What's Happening?

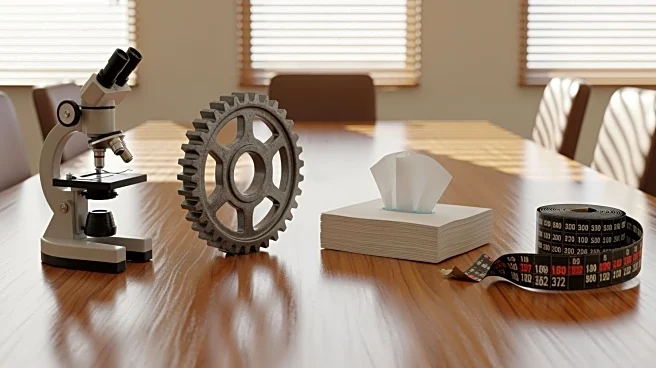

The Investment Committee has identified several key stocks to watch for the second half of the year, including Kimberly-Clark, Thermo Fisher, Wabtec, and Berkshire Hathaway. These companies are highlighted for their potential performance in the market,

with each offering unique strengths and opportunities for investors. Kimberly-Clark is known for its consumer products, Thermo Fisher for its scientific instruments, Wabtec for its transportation solutions, and Berkshire Hathaway for its diverse investment portfolio. The committee's insights are aimed at guiding investors in making informed decisions based on current market trends and company performance.

Why It's Important?

The selection of these stocks by the Investment Committee is significant as it reflects confidence in their potential to perform well in the current economic climate. Investors rely on such expert analyses to navigate the complexities of the stock market and optimize their portfolios. Each company represents a different sector, providing diversification opportunities for investors. Kimberly-Clark's consumer products are essential goods, Thermo Fisher's scientific instruments are crucial for research and development, Wabtec's transportation solutions are vital for logistics, and Berkshire Hathaway's investments span multiple industries, offering stability and growth potential.

What's Next?

Investors may consider monitoring these stocks closely, as the committee's recommendations could influence market movements. The companies may also release quarterly earnings reports, which could impact their stock prices. Additionally, any strategic decisions or market developments related to these companies could further affect investor sentiment and stock performance. Investors should stay informed about industry trends and company announcements to make timely investment decisions.

Beyond the Headlines

The broader implications of these stock recommendations include potential shifts in investor focus towards sectors represented by these companies. For instance, increased interest in consumer goods, scientific research, transportation, and diversified investments could lead to sector growth and innovation. Ethical considerations, such as sustainable practices and corporate governance, may also play a role in investor decisions, influencing long-term company strategies and market dynamics.