What is the story about?

Varun Beverages reported its Q3CY25 results today, in which the company reported a 20% rise in its YoY profit figures. In addition, the company announced its plans for business expansion.

In the exchange filing carrying the quarterly results, the company also announced that VBL's African subsidiaries will enter the market for beer through an exclusive distribution agreement with Carlsberg Breweries. Carlsberg is a Danish alcohol maker.

In addition, the company also added that its snacks facility in Morocco has ramped up to full-scale operations. This will result in a processing plant in Zimbabwe.

In its Q3CY25 results, the company reported a 20% rise in net profit, with the bottom line numbers rising to ₹742 crore, compared to ₹619 crore last year.

The top-line figures also saw a rise of 2%. The company revenue rose from ₹4,805 crore in the previous cycle to ₹4,896.7 crore in this quarter.

The Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) declined to ₹1,150 crore, compared to ₹1,151 crore last year, marking a dip in the margin from 24% to 23.4%.

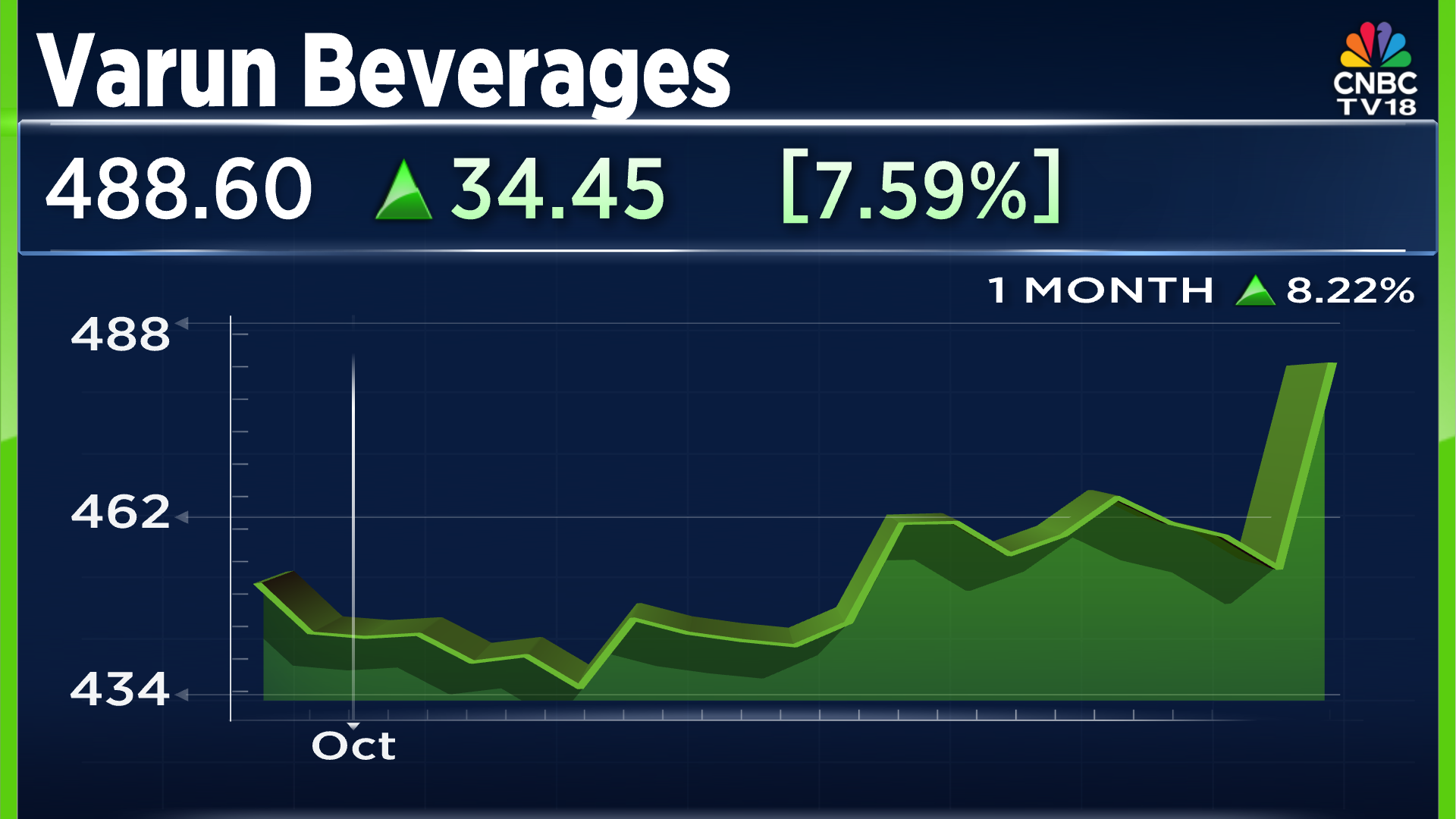

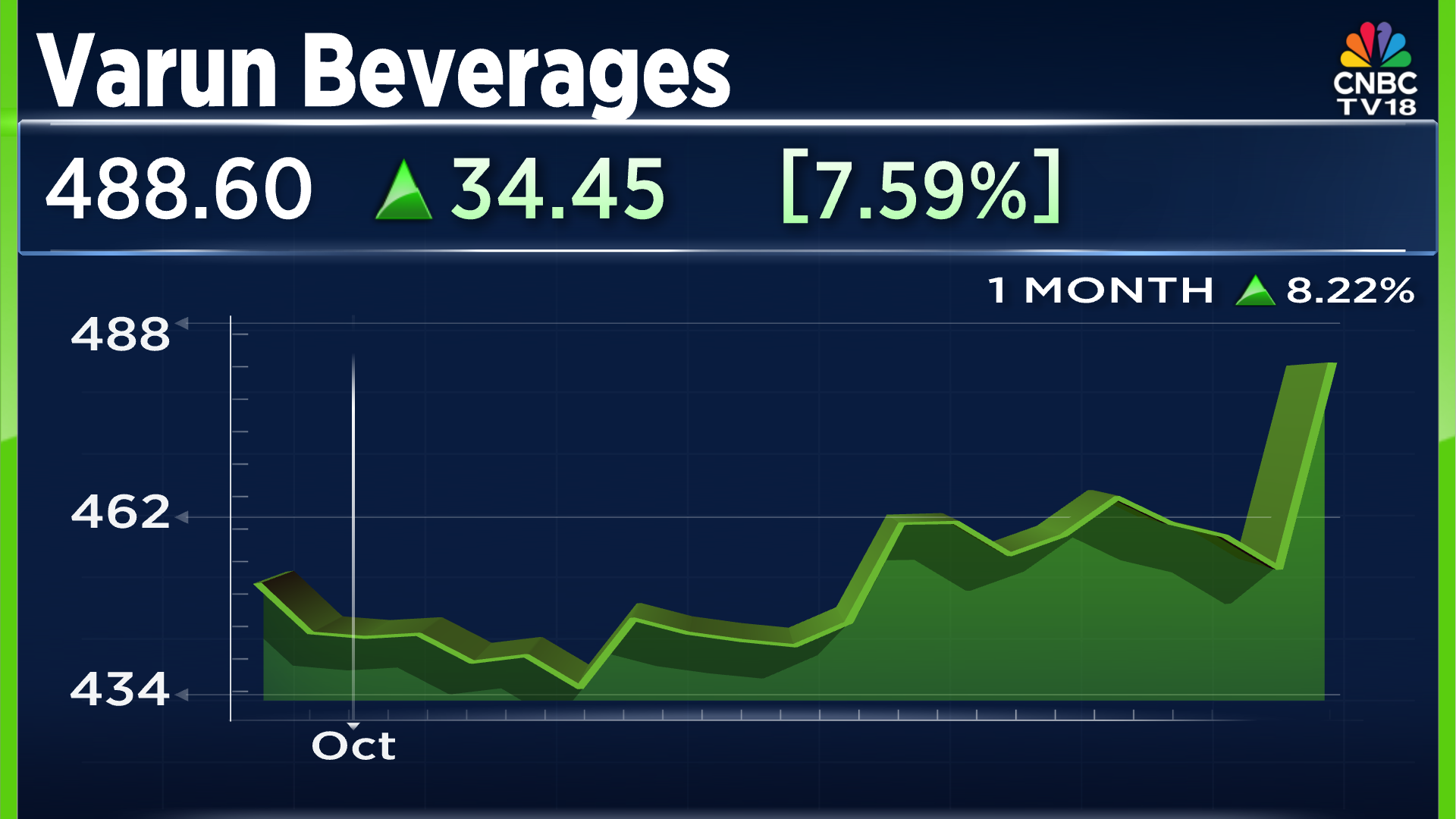

The company shares rose by over 7,59% or ₹34.45 following the results. The company shares have seen an uptick of over 8% in the past month of trade. The current share price of the company stock stands at ₹488.60 per share.

Read Also: Suzlon shares gain nearly 4% after board approves appointment of new CFO Rahul Jain

In the exchange filing carrying the quarterly results, the company also announced that VBL's African subsidiaries will enter the market for beer through an exclusive distribution agreement with Carlsberg Breweries. Carlsberg is a Danish alcohol maker.

In addition, the company also added that its snacks facility in Morocco has ramped up to full-scale operations. This will result in a processing plant in Zimbabwe.

In its Q3CY25 results, the company reported a 20% rise in net profit, with the bottom line numbers rising to ₹742 crore, compared to ₹619 crore last year.

The top-line figures also saw a rise of 2%. The company revenue rose from ₹4,805 crore in the previous cycle to ₹4,896.7 crore in this quarter.

The Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) declined to ₹1,150 crore, compared to ₹1,151 crore last year, marking a dip in the margin from 24% to 23.4%.

The company shares rose by over 7,59% or ₹34.45 following the results. The company shares have seen an uptick of over 8% in the past month of trade. The current share price of the company stock stands at ₹488.60 per share.

Read Also: Suzlon shares gain nearly 4% after board approves appointment of new CFO Rahul Jain

/images/ppid_59c68470-image-176172253054621262.webp)

/images/ppid_a911dc6a-image-177074307992372091.webp)

/images/ppid_a911dc6a-image-177074303034291085.webp)

/images/ppid_59c68470-image-177074252945678901.webp)

/images/ppid_59c68470-image-177074263586952695.webp)

/images/ppid_59c68470-image-177074256690378457.webp)

/images/ppid_59c68470-image-177074267570254615.webp)