What is the story about?

The cement sector, which has seen sharp corrections of 20–25% from recent peaks, could be gearing up for a rebound, Amnish Aggarwal, Director – Institutional Research at PL Capital said. Stocks such as Dalmia Bharat have already priced in a lot of bad news.

He highlighted that volume growth has returned strongly in the third quarter, particularly after Diwali, and demand momentum has continued into January. The key variable now is pricing discipline.

“There has been maybe, one round of pricing and the prices are likely to remain firm. The problem with the cement stocks has been that the pricing has not been holding on, and that is why the margins have not been on the favourable side.”

Cement stocks, he said, are not long-term structural trades but can deliver strong near-term performance if recent price hikes sustain and margins begin to recover over the next two to three months.

On Restaurants Brands Asia, a quick-service restaurant operator Aggarwal said there is no urgent need for fund infusion at this stage. However, any capital raise that brings in a new strategic or promoter-level investor could be a meaningful positive.

He pointed out that while the India business is steady and operationally sound, profitability remains a challenge. The larger concern lies with the Indonesia operations, which continue to bleed. More clarity on future ownership and business strategy, especially around Indonesia, will be critical for the stock.

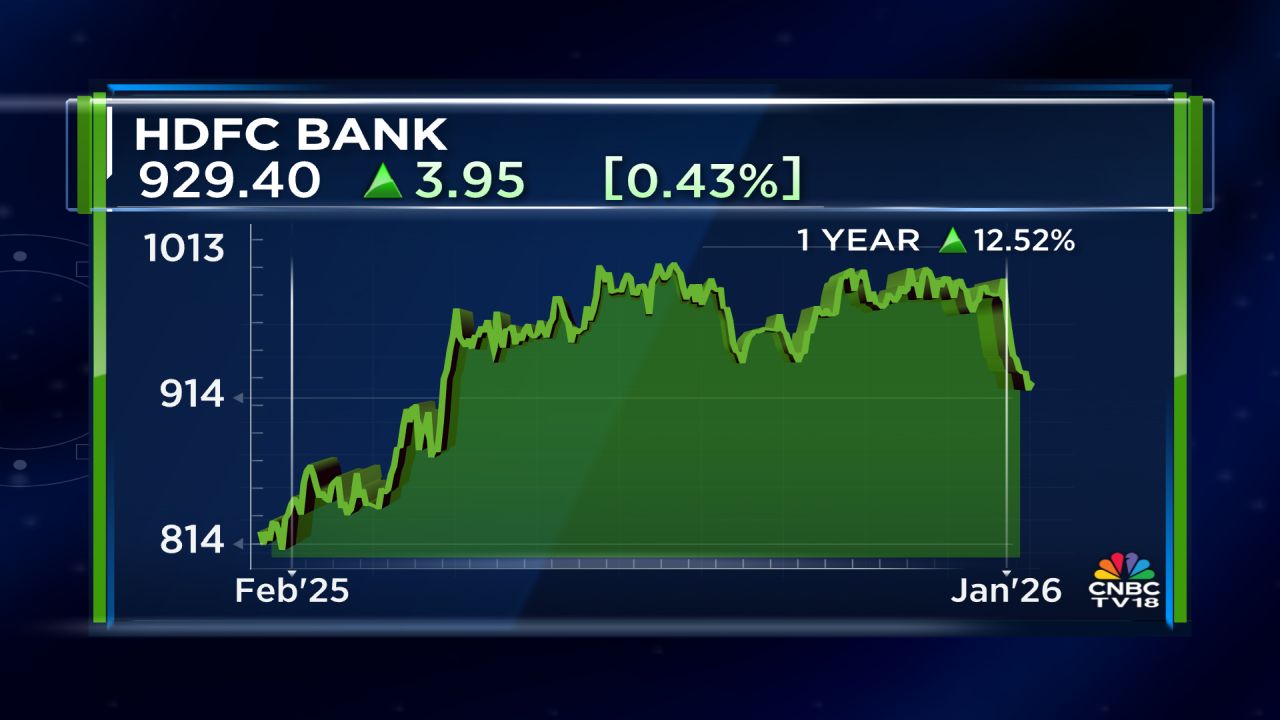

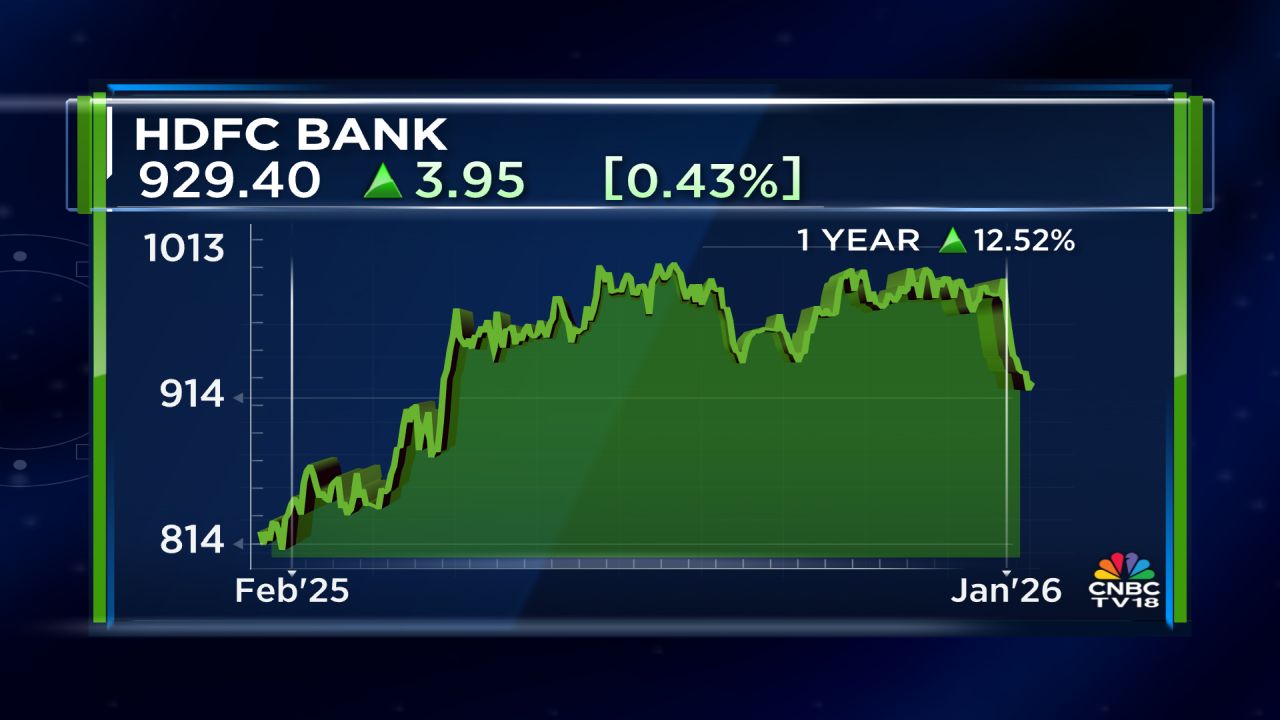

On the sharp reaction in HDFC Bank, Aggarwal said the downside now appears limited. While the elevated loan-to-deposit ratio remains a concern and is correcting only gradually, valuations are no longer expensive.

He believes most banking stocks, including HDFC Bank, are close to bottoming out. With net interest margins showing signs of stabilisation, the risk-reward at current levels is favourable, even though a sharp percentage upside is difficult to predict.

Aggarwal believes a potential India–EU free trade agreement could offer breathing space to Indian industry, especially amid delays in Indo-US trade negotiations.

Sectors such as textiles, gems and jewellery, and other export-oriented industries could benefit from better market access. He also sees longer-term gains from easier access to European technologies in areas such as defence, semiconductors, and renewable energy.

If concluded, the deal could reduce pressure on India to rush into less favourable trade agreements elsewhere while strengthening its technology and manufacturing ecosystem.

Follow our live blog for more stock market updates

Also, catch the latest Budget 2026 expectations updates here

He highlighted that volume growth has returned strongly in the third quarter, particularly after Diwali, and demand momentum has continued into January. The key variable now is pricing discipline.

“There has been maybe, one round of pricing and the prices are likely to remain firm. The problem with the cement stocks has been that the pricing has not been holding on, and that is why the margins have not been on the favourable side.”

Cement stocks, he said, are not long-term structural trades but can deliver strong near-term performance if recent price hikes sustain and margins begin to recover over the next two to three months.

On Restaurants Brands Asia, a quick-service restaurant operator Aggarwal said there is no urgent need for fund infusion at this stage. However, any capital raise that brings in a new strategic or promoter-level investor could be a meaningful positive.

He pointed out that while the India business is steady and operationally sound, profitability remains a challenge. The larger concern lies with the Indonesia operations, which continue to bleed. More clarity on future ownership and business strategy, especially around Indonesia, will be critical for the stock.

On the sharp reaction in HDFC Bank, Aggarwal said the downside now appears limited. While the elevated loan-to-deposit ratio remains a concern and is correcting only gradually, valuations are no longer expensive.

He believes most banking stocks, including HDFC Bank, are close to bottoming out. With net interest margins showing signs of stabilisation, the risk-reward at current levels is favourable, even though a sharp percentage upside is difficult to predict.

Aggarwal believes a potential India–EU free trade agreement could offer breathing space to Indian industry, especially amid delays in Indo-US trade negotiations.

Sectors such as textiles, gems and jewellery, and other export-oriented industries could benefit from better market access. He also sees longer-term gains from easier access to European technologies in areas such as defence, semiconductors, and renewable energy.

If concluded, the deal could reduce pressure on India to rush into less favourable trade agreements elsewhere while strengthening its technology and manufacturing ecosystem.

Follow our live blog for more stock market updates

Also, catch the latest Budget 2026 expectations updates here

/images/ppid_59c68470-image-176854255574891871.webp)

/images/ppid_59c68470-image-177099255243254847.webp)

/images/ppid_59c68470-image-177099253828799666.webp)

/images/ppid_a911dc6a-image-177099303460042510.webp)