What is the story about?

Publicly owned REC Ltd has announced the incorporation of its wholly owned subsidiary. In an exchange filing issued on December 20, the energy infrastructure financing company said Musalgaon Power Transmission Limited has been incorporated as a wholly owned subsidiary of REC Power Development and Consultancy Limited, which in turn is a wholly wwned Subsidiary of REC Limited.

The company added that the authorised capital amount stood at ₹5 lakh. The company said the Government of Maharashtra vide Order dated October 3, 2025, had allocated one intra-state transmission project, wherein REC Power Development and Consultancy Limited (RECPDCL) has been appointed to act as Bid Process Coordinator (BPC).

Musalgaon Power Transmission Limited was incorporated on December 20, 2025. After the selection of the successful bidder in accordance with the Tariff-Based Competitive Bidding (TBCB) guidelines.

Also Read: GIFT City Funds offer new route to global investing, says Daulat Finvest CEO

When we take a look back at the Q4 results, REC Ltd posted an over 9% year-on-year increase in net profit. The bottom line rose to ₹4,414.93 crore in the September quarter. It achieved a net profit of ₹4,037.72 crore in the second quarter of the preceding 2024-25 financial year.

As far as the bottom line is concerned, the revenue rose ₹15,162.38 crore from ₹13,706.31 crore in the year-ago period, marking a 10.62% rise. The Interest income rose to ₹14,589.97 crore from ₹13,484.82 crore in Q2 FY25.

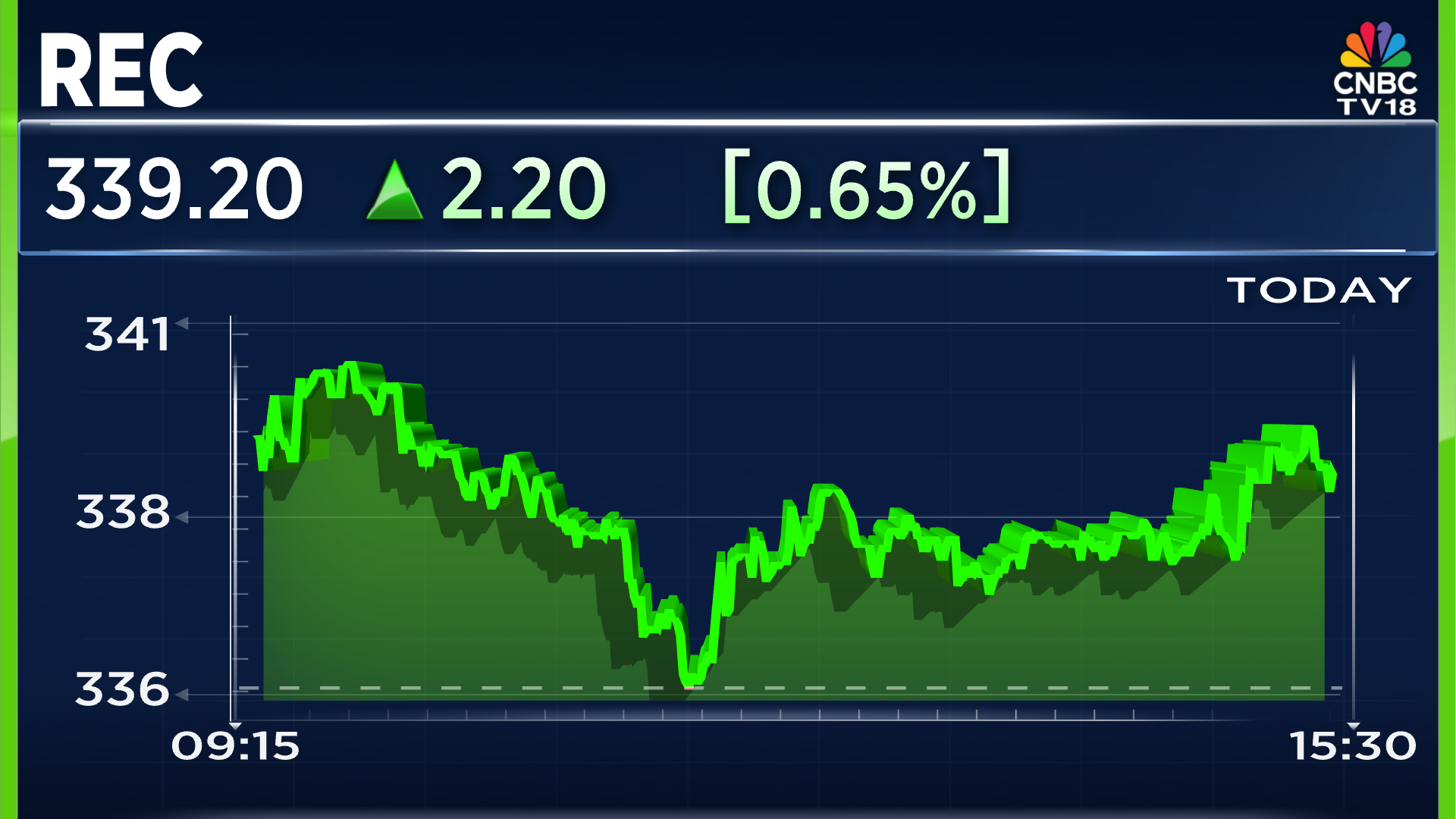

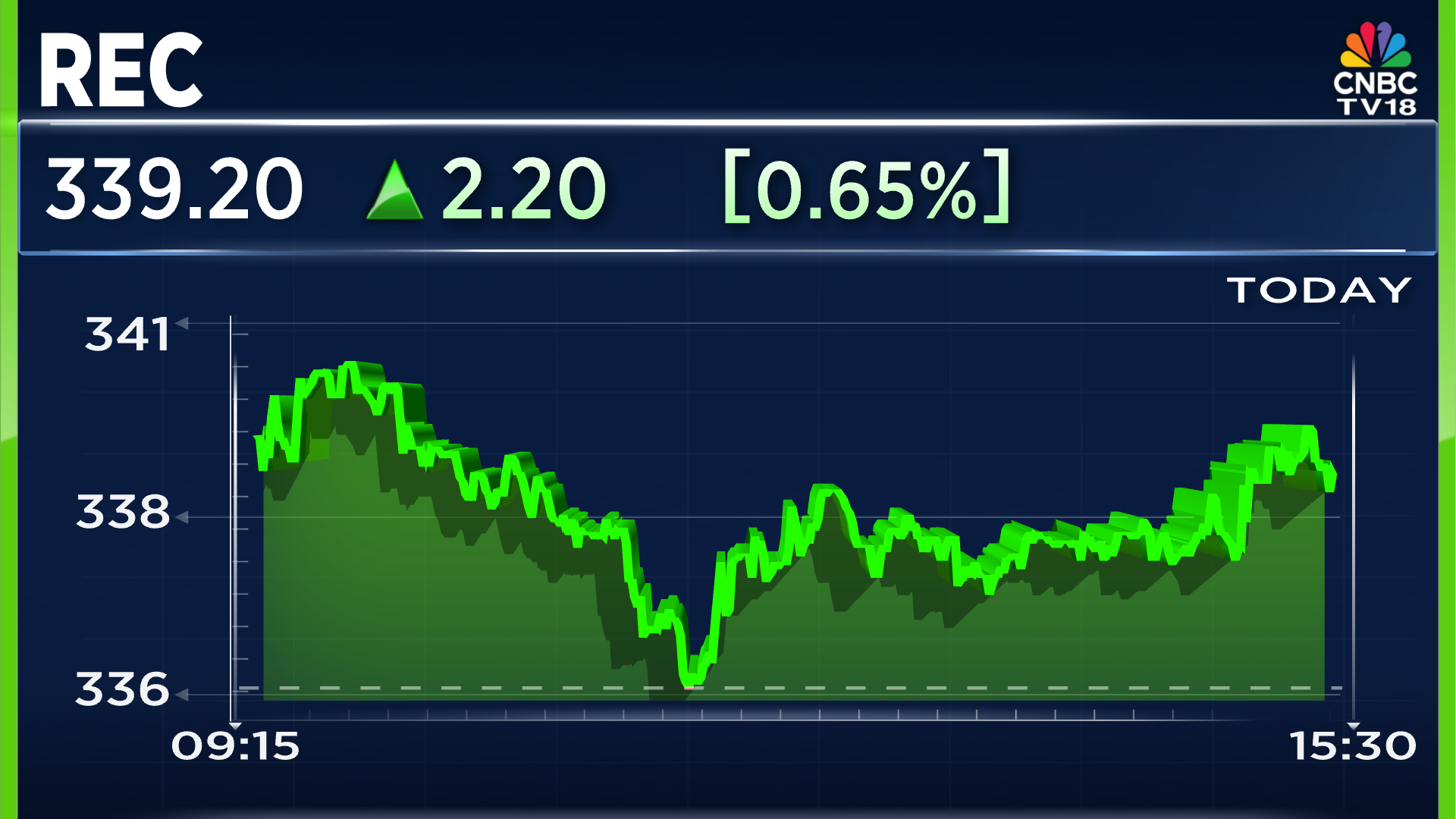

When it comes to the company shares, REC closed the week in red; however, on Friday, the company shares rose by 0.65% or ₹2.20. The total value of the stock price stands at ₹339.20 per share.

The company added that the authorised capital amount stood at ₹5 lakh. The company said the Government of Maharashtra vide Order dated October 3, 2025, had allocated one intra-state transmission project, wherein REC Power Development and Consultancy Limited (RECPDCL) has been appointed to act as Bid Process Coordinator (BPC).

Musalgaon Power Transmission Limited was incorporated on December 20, 2025. After the selection of the successful bidder in accordance with the Tariff-Based Competitive Bidding (TBCB) guidelines.

Also Read: GIFT City Funds offer new route to global investing, says Daulat Finvest CEO

When we take a look back at the Q4 results, REC Ltd posted an over 9% year-on-year increase in net profit. The bottom line rose to ₹4,414.93 crore in the September quarter. It achieved a net profit of ₹4,037.72 crore in the second quarter of the preceding 2024-25 financial year.

As far as the bottom line is concerned, the revenue rose ₹15,162.38 crore from ₹13,706.31 crore in the year-ago period, marking a 10.62% rise. The Interest income rose to ₹14,589.97 crore from ₹13,484.82 crore in Q2 FY25.

When it comes to the company shares, REC closed the week in red; however, on Friday, the company shares rose by 0.65% or ₹2.20. The total value of the stock price stands at ₹339.20 per share.

/images/ppid_59c68470-image-176623503855313870.webp)

/images/ppid_59c68470-image-177081007096256088.webp)

/images/ppid_59c68470-image-17707026503138892.webp)

/images/ppid_59c68470-image-177073507763571006.webp)

/images/ppid_59c68470-image-177089503057587662.webp)

/images/ppid_59c68470-image-177097265650732923.webp)

/images/ppid_59c68470-image-177090253948689009.webp)

/images/ppid_59c68470-image-177088504440359883.webp)

/images/ppid_59c68470-image-177090512191059170.webp)

/images/ppid_59c68470-image-17709575691924647.webp)

/images/ppid_59c68470-image-177074755392764491.webp)

/images/ppid_59c68470-image-177080013292274345.webp)

/images/ppid_59c68470-image-177080256500921890.webp)