What is the story about?

Automobile manufacturer Force Motors Ltd on Friday (February 6) announced the execution of a Memorandum of Understanding (MoU) to acquire 100% shares of Veera Tanneries Private Ltd (VTPL) for a total consideration of ₹175 crore, subject to deduction of applicable taxes.

The acquisition will proceed after undertaking the requisite due diligence and adhering to mutually agreed terms and conditions, which will form the basis of the definitive agreements.

This follows the company’s previous announcement on February 4, 2026, regarding the acquisition. The acquisition process remains subject to the completion of all regulatory approvals.

Also Read: Force Motors Q2 Results: Profit surges over 2.5x YoY, margin expands

Third Quarter Results

Force Motors reported a sharp year-on-year jump in profitability for the third quarter, supported by strong operating performance and a one-time gain during the period. Consolidated net profit for Q3 stood at ₹406.1 crore, compared with ₹115.3 crore in the same quarter last year.

Revenue from operations rose 12.6% year-on-year to ₹2,128 crore from ₹1,889.5 crore, reflecting improved demand and higher realisations. Operating performance strengthened significantly, with EBITDA climbing 61.4% to ₹373.8 crore from ₹231.6 crore a year earlier.

EBITDA margin expanded sharply to 17.5% in the quarter, up from 12.3% in the corresponding period last year, indicating improved operating leverage and cost efficiency. The company also reported a one-time gain of ₹211 crore during the quarter, which supported the overall profitability.

The sharp rise in net profit was driven by a combination of higher revenues, margin expansion and the exceptional income booked in Q3. The improvement in margins highlights better absorption of fixed costs and a favourable operating environment compared with the year-ago period.

Also Read: Force Motors posts 53% YoY sales surge in November; exports dip

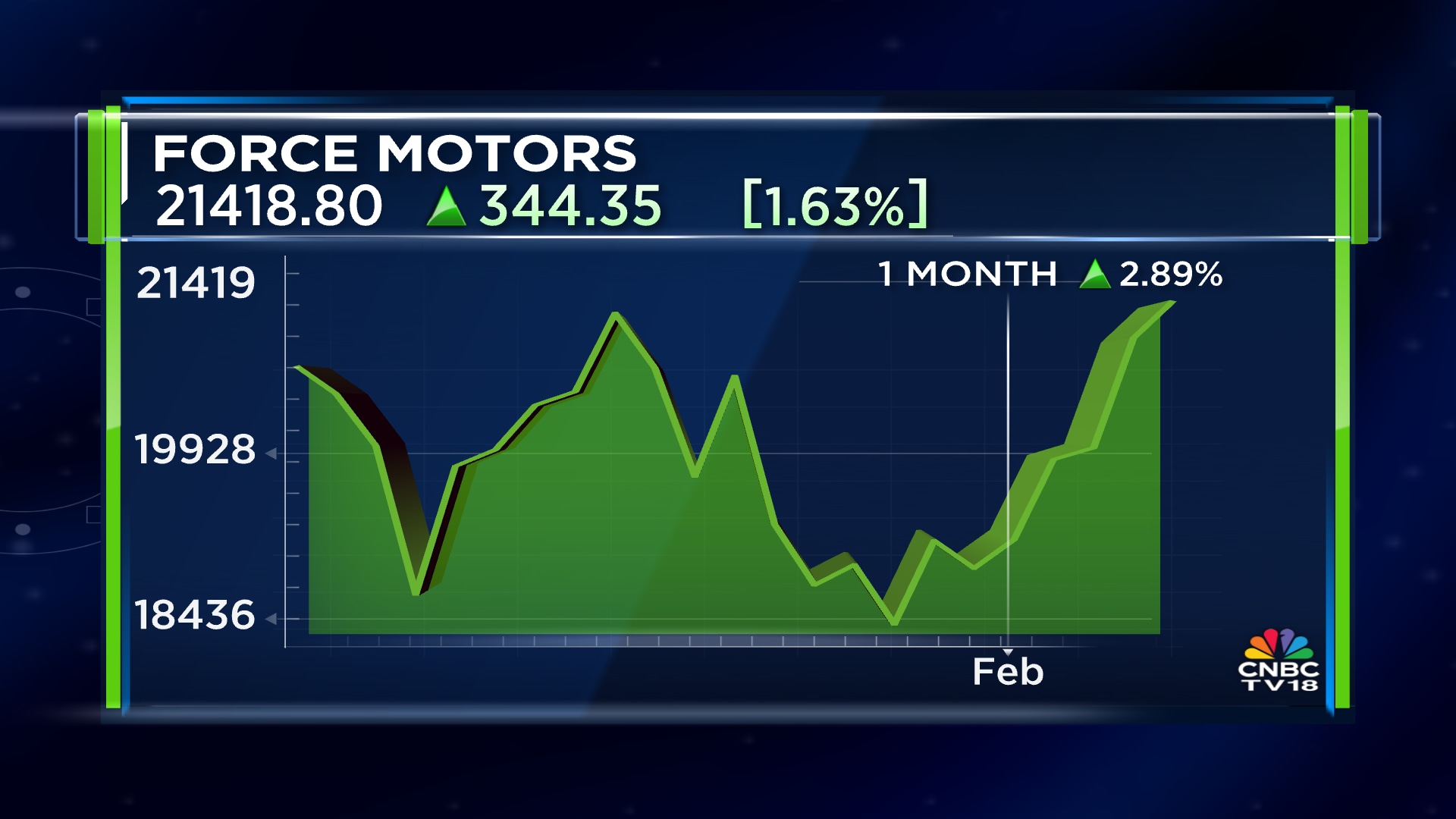

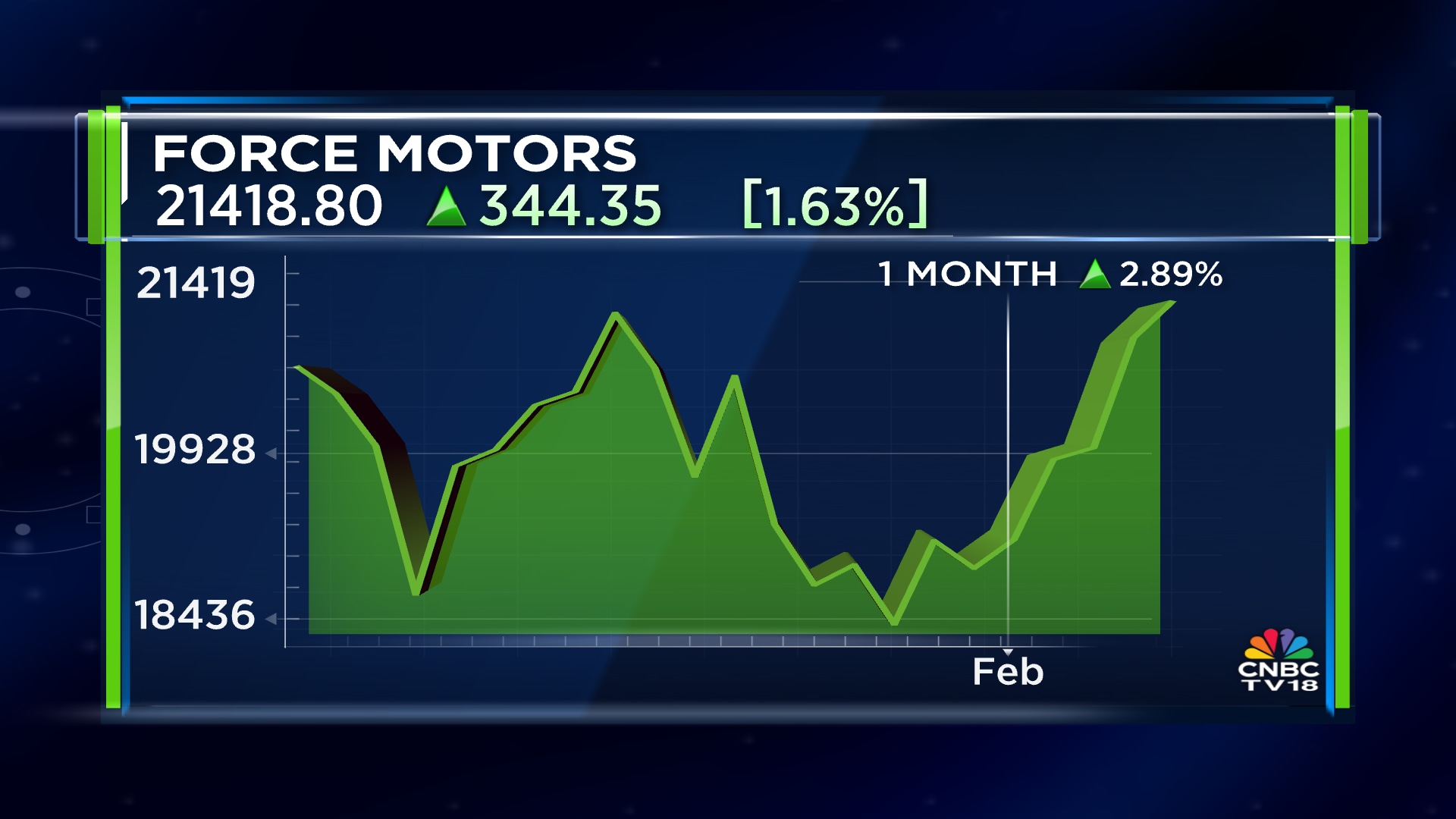

Shares of Force Motors Ltd ended at ₹21,418.85, up by ₹344.35, or 1.63%, on the BSE.

The acquisition will proceed after undertaking the requisite due diligence and adhering to mutually agreed terms and conditions, which will form the basis of the definitive agreements.

This follows the company’s previous announcement on February 4, 2026, regarding the acquisition. The acquisition process remains subject to the completion of all regulatory approvals.

Also Read: Force Motors Q2 Results: Profit surges over 2.5x YoY, margin expands

Third Quarter Results

Force Motors reported a sharp year-on-year jump in profitability for the third quarter, supported by strong operating performance and a one-time gain during the period. Consolidated net profit for Q3 stood at ₹406.1 crore, compared with ₹115.3 crore in the same quarter last year.

Revenue from operations rose 12.6% year-on-year to ₹2,128 crore from ₹1,889.5 crore, reflecting improved demand and higher realisations. Operating performance strengthened significantly, with EBITDA climbing 61.4% to ₹373.8 crore from ₹231.6 crore a year earlier.

EBITDA margin expanded sharply to 17.5% in the quarter, up from 12.3% in the corresponding period last year, indicating improved operating leverage and cost efficiency. The company also reported a one-time gain of ₹211 crore during the quarter, which supported the overall profitability.

The sharp rise in net profit was driven by a combination of higher revenues, margin expansion and the exceptional income booked in Q3. The improvement in margins highlights better absorption of fixed costs and a favourable operating environment compared with the year-ago period.

Also Read: Force Motors posts 53% YoY sales surge in November; exports dip

Shares of Force Motors Ltd ended at ₹21,418.85, up by ₹344.35, or 1.63%, on the BSE.

/images/ppid_59c68470-image-177039004430777171.webp)

/images/ppid_a911dc6a-image-177078723354450407.webp)

/images/ppid_59c68470-image-177078759525160112.webp)

/images/ppid_59c68470-image-177078756180533670.webp)

/images/ppid_59c68470-image-177078753304351539.webp)

/images/ppid_59c68470-image-177078754213636163.webp)