under Section 232 of the US Trade Expansion Act of 1962, including steel, aluminium, and automobiles.

Still, the broad view is that markets may have moved past a key uncertainty. As Singhania put it, positioning was light and expectations were low, making the deal a “very, very pleasant surprise” that could mark a shift in direction for Indian equities.

Read Here | India-US trade deal announced; Tariff on exports drops to 18% from 50%

For full interview, watch accompanying video

Follow our live blog for more stock market updates

Equities rallied on February 3 after India and the US announced a long-awaited trade agreement the previous evening. The rally comes after a tough year, particularly for exporters, who were hit first by a 25% tariff imposed by US President Donald Trump in August, which was later raised to 50%, before being brought down to 18% under the new deal.

Several market veterans pointed out that markets had been struggling without a clear trigger. Now, that missing catalyst may have arrived. “I think the markets were lacking a catalyst. And this certainly comes as a catalyst,” said Sunil Singhania, Founder of Abakkus Asset Manager, which manages assets worth nearly $2.5 billion. He added that the development helps sentiment, corporate profit growth and even the currency outlook.

For many, the bigger change is psychological. After months of worry over tariffs and global trade friction, the removal of a key overhang could shift how investors view India. “There was a hanging sword on Indian equities and currency market because of uncertainty over US tariffs,” said

Fund managers also see this as a moment that could bring foreign investors back in a more durable way. Currency stability, in particular, is seen as crucial. “The only issue was valuations. And valuations have also kind of cooled off,” said Harish Krishnan, CIO-Equity at Aditya Birla Sun Life AMC, which manages assets worth over $3 billion. The persistent slide in the rupee had been a bigger concern earlier, he added. The

"2025 has been a year of extremes… FIIs sold out probably $20-odd billion which is a historic peak," noted Taher Badshah, CIO, Invesco Mutual Fund, which manages assets worth $15.5 billion.

Beyond the initial relief rally, some believe the implications could stretch into future earnings cycles. “It is a macro reset at one level. It is a policy reset at one level,” Badshah said. He expects the deal to improve visibility not just for the coming year but for earnings beyond that, as external demand and policy flexibility improve.

At a sector level, exporters are seen as early beneficiaries, especially areas that were directly hit by tariff uncertainty. Singhania said inventory levels with US buyers are low and that the deal could trigger restocking. That could help engineering exporters and textiles in the near term. Shah also pointed out that sectors such as textiles, aquaculture, handicrafts and gems and jewellery had faced pressure and could now see relief.

Singhania believes that any fresh deployment of capital would initially gravitate towards large-cap stocks. While smaller companies could witness sharp price moves, Singhania cautioned that such rallies may occur without meaningful volumes.

Domestic-focused sectors may gain more gradually as sentiment improves. Krishnan said Indian companies already have strong balance sheets and cash flows, and this could be the moment for corporate investment to pick up. Badshah added that a more stable currency and better policy room could support banks and financials, while improved global trade visibility may also help technology companies over time.

Even so, fund managers cautioned that details of the agreement still matter and the final impact will depend on which sectors benefit and what India gives in return.

Krishnan also sounded a note of caution. "The supply has been relentless," he said, pointing to the steady pipeline of initial public offerings (IPOs) and private equity stake sales. He expects this supply to absorb a large portion of incoming foreign capital, suggesting that the impact of a shift in FPI positioning may take time to fully reflect in the broader market.

Conrad Saldanha, MD and Portfolio Manager at Neuberger Berman, also noted that for a sustained economic recovery and a meaningful earnings inflection, the benefits of the deal must extend beyond a handful of industries to not just meaningfully attract foreign investment but also revive domestic private capital expenditure.

Saldanha also emphasised the need for continued bilateral negotiations, particularly on items covered under Section 232 of the US Trade Expansion Act of 1962, including steel, aluminium, and automobiles.

Still, the broad view is that markets may have moved past a key uncertainty. As Singhania put it, positioning was light and expectations were low, making the deal a “very, very pleasant surprise” that could mark a shift in direction for Indian equities.

Read Here | India-US trade deal announced; Tariff on exports drops to 18% from 50%

For full interview, watch accompanying video

Follow our live blog for more stock market updates

/images/ppid_59c68470-image-177010002890332909.webp)