What is the story about?

Alphabet Inc. has raised close to $32 billion in debt in less than 24 hours, underlining the massive funding needs of global technology giants racing to build artificial intelligence capabilities and the strong appetite from the credit market to finance those plans.

The Google parent sold record-sized corporate bonds in the sterling and Swiss franc markets, following its $20 billion debt sale on Monday, February 9. Notably, the sterling issue included an ultra-rare 100-year note. According to Bloomberg data, this was the first such long-dated bond issued by a technology company since the dot-com era.

Investor demand was robust across maturities. The century bond attracted nearly 10 times the orders for the £1 billion ($1.4 billion) on offer and was priced at 120 basis points above 10-year UK government bonds. The shortest tranche, a three-year note, was priced at 45 basis points over gilts.

The wide range of maturities and currencies helped Alphabet tap demand from diverse investor classes, including asset managers, hedge funds, pension funds and insurers that prefer longer-dated debt.

Also read: After insurance and tech stocks, these shares become the next AI casualty

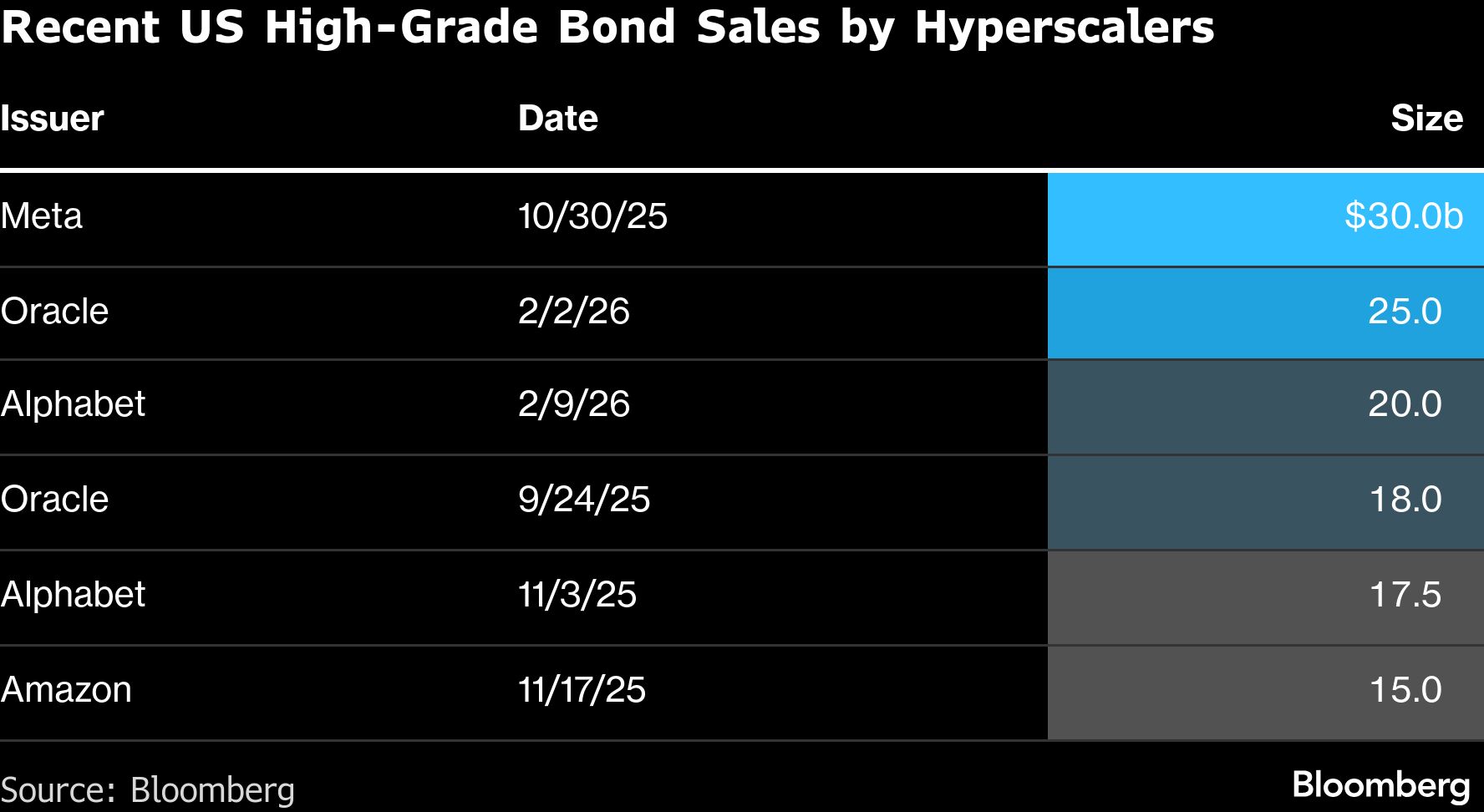

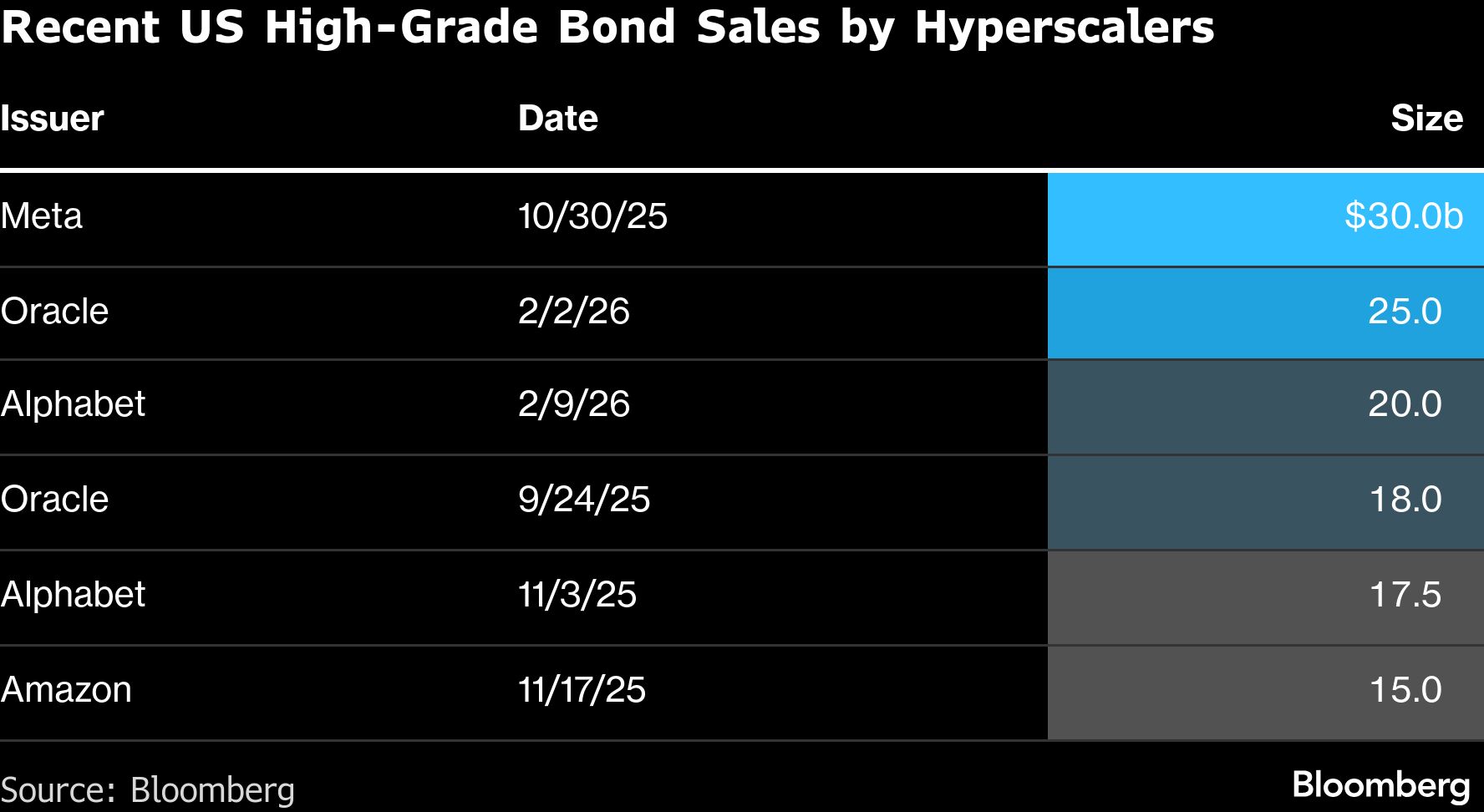

The bond sales come less than a week after Alphabet said its capital expenditure could rise to as much as $185 billion this year, nearly double last year’s spending, largely to support its AI ambitions. Other technology majors are also tapping debt markets aggressively. Oracle recently raised $25 billion, drawing demand of $129 billion, to fund its own AI plans.

Meanwhile, companies such as Meta Platforms and Microsoft have outlined heavy investment plans for 2026. Morgan Stanley estimates that borrowing by hyperscalers — large cloud-computing firms — could reach $400 billion in 2026, up from $165 billion in 2025.

Andrea Seminara, chief executive of Redhedge Asset Management, told Bloomberg, “Hyperscalers will keep coming big,” adding that issuers are testing investor appetite across markets and maturities.

However, the scale of borrowing has begun to raise concerns about potential pressure on bond valuations, with some investors also questioning the durability of the AI investment cycle and its knock-on effects on sectors such as software-as-a-service.

Alphabet’s 100-year bond is particularly unusual for a corporate issuer, given risks such as technological change and shifting business models. Bloomberg data shows that the last technology firm to issue such a bond was Motorola in 1997. Still, strong demand from UK pension funds and insurers has made sterling a preferred market for ultra-long-dated issuance.

Alex Ralph, co-portfolio manager of Nedgroup Investments Global Strategic Bond Fund, said, “I could not justify taking such a long maturity bond in most companies — especially not one subject to an ever-changing landscape."

“100-year bonds tend to have a habit of calling the top of a market as well,” she added.

Alphabet has also diversified its funding sources in recent months. It raised €6.5 billion in the euro bond market in November, making it the largest euro-market borrower of 2025. Its £5.5 billion sterling sale comfortably exceeded the previous market record, while the Swiss franc offering surpassed the earlier high set by Roche Holding.

The sterling and Swiss franc bond issues were arranged by Bank of America, Goldman Sachs and JPMorgan Chase, with additional participation from Barclays, HSBC, NatWest, BNP Paribas and Deutsche Bank.

The Google parent sold record-sized corporate bonds in the sterling and Swiss franc markets, following its $20 billion debt sale on Monday, February 9. Notably, the sterling issue included an ultra-rare 100-year note. According to Bloomberg data, this was the first such long-dated bond issued by a technology company since the dot-com era.

Investor demand was robust across maturities. The century bond attracted nearly 10 times the orders for the £1 billion ($1.4 billion) on offer and was priced at 120 basis points above 10-year UK government bonds. The shortest tranche, a three-year note, was priced at 45 basis points over gilts.

The wide range of maturities and currencies helped Alphabet tap demand from diverse investor classes, including asset managers, hedge funds, pension funds and insurers that prefer longer-dated debt.

Also read: After insurance and tech stocks, these shares become the next AI casualty

The bond sales come less than a week after Alphabet said its capital expenditure could rise to as much as $185 billion this year, nearly double last year’s spending, largely to support its AI ambitions. Other technology majors are also tapping debt markets aggressively. Oracle recently raised $25 billion, drawing demand of $129 billion, to fund its own AI plans.

Meanwhile, companies such as Meta Platforms and Microsoft have outlined heavy investment plans for 2026. Morgan Stanley estimates that borrowing by hyperscalers — large cloud-computing firms — could reach $400 billion in 2026, up from $165 billion in 2025.

Andrea Seminara, chief executive of Redhedge Asset Management, told Bloomberg, “Hyperscalers will keep coming big,” adding that issuers are testing investor appetite across markets and maturities.

However, the scale of borrowing has begun to raise concerns about potential pressure on bond valuations, with some investors also questioning the durability of the AI investment cycle and its knock-on effects on sectors such as software-as-a-service.

Rare 100-year bond

Alphabet’s 100-year bond is particularly unusual for a corporate issuer, given risks such as technological change and shifting business models. Bloomberg data shows that the last technology firm to issue such a bond was Motorola in 1997. Still, strong demand from UK pension funds and insurers has made sterling a preferred market for ultra-long-dated issuance.

Alex Ralph, co-portfolio manager of Nedgroup Investments Global Strategic Bond Fund, said, “I could not justify taking such a long maturity bond in most companies — especially not one subject to an ever-changing landscape."

“100-year bonds tend to have a habit of calling the top of a market as well,” she added.

Alphabet has also diversified its funding sources in recent months. It raised €6.5 billion in the euro bond market in November, making it the largest euro-market borrower of 2025. Its £5.5 billion sterling sale comfortably exceeded the previous market record, while the Swiss franc offering surpassed the earlier high set by Roche Holding.

The sterling and Swiss franc bond issues were arranged by Bank of America, Goldman Sachs and JPMorgan Chase, with additional participation from Barclays, HSBC, NatWest, BNP Paribas and Deutsche Bank.

/images/ppid_59c68470-image-177077754454222790.webp)

/images/ppid_59c68470-image-177077254224536754.webp)

/images/ppid_a911dc6a-image-177077043838376354.webp)

/images/ppid_a911dc6a-image-177077683848562681.webp)

/images/ppid_a911dc6a-image-177077603394625504.webp)

/images/ppid_59c68470-image-177077512106794299.webp)

/images/ppid_59c68470-image-177077504615982639.webp)

/images/ppid_59c68470-image-177077515851590090.webp)

/images/ppid_59c68470-image-177077508321758455.webp)

/images/ppid_a911dc6a-image-177077322976413782.webp)

/images/ppid_59c68470-image-177077258165510745.webp)

/images/ppid_59c68470-image-177077272281824806.webp)

/images/ppid_59c68470-image-177077276056749159.webp)