What is the story about?

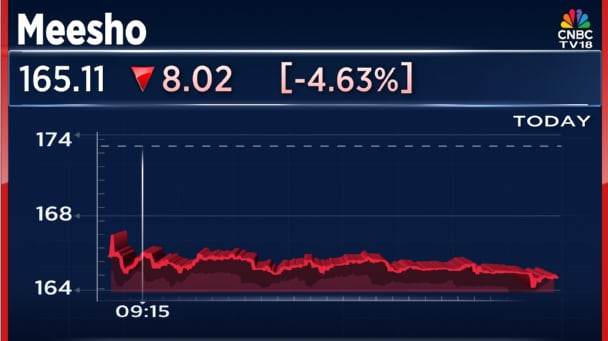

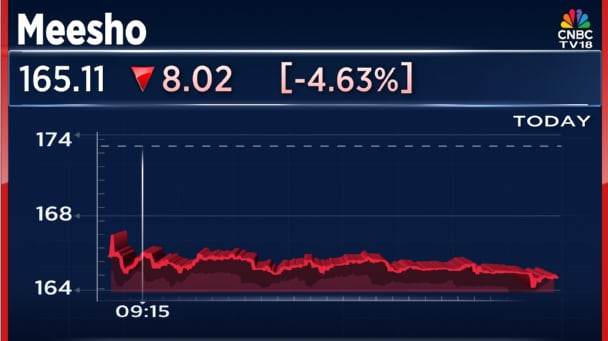

Shares of newly-listed e-commerce company Meesho Ltd. extended their losing streak for a third consecutive session on Thursday, January 8, with the stock falling as much as 5%.

The decline comes a day after the expiry of the company's one-month shareholder lock in.

Following the lock in expiry, around 109.9 million shares, or nearly 2% of Meesho's outstanding equity, became eligible for trading.

The end of the lock in period, however, does not imply that all such shares will be sold in the open market, but only that they can now be traded.

Meesho also disclosed a management role change, stating that Milan Partani, General Manager User Growth and Content Commerce and a Senior Management Personnel, will now take on the role of General Manager Commerce Platform, while continuing to be part of the senior management team.

Despite the recent correction, Meesho shares continue to trade well above their IPO price. The stock is up nearly 48% from its issue price of ₹111, although it has slipped about 35% from its post listing peak of ₹254.

The SoftBank backed e commerce platform made a strong market debut on December 10, listing at a premium to the issue price and ending its first trading session 53% higher.

Meesho's ₹5,000 crore plus public issue had seen robust demand across investor categories, with the IPO subscribed 79 times overall. The retail portion was subscribed over 19 times, while the qualified institutional buyers’ segment saw subscriptions of 120 times.

In an earlier interaction with CNBC-TV18, Meesho Chairman, Managing Director and CEO Vidit Aatrey said the company earns revenue by offering services to sellers, with logistics and advertising forming the key income streams.

He added that free cash flow remains Meesho's most critical metric, noting that the company has been free cash flow positive for the past two years and intends to maintain this even as it scales up operations.

The decline comes a day after the expiry of the company's one-month shareholder lock in.

Following the lock in expiry, around 109.9 million shares, or nearly 2% of Meesho's outstanding equity, became eligible for trading.

The end of the lock in period, however, does not imply that all such shares will be sold in the open market, but only that they can now be traded.

Meesho also disclosed a management role change, stating that Milan Partani, General Manager User Growth and Content Commerce and a Senior Management Personnel, will now take on the role of General Manager Commerce Platform, while continuing to be part of the senior management team.

Despite the recent correction, Meesho shares continue to trade well above their IPO price. The stock is up nearly 48% from its issue price of ₹111, although it has slipped about 35% from its post listing peak of ₹254.

The SoftBank backed e commerce platform made a strong market debut on December 10, listing at a premium to the issue price and ending its first trading session 53% higher.

Meesho's ₹5,000 crore plus public issue had seen robust demand across investor categories, with the IPO subscribed 79 times overall. The retail portion was subscribed over 19 times, while the qualified institutional buyers’ segment saw subscriptions of 120 times.

In an earlier interaction with CNBC-TV18, Meesho Chairman, Managing Director and CEO Vidit Aatrey said the company earns revenue by offering services to sellers, with logistics and advertising forming the key income streams.

He added that free cash flow remains Meesho's most critical metric, noting that the company has been free cash flow positive for the past two years and intends to maintain this even as it scales up operations.

/images/ppid_59c68470-image-176784758154775144.webp)

/images/ppid_59c68470-image-177060015473030542.webp)

/images/ppid_59c68470-image-177061276780943035.webp)

/images/ppid_59c68470-image-177059756327566194.webp)

/images/ppid_59c68470-image-177062502806540716.webp)

/images/ppid_59c68470-image-177062022688538132.webp)

/images/ppid_59c68470-image-177061255382373236.webp)

/images/ppid_59c68470-image-177071511562775348.webp)

/images/ppid_59c68470-image-177068773220034130.webp)

/images/ppid_59c68470-image-177060764201711364.webp)

/images/ppid_59c68470-image-177061013670291300.webp)

/images/ppid_59c68470-image-177071258499638831.webp)

/images/ppid_59c68470-image-177060756327762255.webp)