What is the story about?

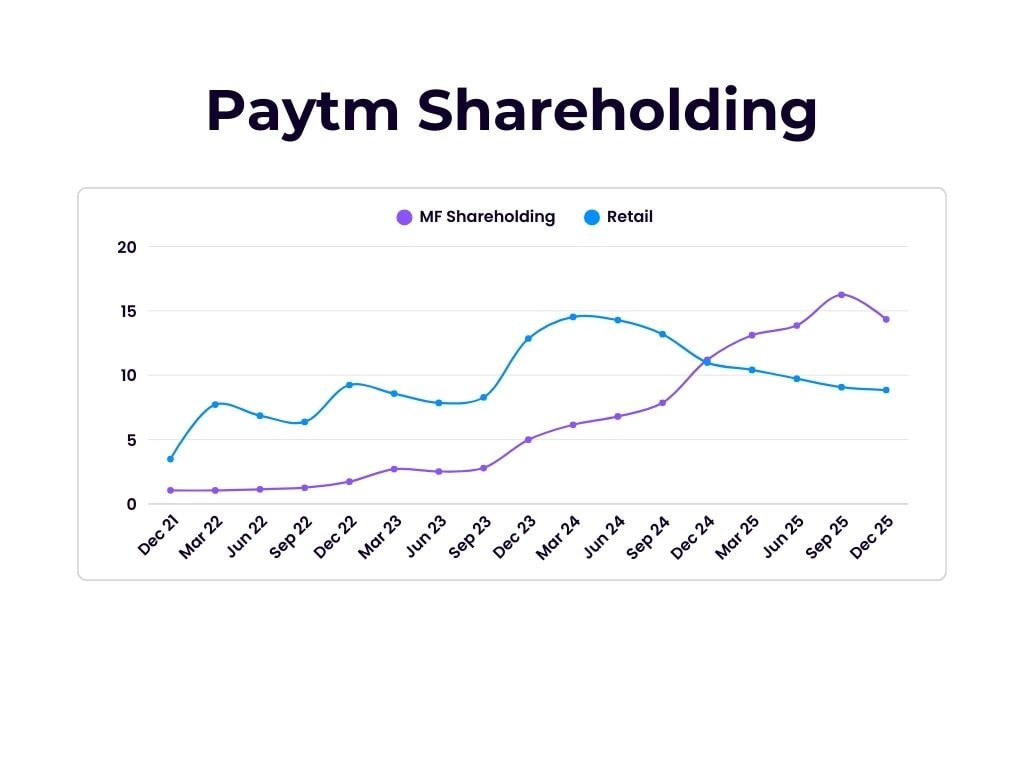

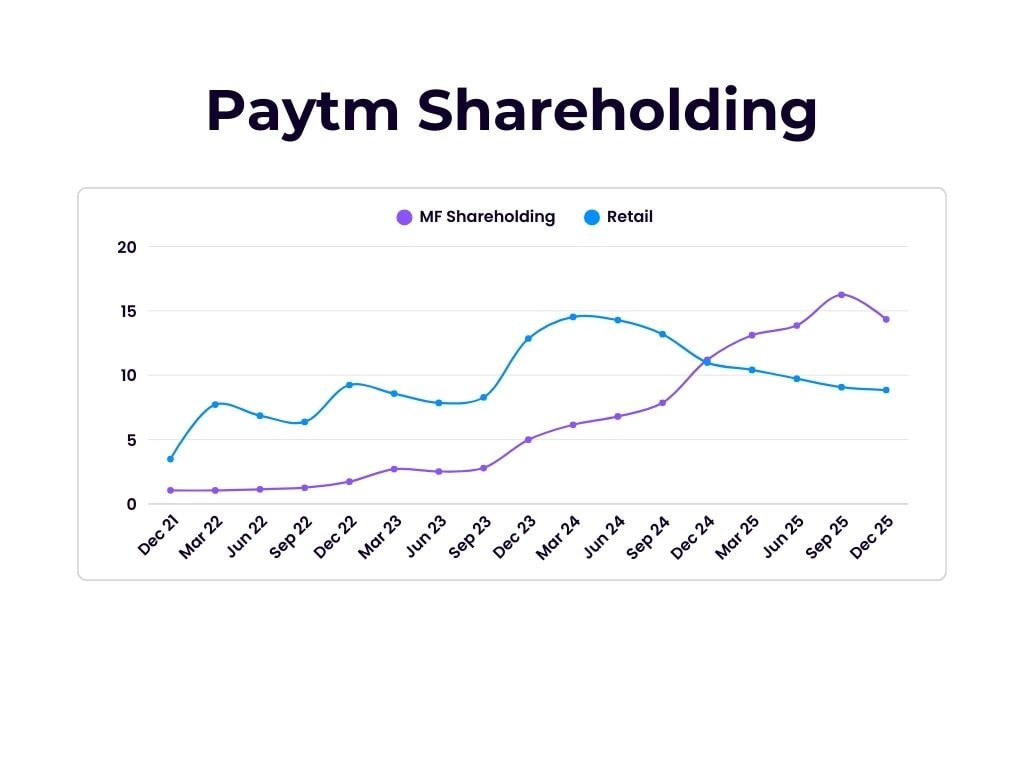

India's domestic mutual funds have trimmed their stake in One97 Communications Ltd., parent company of the payments aggregator Paytm during the October-December period, based on the latest shareholding pattern uploaded by the company on the Bombay Stock Exchange.

This will be the first instance of mutual funds trimming their stake in the company after it went public back in November 2021. Since then, mutual fund stake has consistently been increasing.

On the flip side, retail shareholders continued to sell the stock with their shareholding declining for the seven quarter in a row.

India's Mutual Funds now own a 14.96% stake in Paytm at the end of the December quarter, compared to the 16.25% stake they owned at the end of the September quarter.

For retail shareholders, or those who have an authorized share capital of up to ₹2 lakh, their shareholding in Paytm has dropped to the lowest level since September 2023. Small retail investors have been trimming their stake in Paytm since the June quarter of 2024, when the stock began to rebound from its all-time low of ₹300.

At the end of the September quarter, Motilal Oswal MF, Nippon India MF, Mirae Asset MF and Bandhan MF featured as the prominent funds who held stake in Paytm. In the December shareholding, while the first three names have all trimmed their stake, Bandhan MF's name does not feature in the list. This either means that the fund's stake has dropped below the 1% mark, or it has made its exit from the stock.

Shares of Paytm had made an all-time low of ₹318 on February 16, 2024, over concerns surrounding the Reserve Bank of India's regulatory actions.

Since then, the stock has seen a rebound after regulatory worries eased, and its subsidiary, Paytm Payments Bank secured the final authorization from the Reserve Bank of India late-last year for its payment aggregator license, covering online, offline, and cross-border transactions.

Hopes of the company turning profitable soon also aided the stock rebound. The stock recently made a 52-week high of ₹1,381, a 334% rebound from the record lows.

Despite this recovery, shares of Paytm are still trading 40% below their IPO price of ₹2,150. The company's third quarter results could be the next big trigger for the stock.

This will be the first instance of mutual funds trimming their stake in the company after it went public back in November 2021. Since then, mutual fund stake has consistently been increasing.

On the flip side, retail shareholders continued to sell the stock with their shareholding declining for the seven quarter in a row.

India's Mutual Funds now own a 14.96% stake in Paytm at the end of the December quarter, compared to the 16.25% stake they owned at the end of the September quarter.

For retail shareholders, or those who have an authorized share capital of up to ₹2 lakh, their shareholding in Paytm has dropped to the lowest level since September 2023. Small retail investors have been trimming their stake in Paytm since the June quarter of 2024, when the stock began to rebound from its all-time low of ₹300.

At the end of the September quarter, Motilal Oswal MF, Nippon India MF, Mirae Asset MF and Bandhan MF featured as the prominent funds who held stake in Paytm. In the December shareholding, while the first three names have all trimmed their stake, Bandhan MF's name does not feature in the list. This either means that the fund's stake has dropped below the 1% mark, or it has made its exit from the stock.

| Fund | September (%) | December (%) |

| Motilal Oswal Midcap Fund | 5.57 | 4.96 |

| Nippon India Growth Midcap Fund | 2.11 | 1.64 |

| Mirae Asset Largecap Fund | 1.66 | 1.56 |

| Bandhan Large & Midcap Fund | 1.04 | N/A |

Shares of Paytm had made an all-time low of ₹318 on February 16, 2024, over concerns surrounding the Reserve Bank of India's regulatory actions.

Since then, the stock has seen a rebound after regulatory worries eased, and its subsidiary, Paytm Payments Bank secured the final authorization from the Reserve Bank of India late-last year for its payment aggregator license, covering online, offline, and cross-border transactions.

Hopes of the company turning profitable soon also aided the stock rebound. The stock recently made a 52-week high of ₹1,381, a 334% rebound from the record lows.

Despite this recovery, shares of Paytm are still trading 40% below their IPO price of ₹2,150. The company's third quarter results could be the next big trigger for the stock.

/images/ppid_59c68470-image-176845002758547482.webp)

/images/ppid_59c68470-image-177088252673355494.webp)

/images/ppid_a911dc6a-image-177072488602377070.webp)

/images/ppid_59c68470-image-17708725346551941.webp)

/images/ppid_a911dc6a-image-177088344131221560.webp)

/images/ppid_59c68470-image-177087752852386037.webp)

/images/ppid_59c68470-image-177087756975063071.webp)

/images/ppid_59c68470-image-177087259429213293.webp)

/images/ppid_59c68470-image-17708700482303440.webp)

/images/ppid_59c68470-image-177090503458393910.webp)

/images/ppid_59c68470-image-177089002862172290.webp)