What is the story about?

The initial share sale of edtech platform PhysicsWallah continued to see muted investor response during its third and final day of public bidding on Thursday, November 13. The ₹3,480-crore IPO has been subscribed 21% on so far Day 3.

The maiden public issue of the company received bids for nearly 3.99 crore shares, as against an offer size of 18.62 crore shares, according to data from NSE as of 12:20 pm.

The retail investor portion has been booked 78% so far, while the non institutional investors (NII) quota was subscribed 11%. Qualified Institutional Buyers (QIB) are yet to make any substantial bid for the public offer.

The company is selling its shares in a fixed price band between ₹103 and ₹109. Retail investors can bid for one lot of 137 shares, entailing a minimum investment of ₹14,933, with bids accepted in multiples of 137 shares thereafter.

At the upper end of the price band, PhysicsWallah's post-issue market capitalisation is expected to be ₹31,169 crore.

Meanwhile, shares of PhysicsWallah are commanding a premium of 0.92% in the unlisted market today. However, grey market premiums are indicative and can change rapidly.

The IPO comprises a fresh issue of ₹3,100 crore and an Offer For Sale (OFS) component of ₹380 crore.

The company had already raised ₹1,562.85 crore from 57 anchor investors. Capital Group, Goldman Sachs, Fidelity, Abu Dhabi Investment Council, and PineBridge were among the marquee foreign investors.

Promoter holding will decline to 72.3% from 81.6% post-IPO.

Kotak Capital, JPMorgan India, Goldman Sachs (India), and Axis Capital are the Book Running Lead Managers for the issue. Key investors include WestBridge Capital, GSV Ventures, Hornbill Capital, and Lightspeed Venture Partners.

About PhysicsWallah

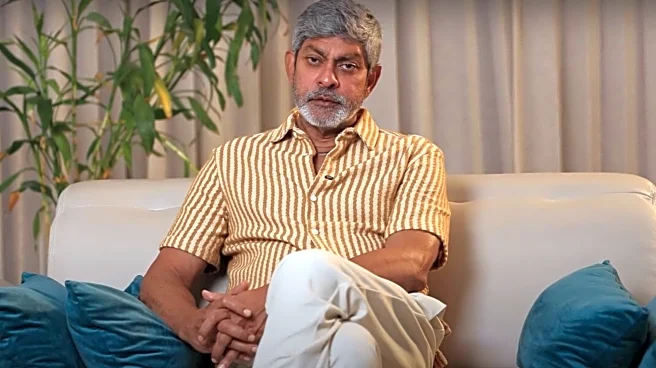

PhysicsWallah was founded by Alakh Pandey in 2016. A physics teacher and college dropout, Pandey began uploading free educational videos to YouTube. The channel gained widespread popularity during the Covid-19 pandemic.

Today, the company operates 303 offline centers across 152 cities in India and the Middle East.

The maiden public issue of the company received bids for nearly 3.99 crore shares, as against an offer size of 18.62 crore shares, according to data from NSE as of 12:20 pm.

The retail investor portion has been booked 78% so far, while the non institutional investors (NII) quota was subscribed 11%. Qualified Institutional Buyers (QIB) are yet to make any substantial bid for the public offer.

The company is selling its shares in a fixed price band between ₹103 and ₹109. Retail investors can bid for one lot of 137 shares, entailing a minimum investment of ₹14,933, with bids accepted in multiples of 137 shares thereafter.

At the upper end of the price band, PhysicsWallah's post-issue market capitalisation is expected to be ₹31,169 crore.

Meanwhile, shares of PhysicsWallah are commanding a premium of 0.92% in the unlisted market today. However, grey market premiums are indicative and can change rapidly.

The IPO comprises a fresh issue of ₹3,100 crore and an Offer For Sale (OFS) component of ₹380 crore.

The company had already raised ₹1,562.85 crore from 57 anchor investors. Capital Group, Goldman Sachs, Fidelity, Abu Dhabi Investment Council, and PineBridge were among the marquee foreign investors.

Promoter holding will decline to 72.3% from 81.6% post-IPO.

Kotak Capital, JPMorgan India, Goldman Sachs (India), and Axis Capital are the Book Running Lead Managers for the issue. Key investors include WestBridge Capital, GSV Ventures, Hornbill Capital, and Lightspeed Venture Partners.

About PhysicsWallah

PhysicsWallah was founded by Alakh Pandey in 2016. A physics teacher and college dropout, Pandey began uploading free educational videos to YouTube. The channel gained widespread popularity during the Covid-19 pandemic.

Today, the company operates 303 offline centers across 152 cities in India and the Middle East.

/images/ppid_59c68470-image-176301753221776790.webp)

/images/ppid_a911dc6a-image-177089662715993601.webp)

/images/ppid_a911dc6a-image-177089643644622181.webp)