What is the story about?

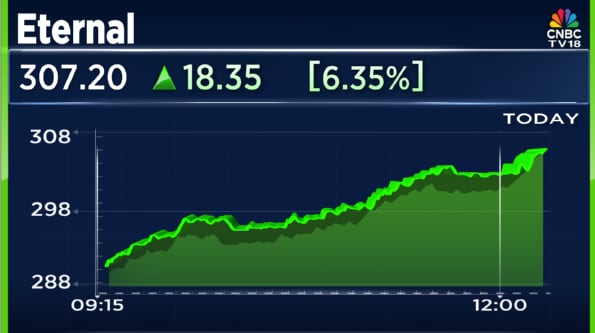

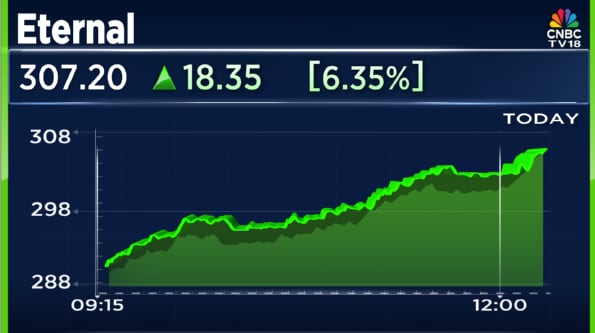

Shares of Eternal Ltd., the parent of food delivery platform Zomato and quick commerce player Blinkit, were trading over 6% higher on Tuesday, February 10.

The stock touched a high of ₹307.45, its highest level since November 27, 2025.

The rebound comes after a sharp correction following the company's third-quarter results, when the Street reacted negatively to founder Deepinder Goyal stepping aside from an executive role.

The decision to pass the baton to Blinkit CEO Albinder Dhindsa had caught investors by surprise.

Dhindsa has since been appointed as the new Managing Director and Chief Executive Officer of Eternal.

For the December quarter, Eternal reported a net profit of ₹102 crore, in line with the CNBC-TV18 poll estimate.

Revenue rose to ₹16,315 crore, surpassing the CNBC-TV18 estimate of ₹15,500 crore, aided partly by higher other income. Topline growth was led by the quick commerce business.

EBITDA for the quarter stood at ₹368 crore, marginally above the ₹300 crore estimate, while margins expanded 50 basis points year-on-year to 2.3%, compared with 1.8% last year and also ahead of the CNBC-TV18 poll of 1.9%.

On a year-on-year basis, net profit grew 57%, revenue increased 20%, and EBITDA rose 54%. The company also announced that its Quick Commerce and Hyperpure businesses turned Adjusted EBITDA profitable during the quarter.

Of the 33 analysts tracking Eternal, 30 have a 'Buy' rating on the stock, while three have a 'Sell' call.

Shares of Eternal were last trading 5.76% higher at ₹305.50, though the stock remains sharply off its recent peak of ₹364.

The stock touched a high of ₹307.45, its highest level since November 27, 2025.

The rebound comes after a sharp correction following the company's third-quarter results, when the Street reacted negatively to founder Deepinder Goyal stepping aside from an executive role.

The decision to pass the baton to Blinkit CEO Albinder Dhindsa had caught investors by surprise.

Dhindsa has since been appointed as the new Managing Director and Chief Executive Officer of Eternal.

For the December quarter, Eternal reported a net profit of ₹102 crore, in line with the CNBC-TV18 poll estimate.

Revenue rose to ₹16,315 crore, surpassing the CNBC-TV18 estimate of ₹15,500 crore, aided partly by higher other income. Topline growth was led by the quick commerce business.

EBITDA for the quarter stood at ₹368 crore, marginally above the ₹300 crore estimate, while margins expanded 50 basis points year-on-year to 2.3%, compared with 1.8% last year and also ahead of the CNBC-TV18 poll of 1.9%.

On a year-on-year basis, net profit grew 57%, revenue increased 20%, and EBITDA rose 54%. The company also announced that its Quick Commerce and Hyperpure businesses turned Adjusted EBITDA profitable during the quarter.

Of the 33 analysts tracking Eternal, 30 have a 'Buy' rating on the stock, while three have a 'Sell' call.

Shares of Eternal were last trading 5.76% higher at ₹305.50, though the stock remains sharply off its recent peak of ₹364.

/images/ppid_59c68470-image-177071511562775348.webp)

/images/ppid_a911dc6a-image-177071307920887358.webp)

/images/ppid_a911dc6a-image-177071303076331213.webp)

/images/ppid_a911dc6a-image-177071443822834480.webp)

/images/ppid_a911dc6a-image-177071443569946022.webp)