What is the story about?

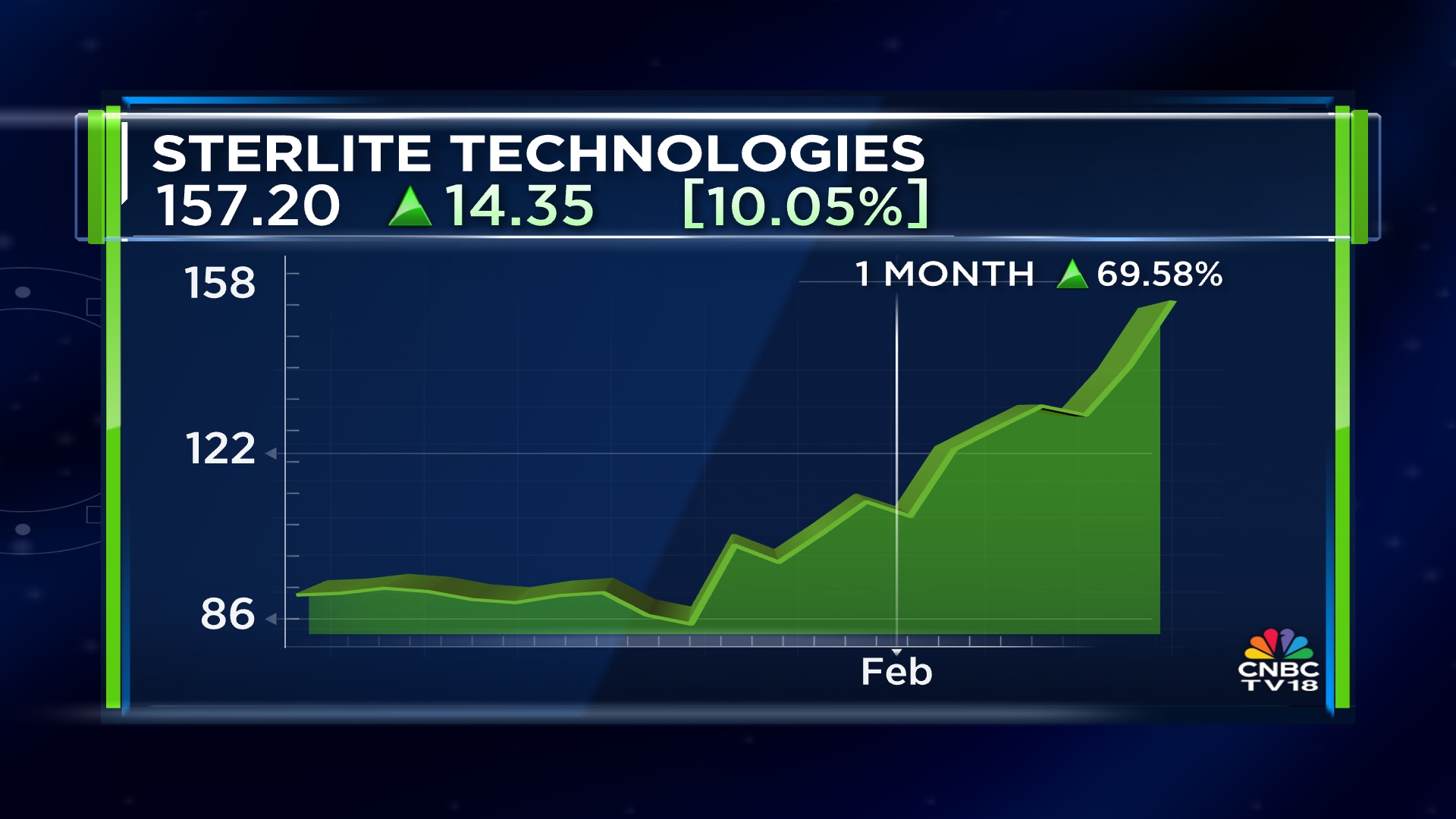

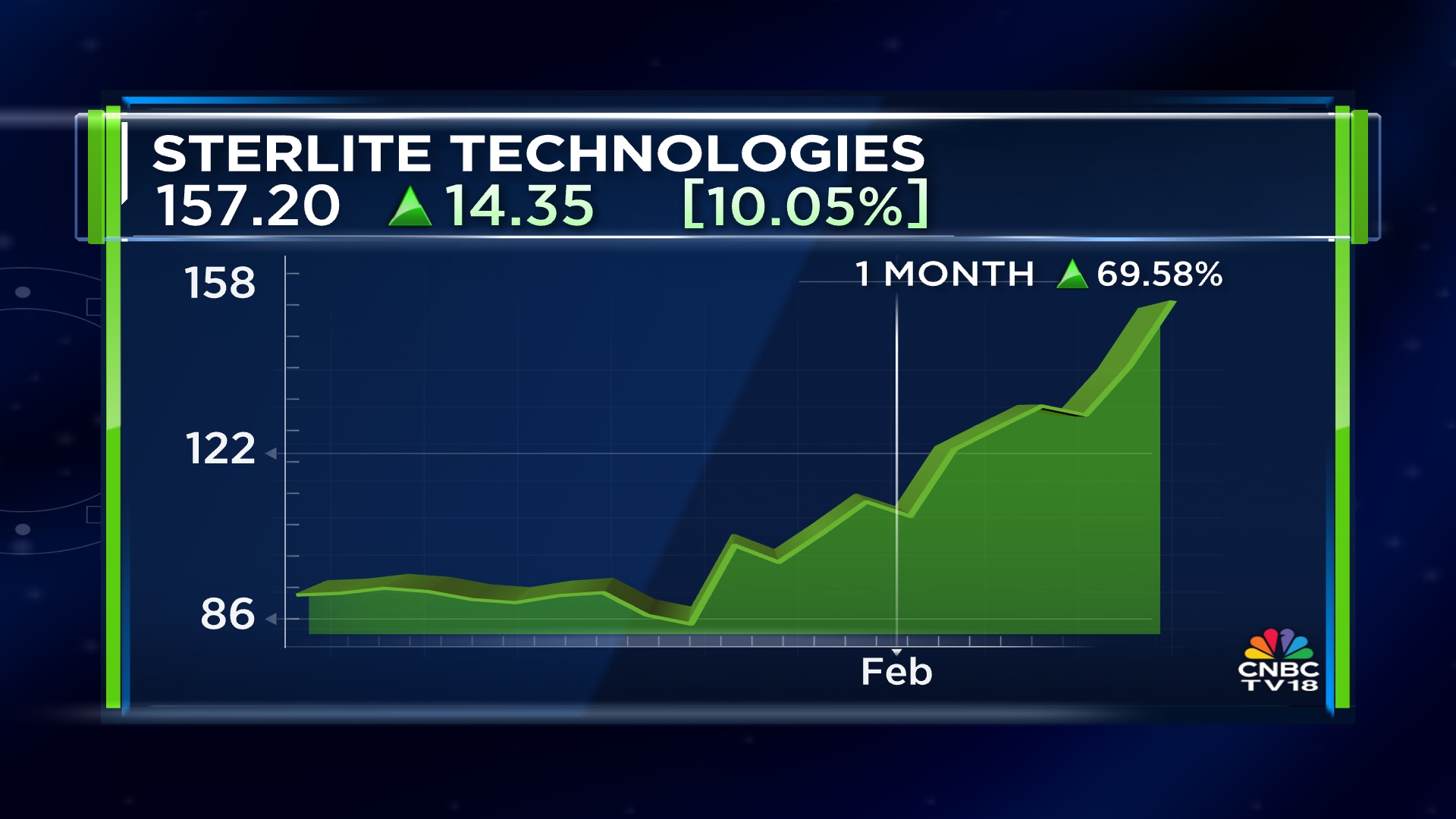

Shares of Sterlite Technologies Ltd. extended their gains for the second consecutive day on Tuesday, February 10, gaining over 14% to hit a fresh 52-week high of ₹163.4 apiece.

The stock has gained 70% in the past month. It has also risen for five out of the last six trade sessions.

On Monday, February 9, Sterlite Tech had surged 8% after brokerage firm Nuvama reiterated its 'buy' rating on the stock and maintained its price target of ₹200, citing improving growth momentum as well as an easing tariff environment.

Nuvama said Sterlite Tech witnessed a sharp pickup in revenue growth in the third quarter.

However, its margin remained under pressure because of tariff-related uncertainties. The analyst is expecting the margin to improve after the US decision to lower reciprocal tariffs on Indian exports to 19% from 25%, along with the removal of the additional punitive 25% tariff, which it believes would be margin-accretive.

Nuvama also said it expected growth momentum to sustain, especially in North America, with support from recovery in demand from telecom operators and hyperscalers, easing trade conditions, Sterlite Tech's local manufacturing footprint and a sharper focus on its data centre portfolio.

Sterlite Tech reported a net loss of ₹17 crore in the December quarter compared to a net loss of ₹24 crore in the year-ago period. Its earnings before interest, tax, depreciation and amortisation (EBITDA) increased 16.2% to ₹129 crore from ₹111 crore in the previous year. Its EBITDA margin narrowed by ₹80 basis points to 10.3% from 11.1% in the third quarter of the previous fiscal.

Sterlite Tech shares were trading 10% up at ₹157.22 apiece around 12.50 pm on Tuesday.

Also Read: Sansera Engineering shares surge 12% to hit 52-week high on strong Q3 earnings

The stock has gained 70% in the past month. It has also risen for five out of the last six trade sessions.

On Monday, February 9, Sterlite Tech had surged 8% after brokerage firm Nuvama reiterated its 'buy' rating on the stock and maintained its price target of ₹200, citing improving growth momentum as well as an easing tariff environment.

Nuvama said Sterlite Tech witnessed a sharp pickup in revenue growth in the third quarter.

However, its margin remained under pressure because of tariff-related uncertainties. The analyst is expecting the margin to improve after the US decision to lower reciprocal tariffs on Indian exports to 19% from 25%, along with the removal of the additional punitive 25% tariff, which it believes would be margin-accretive.

Nuvama also said it expected growth momentum to sustain, especially in North America, with support from recovery in demand from telecom operators and hyperscalers, easing trade conditions, Sterlite Tech's local manufacturing footprint and a sharper focus on its data centre portfolio.

Sterlite Tech reported a net loss of ₹17 crore in the December quarter compared to a net loss of ₹24 crore in the year-ago period. Its earnings before interest, tax, depreciation and amortisation (EBITDA) increased 16.2% to ₹129 crore from ₹111 crore in the previous year. Its EBITDA margin narrowed by ₹80 basis points to 10.3% from 11.1% in the third quarter of the previous fiscal.

Sterlite Tech shares were trading 10% up at ₹157.22 apiece around 12.50 pm on Tuesday.

Also Read: Sansera Engineering shares surge 12% to hit 52-week high on strong Q3 earnings

/images/ppid_59c68470-image-177071008324940804.webp)

/images/ppid_a911dc6a-image-177070882633398788.webp)