What is the story about?

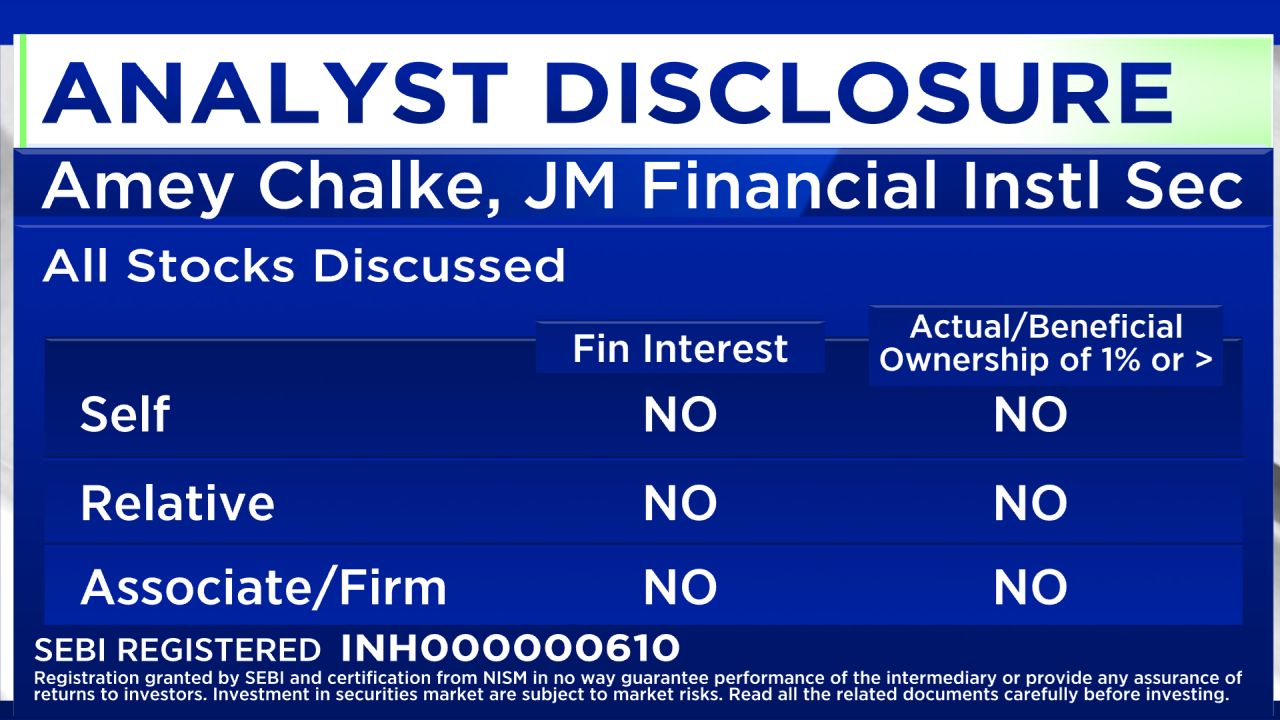

Amey Chalke, Pharma Research Analyst at JM Financial Institutional Securities, said their preferred order within the pharma sector is hospitals, Contract Development and Manufacturing Organization (CDMOs), and then generics.

Speaking to CNBC-TV18 on the sidelines of the JM Financial India Xchange 2025 conference, Chalke said he remains bullish on hospitals, driven by rising formalisation and broader structural tailwinds. “There is a structural trend from unorganised to organised,” he said, adding that he expects 15–20% growth over the next three to four years.

Even though valuations look expensive today, he believes the picture will change once investors shift to FY28 estimates. “Some of these hospitals are trading at around 20 times, and they are looking attractive,” he said.

Talking about winners in the CDMO space, Chalke explained that the industry tends to consolidate around leaders. “The top five players are accounting for more than 50–60% market share,” he said, referring to China as an example.

He emphasised that larger CDMO companies remain safer bets, while smaller firms may offer higher returns but come with higher volatility because the business depends heavily on fluctuating orders. “The bigger companies are better in my view,” he added.

Pharma generics rank last because of upcoming competitive pressures. “Revlimid is a big overhang,” he said, adding that other large products may also lose exclusivity by FY27. As a result, “five of the six top large-cap companies in pharma generics are likely to see muted earnings growth for the next two years.”

He believes valuations in this segment are not attractive enough when compared to hospitals and CDMOs, where he expects at least 20% EBITDA growth for the next three to four years.

Watch accompanying video for more

Follow our live blog for more stock market updates

Speaking to CNBC-TV18 on the sidelines of the JM Financial India Xchange 2025 conference, Chalke said he remains bullish on hospitals, driven by rising formalisation and broader structural tailwinds. “There is a structural trend from unorganised to organised,” he said, adding that he expects 15–20% growth over the next three to four years.

Even though valuations look expensive today, he believes the picture will change once investors shift to FY28 estimates. “Some of these hospitals are trading at around 20 times, and they are looking attractive,” he said.

Talking about winners in the CDMO space, Chalke explained that the industry tends to consolidate around leaders. “The top five players are accounting for more than 50–60% market share,” he said, referring to China as an example.

He emphasised that larger CDMO companies remain safer bets, while smaller firms may offer higher returns but come with higher volatility because the business depends heavily on fluctuating orders. “The bigger companies are better in my view,” he added.

Pharma generics rank last because of upcoming competitive pressures. “Revlimid is a big overhang,” he said, adding that other large products may also lose exclusivity by FY27. As a result, “five of the six top large-cap companies in pharma generics are likely to see muted earnings growth for the next two years.”

He believes valuations in this segment are not attractive enough when compared to hospitals and CDMOs, where he expects at least 20% EBITDA growth for the next three to four years.

On

India’s semaglutide market potential, Chalke estimates a sizeable opportunity. “This opportunity can be as big as ₹15,000 crore in a few years,” he said.

As generic versions enter the market next year, prices will initially stay high but are likely to fall with time. He expects many players — both large and mid-sized — to gain. “The leading top five to six players… would generate big-size brands, but there would be lot of small-scale players as well,” he noted.

Watch accompanying video for more

Follow our live blog for more stock market updates

/images/ppid_59c68470-image-176354756190443523.webp)