What is the story about?

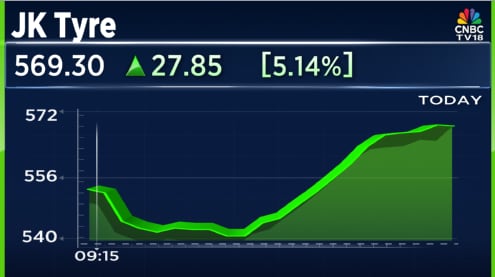

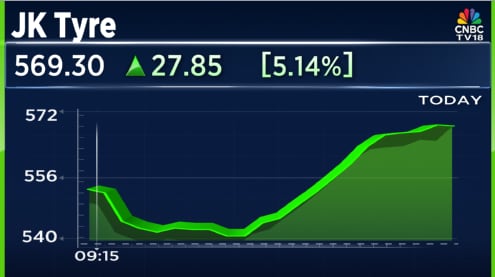

Shares of JK Tyre & Industries Ltd. climbed over 5% in Monday's session after the company posted a strong December quarter, aided by a low base last year.

In Q3, revenue rose 15% year-on-year to ₹4,223 crore from ₹3,674 crore, while EBITDA jumped 81% to ₹571 crore from ₹315 crore. Operating margin expanded sharply to 13.5% from 8.6% a year ago.

The India business saw revenue growth of 15% to ₹3,741 crore, with margins improving to 11.3% from 6%.

Mexico also delivered a healthy performance, with revenue up 21% to ₹615 crore and margins rising to 6.7% from 4.9%.

Speaking to CNBC-TV18, Managing Director Anshuman Singhania said margins are expected to stay above 13% going forward.

Consolidated volume growth stood at 15%, led by 16% growth in the domestic market. Replacement volumes grew 11%, while OEM volumes surged 27%.

Mexico continued to perform well, supported by a positive economic environment, with market share gains recorded during the quarter.

Singhania added that raw material costs are expected to remain range-bound in Q4, and any decision on price hikes will depend on raw material trends.

The US currently contributes only about 3% to total turnover, with supplies earlier diverted to other markets. A call on resuming US supplies will be taken once clarity emerges on trade deal details.

In Q3, revenue rose 15% year-on-year to ₹4,223 crore from ₹3,674 crore, while EBITDA jumped 81% to ₹571 crore from ₹315 crore. Operating margin expanded sharply to 13.5% from 8.6% a year ago.

The India business saw revenue growth of 15% to ₹3,741 crore, with margins improving to 11.3% from 6%.

Mexico also delivered a healthy performance, with revenue up 21% to ₹615 crore and margins rising to 6.7% from 4.9%.

Speaking to CNBC-TV18, Managing Director Anshuman Singhania said margins are expected to stay above 13% going forward.

Consolidated volume growth stood at 15%, led by 16% growth in the domestic market. Replacement volumes grew 11%, while OEM volumes surged 27%.

Mexico continued to perform well, supported by a positive economic environment, with market share gains recorded during the quarter.

Singhania added that raw material costs are expected to remain range-bound in Q4, and any decision on price hikes will depend on raw material trends.

The US currently contributes only about 3% to total turnover, with supplies earlier diverted to other markets. A call on resuming US supplies will be taken once clarity emerges on trade deal details.

/images/ppid_59c68470-image-177061252551686635.webp)

/images/ppid_a911dc6a-image-177101752951095973.webp)

/images/ppid_a911dc6a-image-177101403147018469.webp)

/images/ppid_a911dc6a-image-177101053501199609.webp)

/images/ppid_59c68470-image-177101003680064644.webp)