What is the story about?

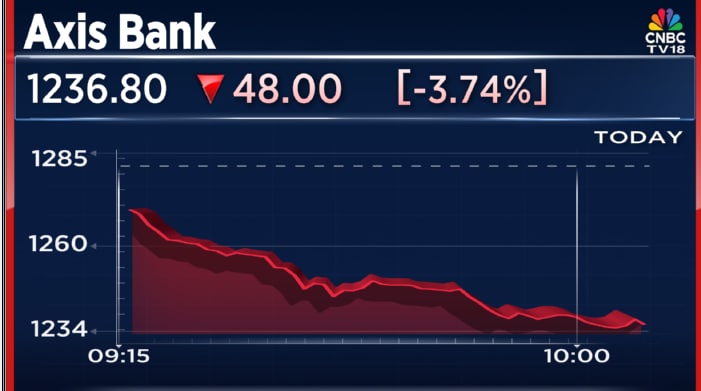

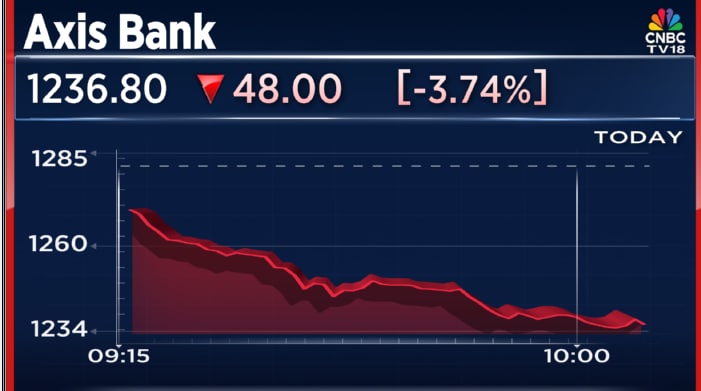

Shares of Axis Bank are under pressure on Tuesday, December 16, falling nearly 4%. The stock is also the top loser on the Nifty50 index.

The stock is reacting to a delay in net interest margin recovery, with the bank now indicating that NIMs are likely to bottom out later than previously guided.

Axis Bank has revised its outlook, saying NIMs are now expected to trough in either the fourth quarter or the first quarter of FY26, compared with its earlier guidance of the third quarter.

Management told Citi Research that margins are likely to follow a shallow, C-shaped recovery path, with NIMs targeted at 3.8% over the next 15-18 months, from 3.73% in the second quarter of FY26.

Citi has maintained a ‘Neutral’ rating on the stock with a price target of ₹1,285.

According to the brokerage, the corporate segment is gaining traction, while the retail business is also showing signs of recovery, though sustained momentum will need to be closely monitored.

Stress in the credit card portfolio is easing, personal loan growth is stabilising, and there is no visible stress in export-oriented MSMEs.

The brokerage added that slippages could see some seasonal uptick in the third quarter due to the agricultural cycle, though they are expected to be less severe than in the first quarter.

Citi also said that optimisation of the fee-to-asset ratio remains constrained in the near term.

The stock is reacting to a delay in net interest margin recovery, with the bank now indicating that NIMs are likely to bottom out later than previously guided.

Axis Bank has revised its outlook, saying NIMs are now expected to trough in either the fourth quarter or the first quarter of FY26, compared with its earlier guidance of the third quarter.

Management told Citi Research that margins are likely to follow a shallow, C-shaped recovery path, with NIMs targeted at 3.8% over the next 15-18 months, from 3.73% in the second quarter of FY26.

Citi has maintained a ‘Neutral’ rating on the stock with a price target of ₹1,285.

According to the brokerage, the corporate segment is gaining traction, while the retail business is also showing signs of recovery, though sustained momentum will need to be closely monitored.

Stress in the credit card portfolio is easing, personal loan growth is stabilising, and there is no visible stress in export-oriented MSMEs.

The brokerage added that slippages could see some seasonal uptick in the third quarter due to the agricultural cycle, though they are expected to be less severe than in the first quarter.

Citi also said that optimisation of the fee-to-asset ratio remains constrained in the near term.

/images/ppid_59c68470-image-176586252695328390.webp)

/images/ppid_a911dc6a-image-177080093159334115.webp)

/images/ppid_a911dc6a-image-177080056067494154.webp)

/images/ppid_a911dc6a-image-177080052363846330.webp)

/images/ppid_a911dc6a-image-177080382939031904.webp)

/images/ppid_a911dc6a-image-177080283060312298.webp)

/images/ppid_59c68470-image-177080260455435611.webp)

/images/ppid_59c68470-image-177080263329252397.webp)

/images/ppid_59c68470-image-177080252755837030.webp)

/images/ppid_59c68470-image-177080256500921890.webp)