What is the story about?

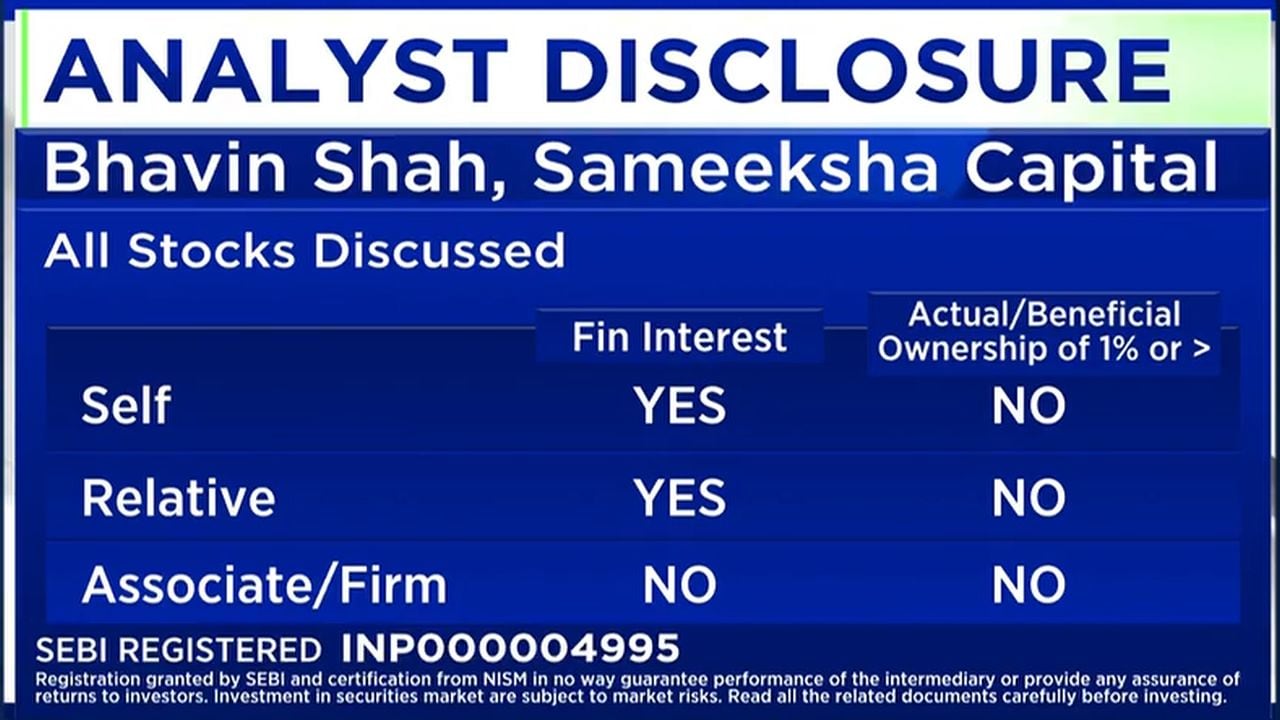

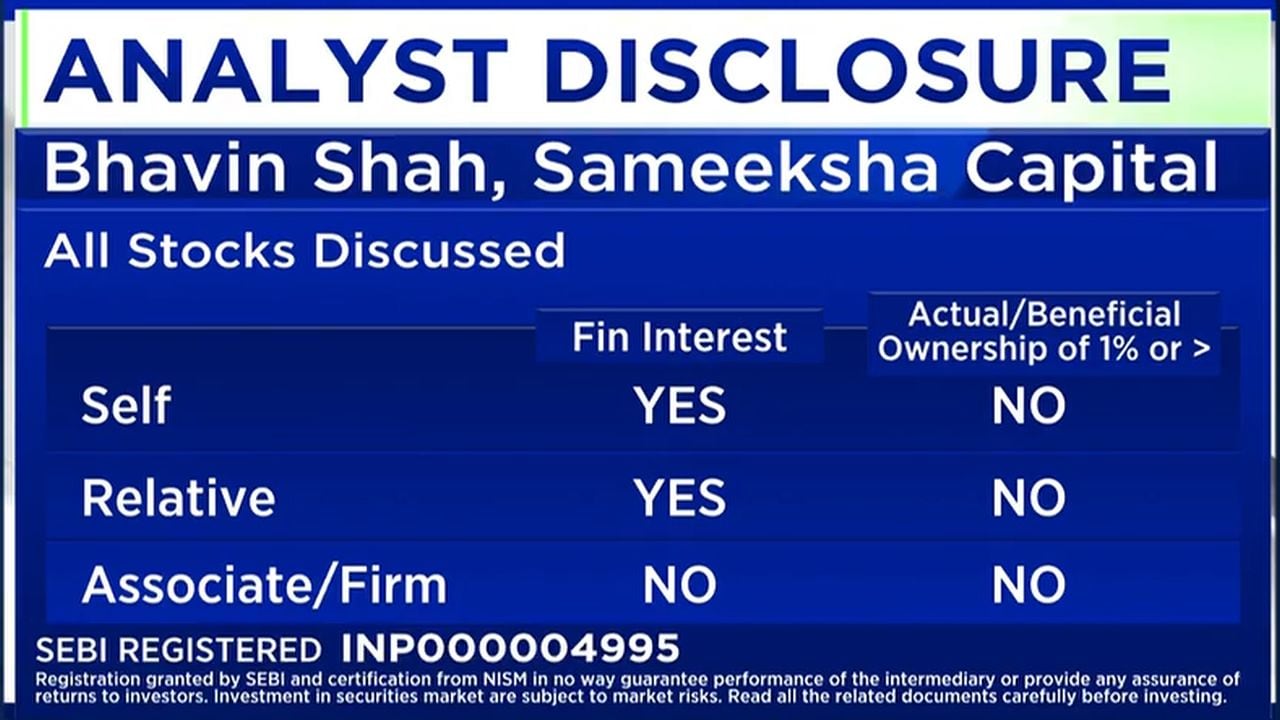

Mid-cap and small-cap stocks are showing early signs of stability, with some improvement in outlook for Indian IT companies such as Infosys, according to Bhavin A Shah, Founder, CIO, and CEO of Sameeksha Capital, which manages funds worth over ₹1,200 crore.

He said recent results from Tata Consultancy Services (TCS) and Infosys were better than market expectations and that the second half of the year looks relatively stronger for Infosys.

Industry discussions suggest artificial intelligence projects are moving from pilot stages to real implementation in calendar year 2026. This could create new opportunities for IT companies, even though automation may reduce demand for manpower in some areas.

Also read | Tariff overhang weighs on foreign sentiment, but banks and IT offer opportunities: Raymond James

Shah said Infosys stock is still offering a free cash flow yield of about 4 to 4.5%, with potential growth of around 7 to 8%. This could translate into a total return of around 10 to 12% for long-term investors.

“Sometimes you don’t have to be brilliant, you just have to be consistent,” he said, quoting Charlie Munger, referring to the long-term nature of IT services businesses.

He also noted that after a sharp move following results, IT stocks may trade sideways for some time, but remain suitable for long-term portfolios. The artificial intelligence (AI) momentum, he said, is being driven more by industry demand than company statements.

Also read | Market crises are becoming more frequent and that’s not bad news, says HDFC AMC’s Setalvad

Overall, earnings growth in the coming quarters will be key. “If this earning season goes well, it could play out pretty well,” he said, naming a few companies that are worth tracking:

InterGlobe Aviation (IndiGo) looks good for its market position and steps such as wet leasing to manage capacity, while Nuvama Wealth Management for its presence in the wealth management and capital markets space.

NephroPlus, a recent listing in the dialysis segment, he says, has a focused business model and experienced management.

He also said that some stocks have not reflected their business performance in share prices due to selling pressure, creating more opportunities in the current market.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

Also, catch the latest Budget 2026 expectations updates here

He said recent results from Tata Consultancy Services (TCS) and Infosys were better than market expectations and that the second half of the year looks relatively stronger for Infosys.

Industry discussions suggest artificial intelligence projects are moving from pilot stages to real implementation in calendar year 2026. This could create new opportunities for IT companies, even though automation may reduce demand for manpower in some areas.

Also read | Tariff overhang weighs on foreign sentiment, but banks and IT offer opportunities: Raymond James

Shah said Infosys stock is still offering a free cash flow yield of about 4 to 4.5%, with potential growth of around 7 to 8%. This could translate into a total return of around 10 to 12% for long-term investors.

“Sometimes you don’t have to be brilliant, you just have to be consistent,” he said, quoting Charlie Munger, referring to the long-term nature of IT services businesses.

He also noted that after a sharp move following results, IT stocks may trade sideways for some time, but remain suitable for long-term portfolios. The artificial intelligence (AI) momentum, he said, is being driven more by industry demand than company statements.

Also read | Market crises are becoming more frequent and that’s not bad news, says HDFC AMC’s Setalvad

Overall, earnings growth in the coming quarters will be key. “If this earning season goes well, it could play out pretty well,” he said, naming a few companies that are worth tracking:

InterGlobe Aviation (IndiGo) looks good for its market position and steps such as wet leasing to manage capacity, while Nuvama Wealth Management for its presence in the wealth management and capital markets space.

NephroPlus, a recent listing in the dialysis segment, he says, has a focused business model and experienced management.

He also said that some stocks have not reflected their business performance in share prices due to selling pressure, creating more opportunities in the current market.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

Also, catch the latest Budget 2026 expectations updates here

/images/ppid_59c68470-image-176854504161883012.webp)

/images/ppid_59c68470-image-177060015473030542.webp)

/images/ppid_59c68470-image-177064260285343894.webp)

/images/ppid_59c68470-image-177063512178491505.webp)

/images/ppid_59c68470-image-177070504854362320.webp)

/images/ppid_59c68470-image-17706926096387229.webp)

/images/ppid_59c68470-image-177074755392764491.webp)

/images/ppid_59c68470-image-177077508321758455.webp)

/images/ppid_59c68470-image-177071011165153667.webp)

/images/ppid_59c68470-image-177071756556855330.webp)

/images/ppid_59c68470-image-177060012334420918.webp)