What is the story about?

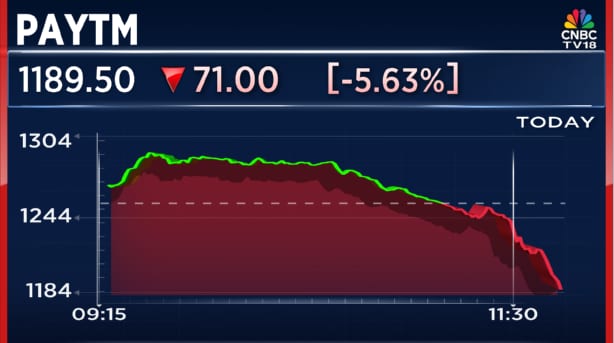

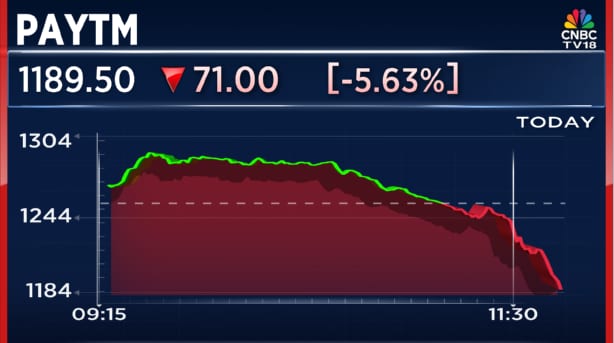

Shares of One97 Communications, the parent company of payments aggregator Paytm, fell as much as 10% from the day's high to decline 6%. The stock is down in four out of the last five sessions

A potential concern in the market could be the Payment Infrastructure Development Fund (PIDF) that was extended until December 2025. The scheme was used to incentivize the deployment of payment infrastructure.

However, there has been no update on whether this has been extended beyond December 2025 or not.

According to an analyst note, this is 20% of Paytm's operating profit.

Meanwhile, brokerage firm Investec has initiated coverage on Paytm with a 'Buy' rating and a price target of ₹1,550 per share, implying a potential upside of 23% from current levels.

Investec said that Paytm's deep tech capabilities and embedded merchant relationships provide long-term pricing power and create high switching costs.

With most of its merchant acquisition already in place and a digital-first model, the company enjoys substantial operating leverage.

Scale efficiencies, coupled with contributions from higher-margin credit-adjacent businesses, are expected to support margin expansion.

The brokerage forecasts a 23% net revenue CAGR for FY26-28, with EBITDA margin potentially rising to 24% by FY28 from 8% in H1FY26.

ALSO READ | Fortis Healthcare shares have 33% upside potential on strong earnings visibility

Meanwhile, domestic mutual funds trimmed their stake in Paytm during the October-December quarter, according to the latest shareholding pattern filed on the BSE.

This is the first instance of mutual funds reducing their holding since the company's November 2021 IPO, after a period of consistent increases.

Mutual fund ownership now stands at 14.96% at the end of December, down from 16.25% at the end of September.

On the technical side, shares of Paytm are near 'oversold' territory, with a Relative Strength Index (RSI) of 43. (An RSI below 30 indicates a stock is oversold.)

Among the 21 analysts covering Paytm, 14 have a 'Buy' rating, six have a 'Hold', and one has a 'Sell'.

Paytm shares are trading 3.04% higher at ₹1,298.80, still 40% below their IPO price of ₹2,150.

A potential concern in the market could be the Payment Infrastructure Development Fund (PIDF) that was extended until December 2025. The scheme was used to incentivize the deployment of payment infrastructure.

However, there has been no update on whether this has been extended beyond December 2025 or not.

According to an analyst note, this is 20% of Paytm's operating profit.

Meanwhile, brokerage firm Investec has initiated coverage on Paytm with a 'Buy' rating and a price target of ₹1,550 per share, implying a potential upside of 23% from current levels.

Investec said that Paytm's deep tech capabilities and embedded merchant relationships provide long-term pricing power and create high switching costs.

With most of its merchant acquisition already in place and a digital-first model, the company enjoys substantial operating leverage.

Scale efficiencies, coupled with contributions from higher-margin credit-adjacent businesses, are expected to support margin expansion.

The brokerage forecasts a 23% net revenue CAGR for FY26-28, with EBITDA margin potentially rising to 24% by FY28 from 8% in H1FY26.

ALSO READ | Fortis Healthcare shares have 33% upside potential on strong earnings visibility

Meanwhile, domestic mutual funds trimmed their stake in Paytm during the October-December quarter, according to the latest shareholding pattern filed on the BSE.

This is the first instance of mutual funds reducing their holding since the company's November 2021 IPO, after a period of consistent increases.

Mutual fund ownership now stands at 14.96% at the end of December, down from 16.25% at the end of September.

On the technical side, shares of Paytm are near 'oversold' territory, with a Relative Strength Index (RSI) of 43. (An RSI below 30 indicates a stock is oversold.)

Among the 21 analysts covering Paytm, 14 have a 'Buy' rating, six have a 'Hold', and one has a 'Sell'.

Paytm shares are trading 3.04% higher at ₹1,298.80, still 40% below their IPO price of ₹2,150.

/images/ppid_59c68470-image-1769150087019649.webp)

/images/ppid_59c68470-image-177073003794359220.webp)

/images/ppid_59c68470-image-177085753226281386.webp)

/images/ppid_59c68470-image-177087252723963095.webp)

/images/ppid_59c68470-image-17708100384491046.webp)

/images/ppid_59c68470-image-177090503555267998.webp)

/images/ppid_59c68470-image-177073507927493167.webp)

/images/ppid_59c68470-image-177074252945678901.webp)

/images/ppid_59c68470-image-177064753004379238.webp)

/images/ppid_59c68470-image-177072004423273525.webp)