What is the story about?

Shares of Steel Authority of India Ltd. (SAIL) gained over 7% to hit a fresh 52-week high on Wednesday, October 29, ahead of their second quarter earnings.

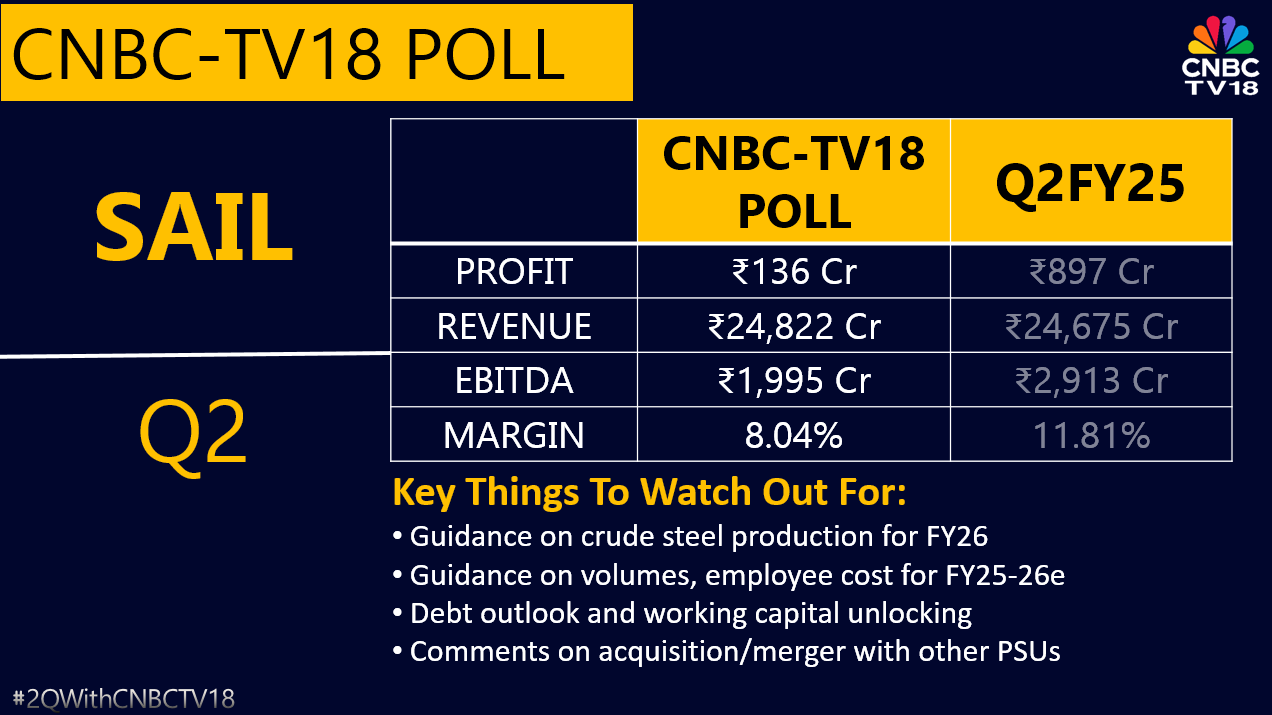

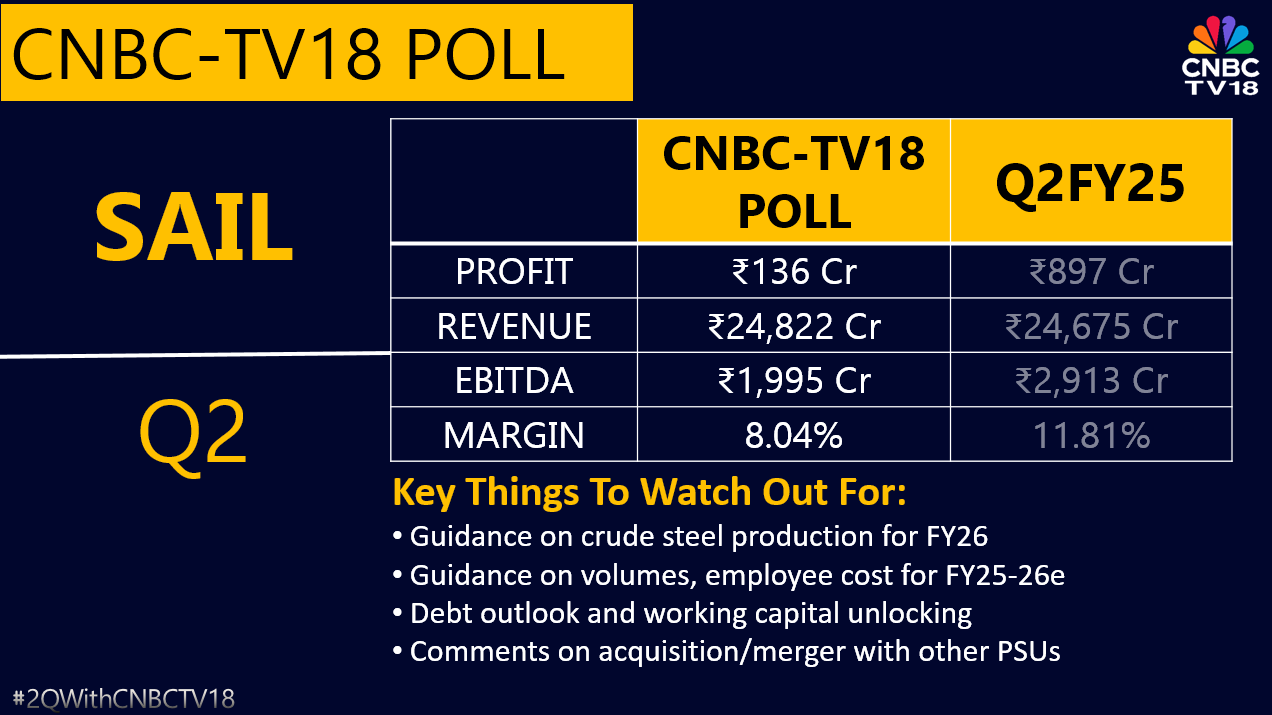

The Street estimates SAIL's margins to contract to 8.04% from 11.81% in the year-ago period.

It has also estimated an 85% decline in its profit after tax to ₹136 crore from ₹897 crore last year.

The Street expects SAIL's volumes to increase by around 10% from the previous year. Steel realisations are likely to contract sharply on a sequential-basis as SAIl has higher proportion of longs.

Its pricing is weak, led by seasonal price cuts during the quarter. Weak pricing on a sequential basis leads to contraction in margins.

It is partially offset by lower coking coal down, down $10/t sequentially.

SAIL shares gained 7.4% to hit a fresh 52-week high of ₹142 apiece on Wednesday. The stock was up 6.5% at ₹140.7 apiece around 9.55 am. It has gained 22.2% in the past six months.

Also Read:DCM Shriram shares jump 7% as Q2 EBITDA surges 71%, margin expands

A

CNBC-TV18 poll has forecast SAIL’s revenue from operations to increase 0.6% to ₹24,822 crore in the September quarter from ₹24,675 crore a year earlier.

Operating profit is expected to decline 32% YoY to ₹1,995 crore from ₹2,913 crore, while margins are likely to contract to 8.04% from 11.81%.

Net profit is estimated to fall sharply by 85% to ₹136 crore from ₹897 crore, as per the poll.

The Street estimates SAIL's margins to contract to 8.04% from 11.81% in the year-ago period.

It has also estimated an 85% decline in its profit after tax to ₹136 crore from ₹897 crore last year.

The Street expects SAIL's volumes to increase by around 10% from the previous year. Steel realisations are likely to contract sharply on a sequential-basis as SAIl has higher proportion of longs.

Its pricing is weak, led by seasonal price cuts during the quarter. Weak pricing on a sequential basis leads to contraction in margins.

It is partially offset by lower coking coal down, down $10/t sequentially.

SAIL shares gained 7.4% to hit a fresh 52-week high of ₹142 apiece on Wednesday. The stock was up 6.5% at ₹140.7 apiece around 9.55 am. It has gained 22.2% in the past six months.

Also Read:DCM Shriram shares jump 7% as Q2 EBITDA surges 71%, margin expands

/images/ppid_59c68470-image-176171515925733023.webp)

/images/ppid_a911dc6a-image-177095525072836974.webp)

/images/ppid_a911dc6a-image-177095464341460939.webp)

/images/ppid_a911dc6a-image-177095459124798392.webp)

/images/ppid_59c68470-image-177095519003435839.webp)

/images/ppid_59c68470-image-177095526141973949.webp)

/images/ppid_59c68470-image-177095515658937155.webp)

/images/ppid_59c68470-image-177095522379556946.webp)