What is the story about?

Speciality chemicals major Jubilant Ingrevia Ltd on Wednesday (February 4) reported a 32.4% year-on-year decline in net profit for Q3 at ₹47 crore, compared with ₹69.4 crore in the same period last year.

Revenue remained largely flat, rising 0.5% to ₹1,051 crore from ₹1,056.7 crore in Q3FY25. EBITDA fell 8.5% to ₹126.1 crore from ₹137.9 crore a year ago. EBITDA margin contracted to 12% from 13% in the corresponding quarter of the previous year.

Jubilant Ingrevia said its board has declared an interim dividend of ₹2.50 per equity share of Re. 1 each on the paid-up equity share capital of the company for the financial year 2025-26. The Board has fixed Tuesday, February 10, 2026, as the record date to determine the eligibility of shareholders for the interim dividend. The interim dividend will be paid or dispatched on or before March 4, 2026.

Also Read: Jubilant Ingrevia Q2 net profit up 17.74% at ₹69.47 crore

The board also approved the re-appointment of Ameeta Chatterjee for another term of five years, starting from April 17, 2026, and ending on April 16, 2031, subject to shareholder approval. Ameeta Chatterjee, 51, holds a bachelor’s degree in commerce from Lady Shri Ram College for Women, Delhi University, and is a management graduate from the Indian Institute of Management, Bangalore.

She has over 23 years of corporate experience in developing, managing, financing, and executing projects in India and the UK. She began her career with ICICI Limited in 1995 in the Project Finance Division and later joined KPMG to set up an infrastructure-related Corporate Finance team. During her eight-year tenure at KPMG, she gained international experience while working in London across sectors, including health and education and handled cross-border transactions in the India-UK corridor.

On returning to India in 2008, she established the KPMG Infrastructure Corporate Finance team to advise on fundraising, joint ventures, mergers & acquisitions, and financing transactions. In 2010, she joined the corporate sector as GM–Mergers & Acquisitions at Leighton, an Australian infrastructure firm, where she played a key role in originating, leading, and managing the equity portfolio of its infrastructure projects.

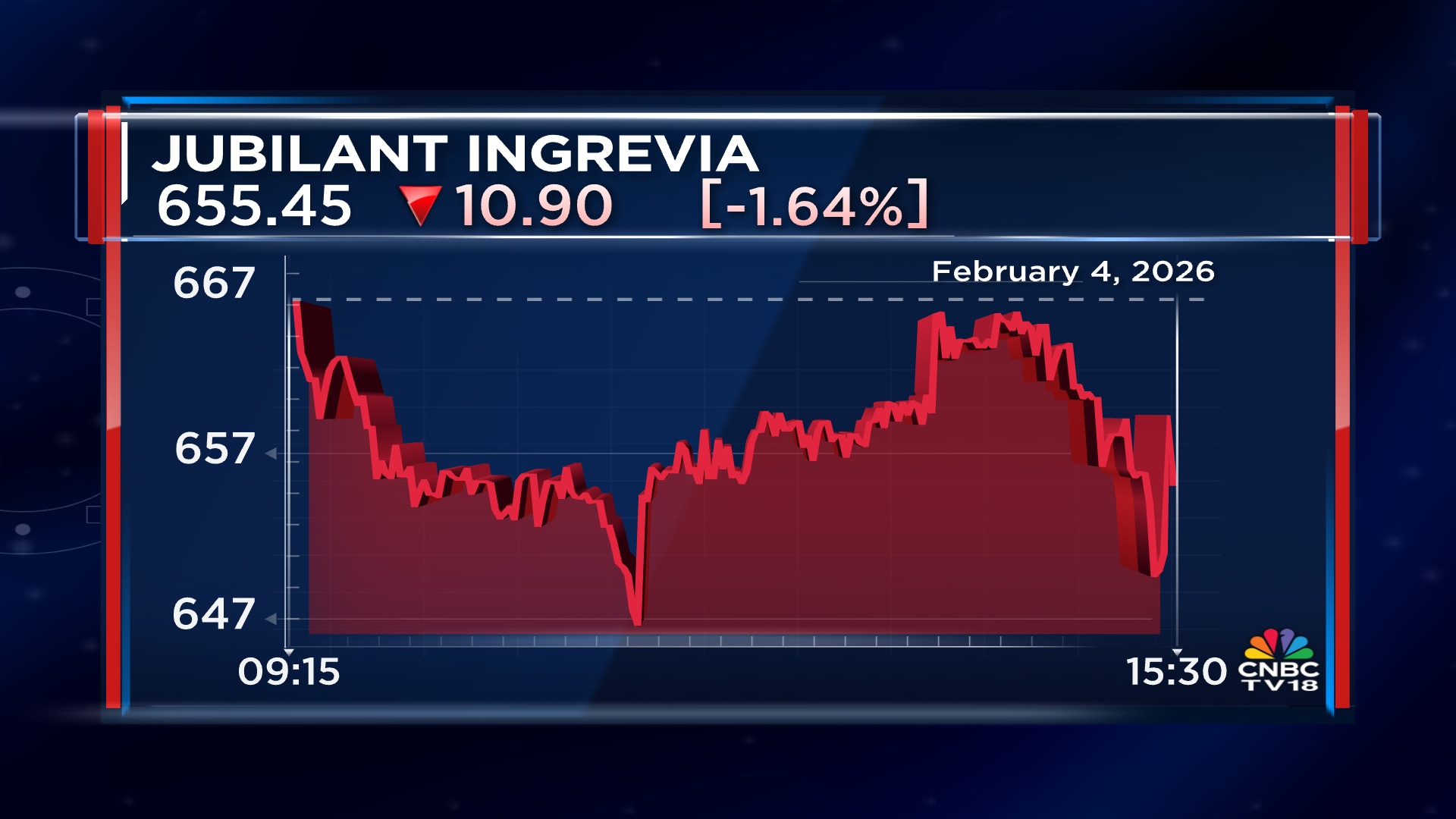

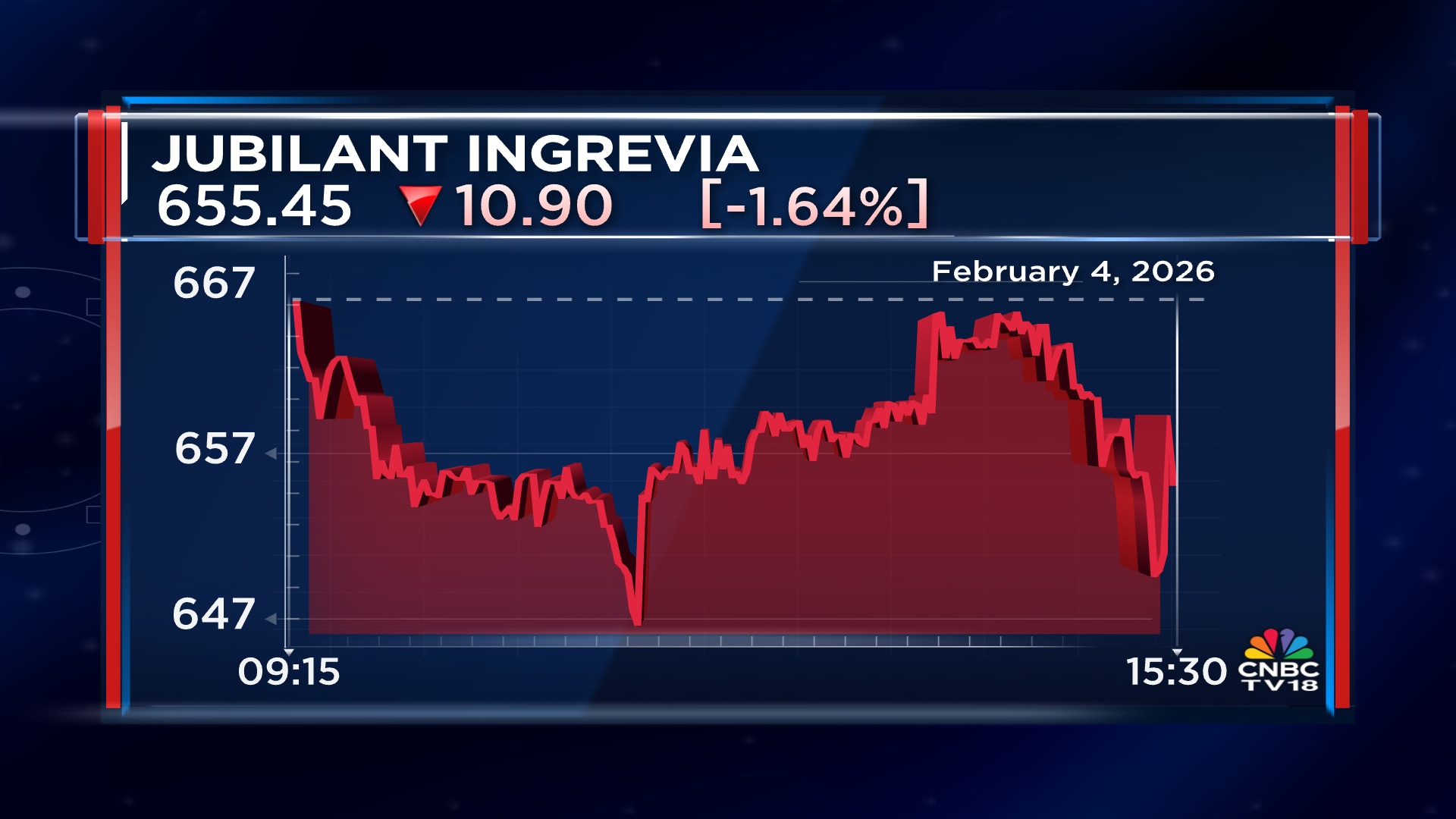

Shares of Jubilant Ingrevia Ltd ended at ₹655.45, down by ₹10.90, or 1.64%, on the BSE.

Also Read: Three Jubilant Group companies see block deals worth nearly ₹1,900 crore

Revenue remained largely flat, rising 0.5% to ₹1,051 crore from ₹1,056.7 crore in Q3FY25. EBITDA fell 8.5% to ₹126.1 crore from ₹137.9 crore a year ago. EBITDA margin contracted to 12% from 13% in the corresponding quarter of the previous year.

Jubilant Ingrevia said its board has declared an interim dividend of ₹2.50 per equity share of Re. 1 each on the paid-up equity share capital of the company for the financial year 2025-26. The Board has fixed Tuesday, February 10, 2026, as the record date to determine the eligibility of shareholders for the interim dividend. The interim dividend will be paid or dispatched on or before March 4, 2026.

Also Read: Jubilant Ingrevia Q2 net profit up 17.74% at ₹69.47 crore

The board also approved the re-appointment of Ameeta Chatterjee for another term of five years, starting from April 17, 2026, and ending on April 16, 2031, subject to shareholder approval. Ameeta Chatterjee, 51, holds a bachelor’s degree in commerce from Lady Shri Ram College for Women, Delhi University, and is a management graduate from the Indian Institute of Management, Bangalore.

She has over 23 years of corporate experience in developing, managing, financing, and executing projects in India and the UK. She began her career with ICICI Limited in 1995 in the Project Finance Division and later joined KPMG to set up an infrastructure-related Corporate Finance team. During her eight-year tenure at KPMG, she gained international experience while working in London across sectors, including health and education and handled cross-border transactions in the India-UK corridor.

On returning to India in 2008, she established the KPMG Infrastructure Corporate Finance team to advise on fundraising, joint ventures, mergers & acquisitions, and financing transactions. In 2010, she joined the corporate sector as GM–Mergers & Acquisitions at Leighton, an Australian infrastructure firm, where she played a key role in originating, leading, and managing the equity portfolio of its infrastructure projects.

Shares of Jubilant Ingrevia Ltd ended at ₹655.45, down by ₹10.90, or 1.64%, on the BSE.

Also Read: Three Jubilant Group companies see block deals worth nearly ₹1,900 crore

/images/ppid_59c68470-image-177021003084893047.webp)

/images/ppid_a911dc6a-image-177077322976413782.webp)

/images/ppid_59c68470-image-177077258165510745.webp)

/images/ppid_59c68470-image-177077272281824806.webp)

/images/ppid_59c68470-image-177077276056749159.webp)

/images/ppid_59c68470-image-177077261155977594.webp)

/images/ppid_59c68470-image-177077268877789072.webp)

/images/ppid_59c68470-image-17707726531682045.webp)

/images/ppid_59c68470-image-177077254224536754.webp)

/images/ppid_a911dc6a-image-177077043838376354.webp)