What is the story about?

Bond issuances in India are seeing increased activity across state governments, financial companies, banks and corporates, as multiple issuers prepare to raise funds through bonds and non-convertible debentures (NCDs).

The Reserve Bank of India (RBI) said 14 states raised nearly ₹380 billion through bond auctions on Tuesday. The issuances reflect continued borrowing by states to fund spending and infrastructure plans.

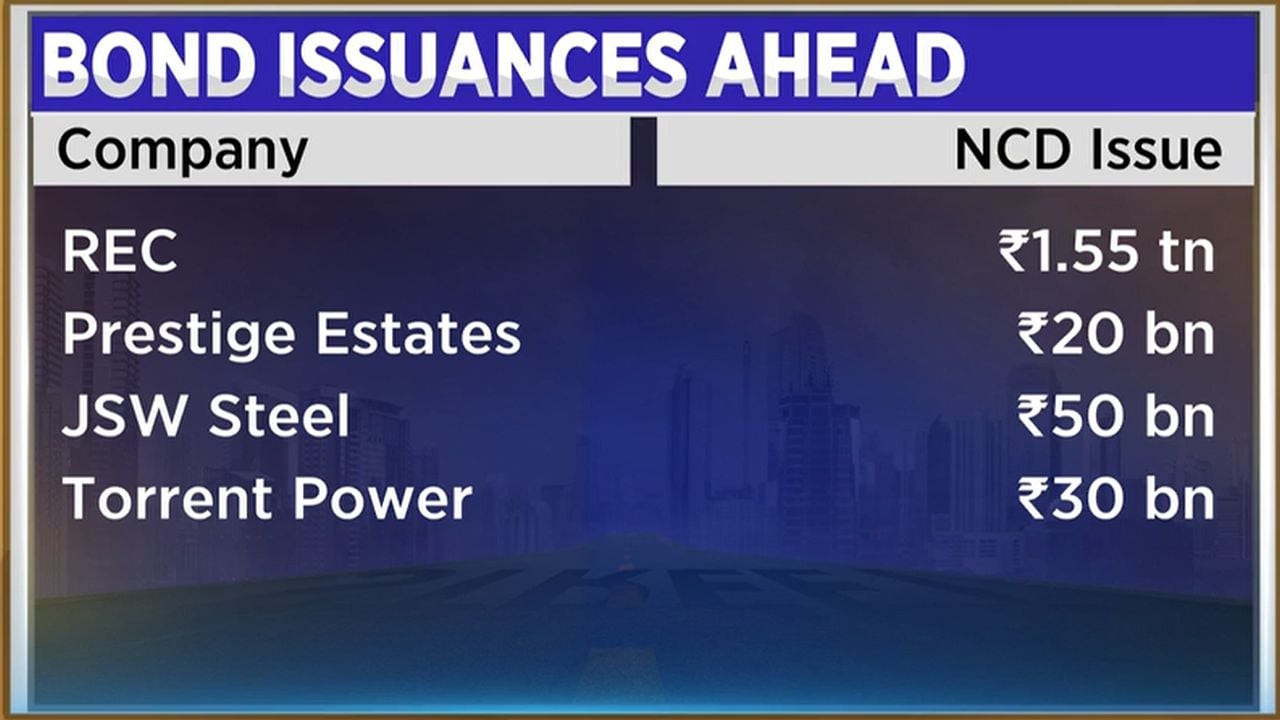

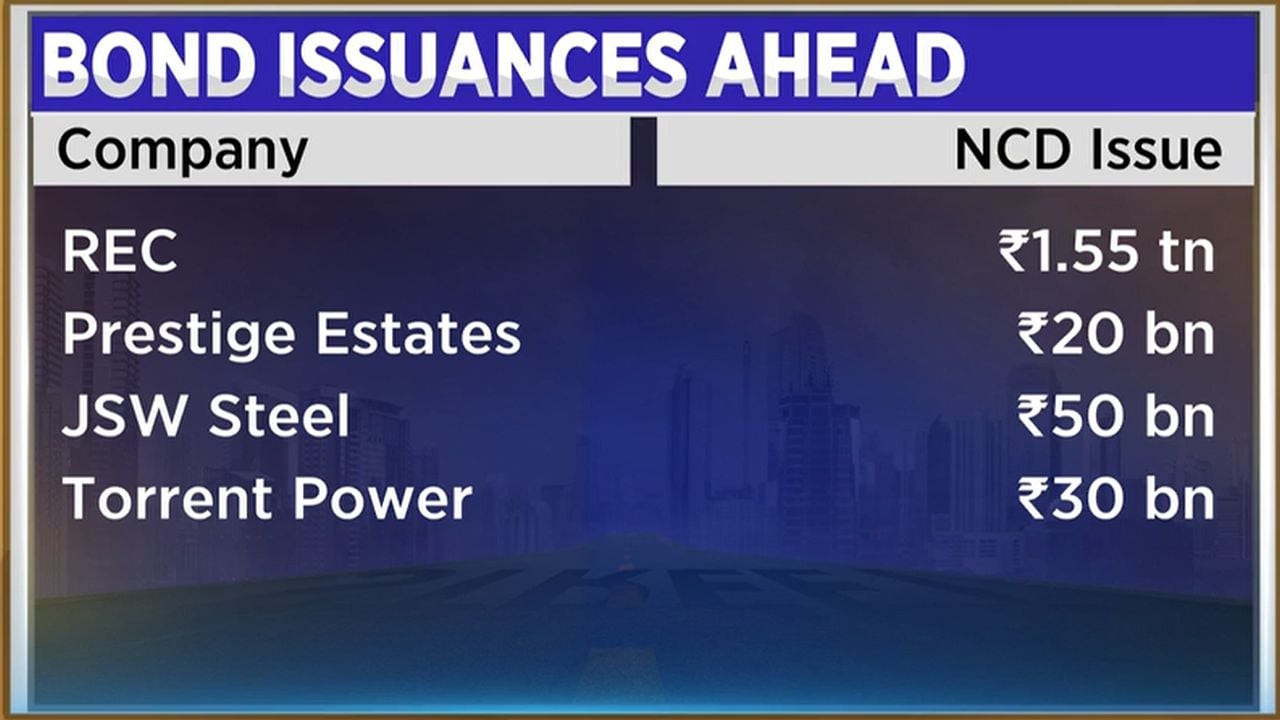

In the corporate segment, several issuances are expected in the private placement market.

Poonawalla Fincorp is seeking bids to raise about ₹5 billion through 10-year bonds. Veritas Finance is looking to raise about ₹2 billion through four-year bonds and is also seeking bids.

Also Read | India’s 7% growth outlook supports markets, but economists flag fiscal, trade, and currency risks

At the municipal level, Tiruchirappalli Municipal Corporation plans to raise about ₹1 billion through bonds, with bids expected around February 6.

Large issuances are also planned by the public sector and private companies. NHPC is looking to raise about ₹20 billion through bonds. REC Ltd is planning to raise about ₹1.5 trillion through NCDs in one or more tranches.

Among real estate and industrial companies, Prestige Estates is planning to raise about ₹20 billion through NCDs. JSW Steel is looking to raise about ₹50 billion through NCDs. Torrent Pharma is planning to raise about ₹30 billion through NCDs.

In the banking sector, Axis Bank is planning to raise about ₹350 billion through the debt market. Bank of Maharashtra is planning to raise about ₹100 billion through infrastructure bonds during FY26.

Catch all the latest updates from the stock market here

The Reserve Bank of India (RBI) said 14 states raised nearly ₹380 billion through bond auctions on Tuesday. The issuances reflect continued borrowing by states to fund spending and infrastructure plans.

In the corporate segment, several issuances are expected in the private placement market.

Also Read | India’s 7% growth outlook supports markets, but economists flag fiscal, trade, and currency risks

At the municipal level, Tiruchirappalli Municipal Corporation plans to raise about ₹1 billion through bonds, with bids expected around February 6.

Large issuances are also planned by the public sector and private companies. NHPC is looking to raise about ₹20 billion through bonds. REC Ltd is planning to raise about ₹1.5 trillion through NCDs in one or more tranches.

Among real estate and industrial companies, Prestige Estates is planning to raise about ₹20 billion through NCDs. JSW Steel is looking to raise about ₹50 billion through NCDs. Torrent Pharma is planning to raise about ₹30 billion through NCDs.

In the banking sector, Axis Bank is planning to raise about ₹350 billion through the debt market. Bank of Maharashtra is planning to raise about ₹100 billion through infrastructure bonds during FY26.

Catch all the latest updates from the stock market here

/images/ppid_59c68470-image-177019762762874743.webp)

/images/ppid_59c68470-image-177019774574074446.webp)

/images/ppid_59c68470-image-177019753384254167.webp)

/images/ppid_59c68470-image-17701977059601974.webp)

/images/ppid_59c68470-image-177019766706144192.webp)

/images/ppid_59c68470-image-177019757502245447.webp)

/images/ppid_59c68470-image-177019777907098409.webp)

/images/ppid_59c68470-image-177019752663120193.webp)