What is the story about?

REC Limited, a leading power sector financier under the Ministry of Power, had seen early payment of loans worth ₹49,000 crore between July and September 2025.

The bulk of the payment, about ₹11,413 crore came from the Kaleshwaram Irrigation Project in Telangana, executed by another public sector enterprise, BHEL.

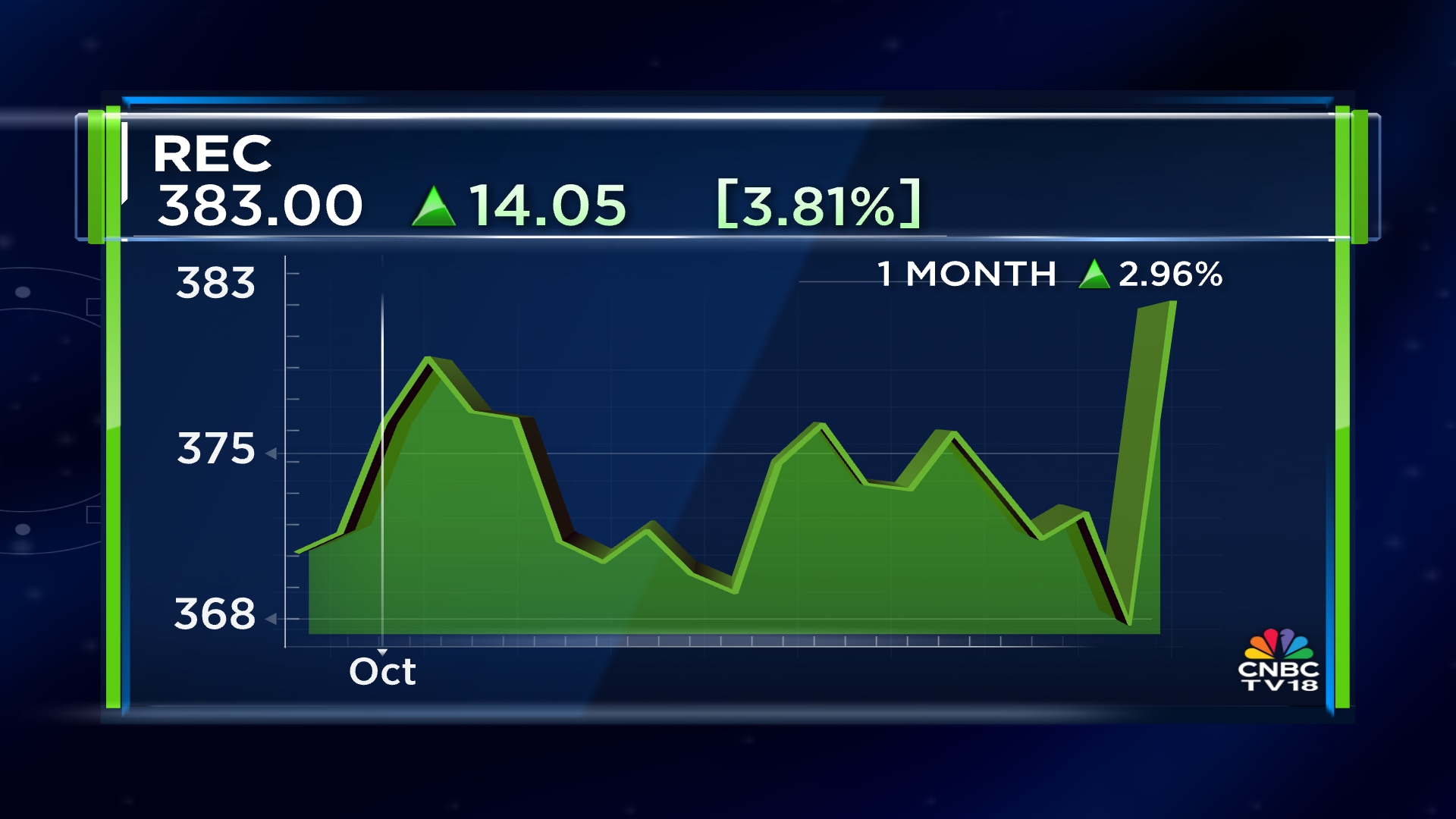

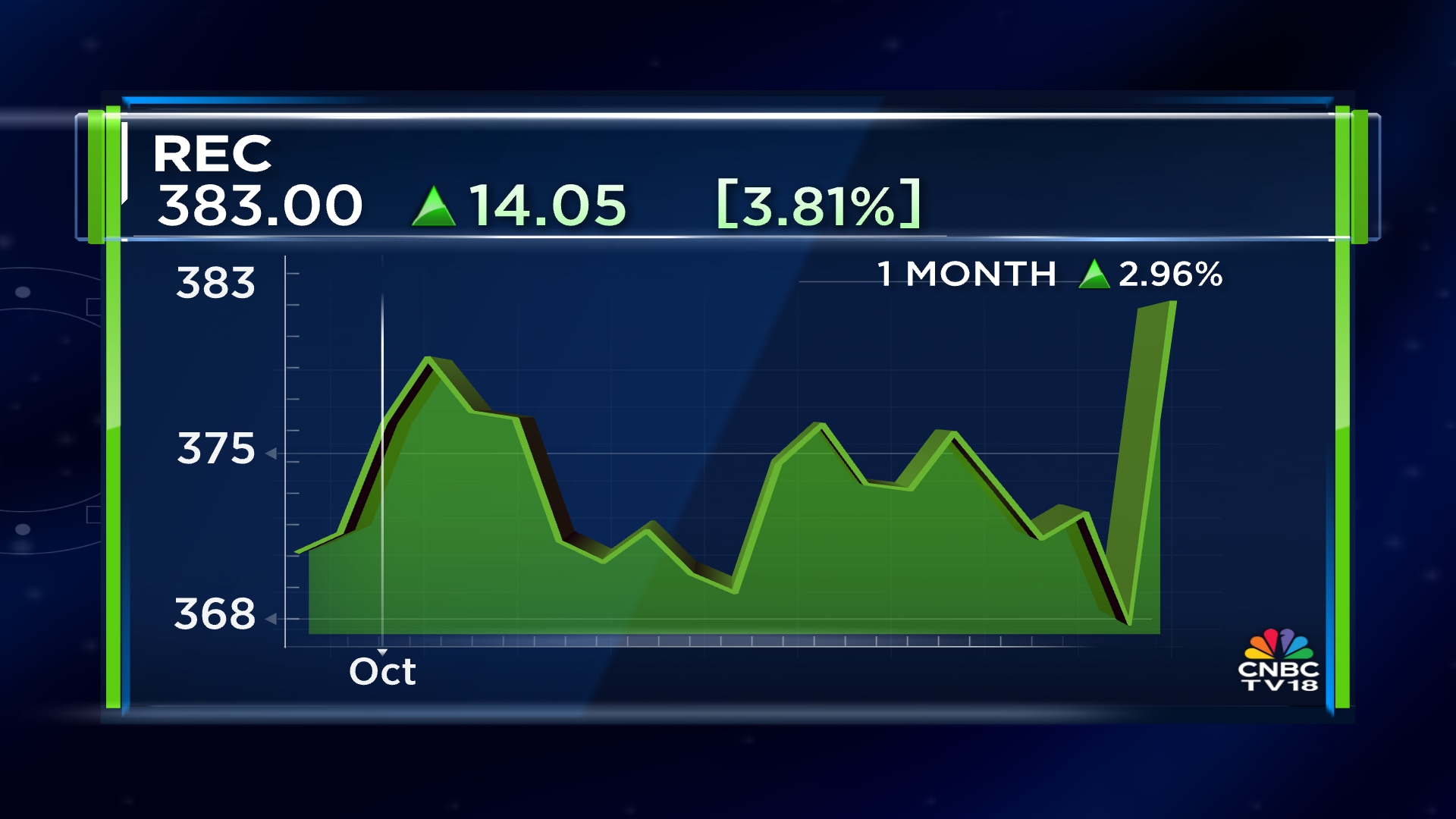

The pre-payment had squeezed the growth in the size of the loan book to 6.6% from a potential 16.6% growth. However, there may be no such pre-payments in the remaining two quarters of the financial year ending March 2026, the management told analysts in a conference call, triggering a rally in the stock price on Oct 29.

The team also reiterated its goal to achieve a loan book of ₹10 lakh crore by March 2030. That would imply a compounded annual growth rate of over 13% from now, faster than the growth rate of the last few years.

The company, with a market capitalisation of approximately ₹97,560 crore, had a loan book of over ₹5.82 lakh crore at the end of March 2025.

Read more: Shree Cement: Time for a breather?

The bulk of the payment, about ₹11,413 crore came from the Kaleshwaram Irrigation Project in Telangana, executed by another public sector enterprise, BHEL.

The pre-payment had squeezed the growth in the size of the loan book to 6.6% from a potential 16.6% growth. However, there may be no such pre-payments in the remaining two quarters of the financial year ending March 2026, the management told analysts in a conference call, triggering a rally in the stock price on Oct 29.

Shares of REC had been on a decline since the company reported its earnings on Oct 17.

The team also reiterated its goal to achieve a loan book of ₹10 lakh crore by March 2030. That would imply a compounded annual growth rate of over 13% from now, faster than the growth rate of the last few years.

The company, with a market capitalisation of approximately ₹97,560 crore, had a loan book of over ₹5.82 lakh crore at the end of March 2025.

Read more: Shree Cement: Time for a breather?

/images/ppid_59c68470-image-176172503246759560.webp)

/images/ppid_a911dc6a-image-177095176389429444.webp)

/images/ppid_59c68470-image-177095006121036330.webp)

/images/ppid_59c68470-image-17709502481006608.webp)

/images/ppid_a911dc6a-image-177095464341460939.webp)

/images/ppid_a911dc6a-image-177095459124798392.webp)

/images/ppid_a911dc6a-image-177095456236021374.webp)

/images/ppid_a911dc6a-image-177095464047646858.webp)

/images/ppid_a911dc6a-image-177095453061774080.webp)

/images/ppid_a911dc6a-image-177095452776148437.webp)

/images/ppid_a911dc6a-image-177095363447023809.webp)

/images/ppid_59c68470-image-177095256656558605.webp)

/images/ppid_59c68470-image-177095259574929498.webp)