What is the story about?

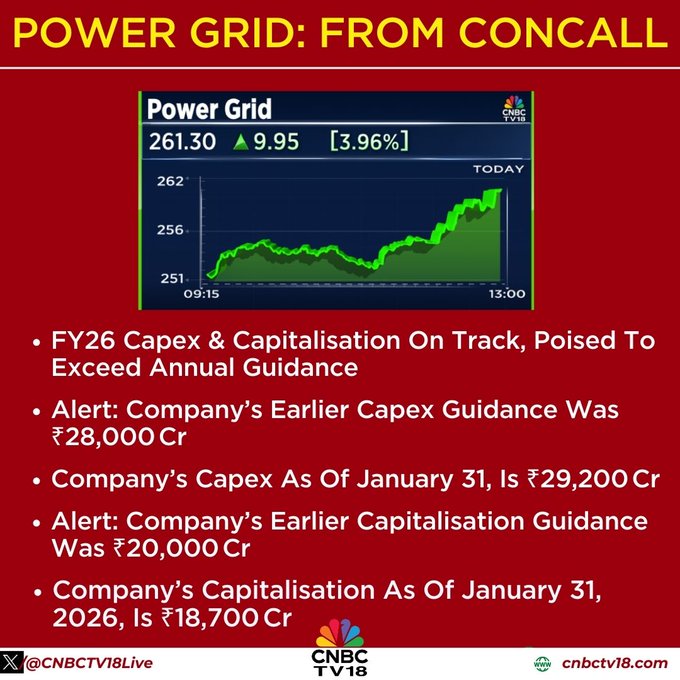

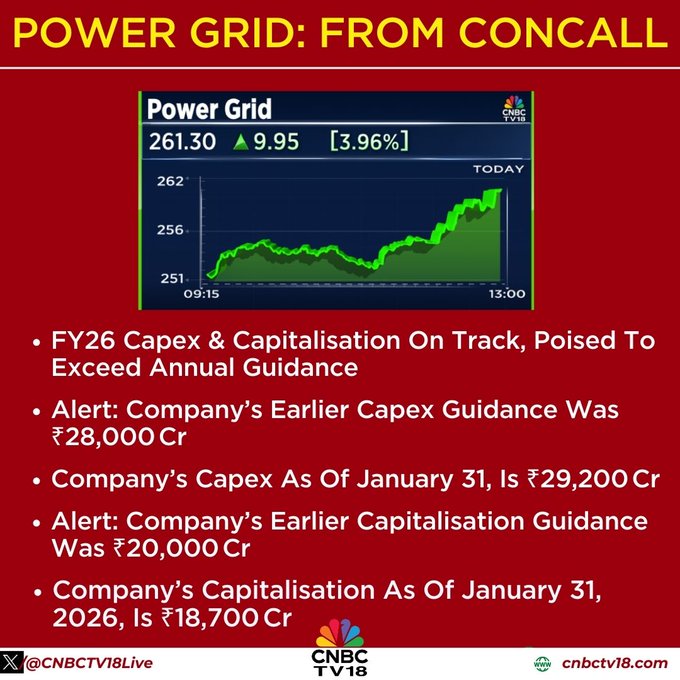

Shares of state-run Power Grid Corporation of India Ltd

. were trading up as much as 5% on Monday, February 2, after the company shared updates at its analyst meet.

The company said its FY26 capex and capitalisation plans remain firmly on track and are likely to exceed annual guidance.

Power Grid's earlier capex guidance for FY26 stood at ₹28,000 crore, while actual capex as of January 31, 2026, has already reached ₹29,200 crore.

Capitalisation, guided at ₹20,000 crore for the year, stood at ₹18,700 crore by the end of January.

Power Grid reported Q3 revenue of ₹12,395 crore, improving from ₹11,476 crore in Q2FY26 and ₹11,233 crore in the year-ago quarter.

Profit after tax rising to ₹4,185 crore in Q3FY26 from ₹3,566 crore in the preceding quarter and ₹3,861 crore a year earlier.

For the nine-month period of FY26, net profit came in at ₹35,067 crore, compared with ₹33,516 crore in the corresponding period of FY25.

Cumulative PAT for the nine months stood at ₹11,318 crore, broadly flat versus ₹11,378 crore last year. Earnings per share, with a face value of ₹10, improved to ₹4.50 in Q3FY26 from ₹4.15 in Q3FY25.

In addition, the board approved a second interim dividend of ₹3.25 per share for FY26, amounting to 32.5% of the paid-up equity capital. The record date has been set for February 9, 2026, with the dividend scheduled to be paid on February 27, 2026.

The company said its FY26 capex and capitalisation plans remain firmly on track and are likely to exceed annual guidance.

Power Grid's earlier capex guidance for FY26 stood at ₹28,000 crore, while actual capex as of January 31, 2026, has already reached ₹29,200 crore.

Capitalisation, guided at ₹20,000 crore for the year, stood at ₹18,700 crore by the end of January.

Power Grid reported Q3 revenue of ₹12,395 crore, improving from ₹11,476 crore in Q2FY26 and ₹11,233 crore in the year-ago quarter.

Profit after tax rising to ₹4,185 crore in Q3FY26 from ₹3,566 crore in the preceding quarter and ₹3,861 crore a year earlier.

For the nine-month period of FY26, net profit came in at ₹35,067 crore, compared with ₹33,516 crore in the corresponding period of FY25.

Cumulative PAT for the nine months stood at ₹11,318 crore, broadly flat versus ₹11,378 crore last year. Earnings per share, with a face value of ₹10, improved to ₹4.50 in Q3FY26 from ₹4.15 in Q3FY25.

In addition, the board approved a second interim dividend of ₹3.25 per share for FY26, amounting to 32.5% of the paid-up equity capital. The record date has been set for February 9, 2026, with the dividend scheduled to be paid on February 27, 2026.

/images/ppid_59c68470-image-177002256424997012.webp)

/images/ppid_a911dc6a-image-177002005751476409.webp)

/images/ppid_59c68470-image-177002005339166241.webp)

/images/ppid_a911dc6a-image-177002002358023319.webp)

/images/ppid_a911dc6a-image-17700208368093418.webp)

/images/ppid_a911dc6a-image-177002022725169425.webp)

/images/ppid_59c68470-image-177002003138617533.webp)

/images/ppid_59c68470-image-177002002874883177.webp)