What is the story about?

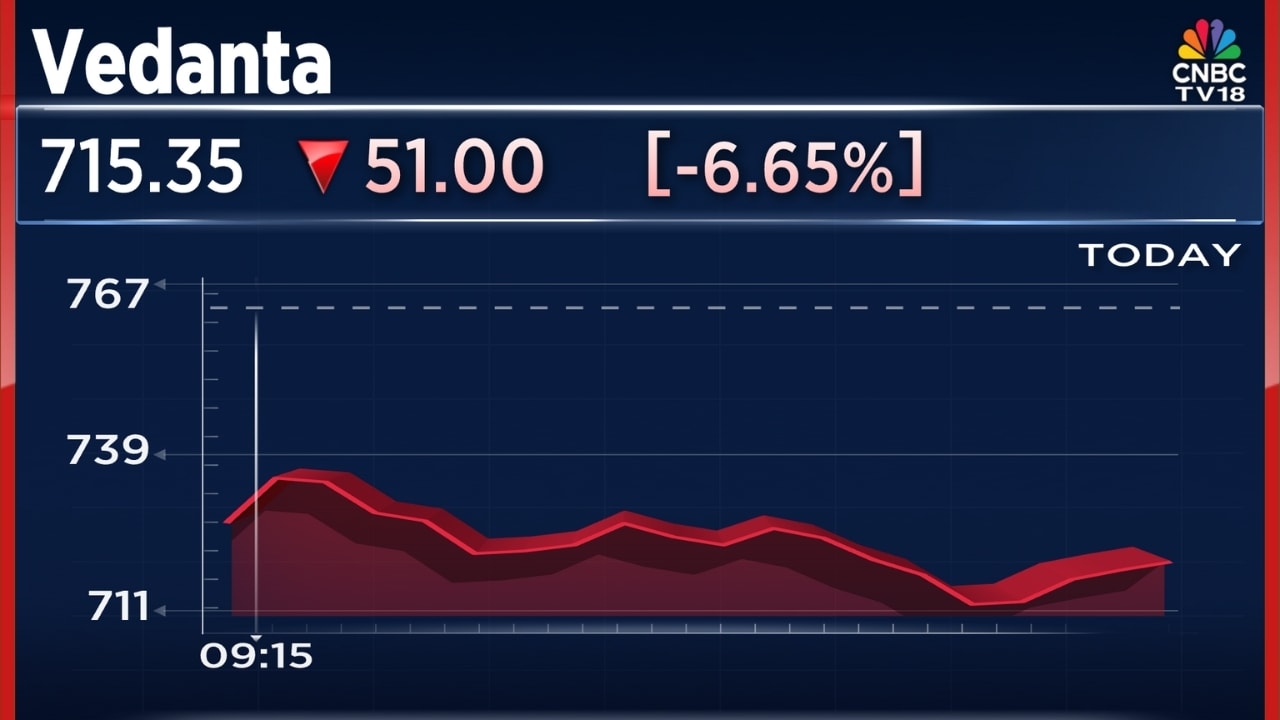

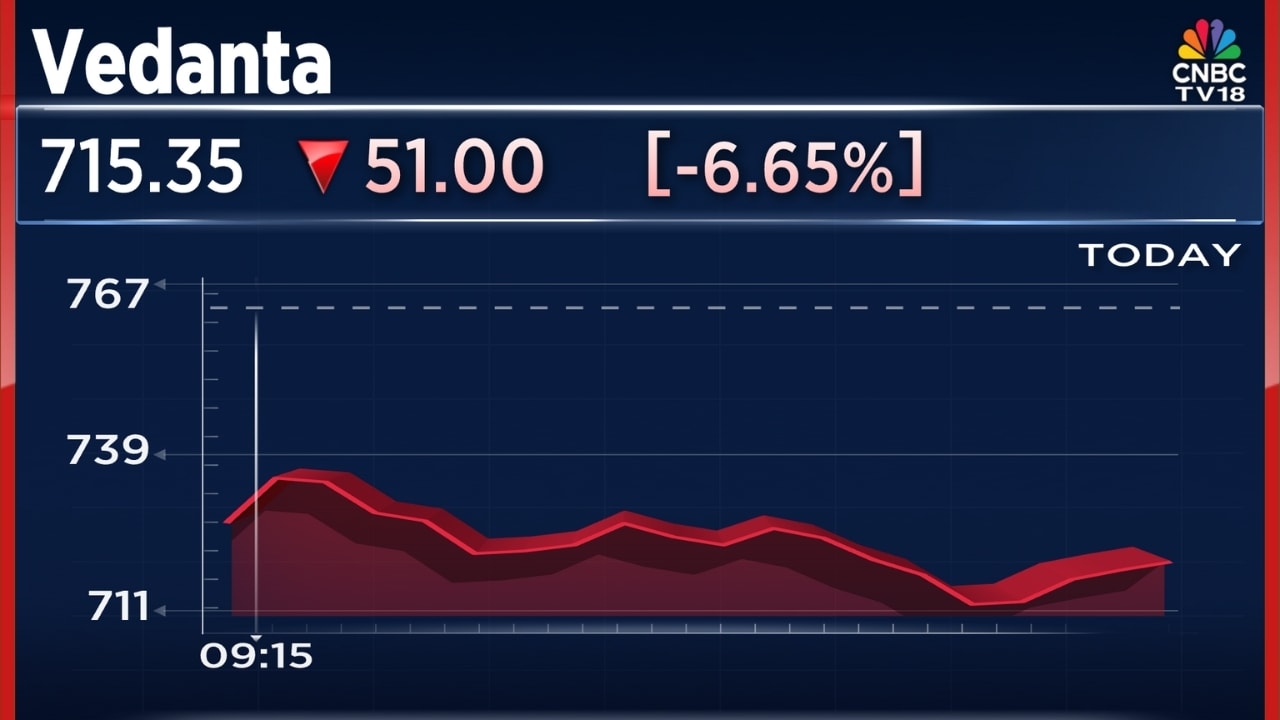

Shares of Vedanta Ltd., the Anil Agarwal-owned mining conglomerate, are down over 8% on Friday, January 30, in-line with the sell-off seen across metals in the global markets. The company also reported its results after market hours on Thursday, which were better on a year-on-year basis.

Analysts who have coverage on Vedanta have raised their price targets on the stock further, expecting the demerger to unlock value and shareholders to receive further dividend payouts in the ongoing financial year.

Investec now has the highest price target on Vedanta. It raised its target to ₹930 from the earlier target of ₹700.

Citi also raised its price target on Vedanta to ₹900 from the earlier target of ₹585. The brokerage said that the stock warrants a "buy" as parent leverage is now at comfortable levels, there is also upside potential to Aluminium on the London Metal Exchange, as it sees prices at $3,425 in financial year 2027 compared to the curret spot price of $3,250.

Volume growth prospects, lower costs and completion of the demerger process are also some other major factors behind Citi's bullish stance on Vedanta.

The brokerage expects a dividend payout of ₹40 per share in the current financial year, of which ₹23 per share has already been paid so far.

On the flip side, JPMorgan, which is "neutral" on Vedanta also raised its price target to ₹680, stating that capacity expansion is largely on track and the demerger process should mostly be completed by the end of May.

14 analysts have coverage on Vedanta, of which none have a "sell" recommendation. 10 have a "buy" rating on the stock, while the other four have a "hold" rating.

Shares of Vedanta are now trading 8% lower on Friday at ₹707.65. The stock had made a new high of ₹755 on Thursday and is still up 18% so far in January.

Analysts who have coverage on Vedanta have raised their price targets on the stock further, expecting the demerger to unlock value and shareholders to receive further dividend payouts in the ongoing financial year.

Investec now has the highest price target on Vedanta. It raised its target to ₹930 from the earlier target of ₹700.

Citi also raised its price target on Vedanta to ₹900 from the earlier target of ₹585. The brokerage said that the stock warrants a "buy" as parent leverage is now at comfortable levels, there is also upside potential to Aluminium on the London Metal Exchange, as it sees prices at $3,425 in financial year 2027 compared to the curret spot price of $3,250.

Volume growth prospects, lower costs and completion of the demerger process are also some other major factors behind Citi's bullish stance on Vedanta.

The brokerage expects a dividend payout of ₹40 per share in the current financial year, of which ₹23 per share has already been paid so far.

On the flip side, JPMorgan, which is "neutral" on Vedanta also raised its price target to ₹680, stating that capacity expansion is largely on track and the demerger process should mostly be completed by the end of May.

14 analysts have coverage on Vedanta, of which none have a "sell" recommendation. 10 have a "buy" rating on the stock, while the other four have a "hold" rating.

Shares of Vedanta are now trading 8% lower on Friday at ₹707.65. The stock had made a new high of ₹755 on Thursday and is still up 18% so far in January.

/images/ppid_59c68470-image-176974760987461455.webp)

/images/ppid_59c68470-image-177060503103375745.webp)

/images/ppid_59c68470-image-177060516900074972.webp)

/images/ppid_59c68470-image-177061276780943035.webp)

/images/ppid_59c68470-image-177061016935462141.webp)

/images/ppid_59c68470-image-177069774045880142.webp)

/images/ppid_59c68470-image-177061270228793304.webp)

/images/ppid_59c68470-image-177069503136825695.webp)

/images/ppid_59c68470-image-17706926650825720.webp)

/images/ppid_59c68470-image-177062253691584457.webp)

/images/ppid_59c68470-image-177071008324940804.webp)

/images/ppid_59c68470-image-177069782473547371.webp)

/images/ppid_59c68470-image-177062256143028928.webp)