What's Happening?

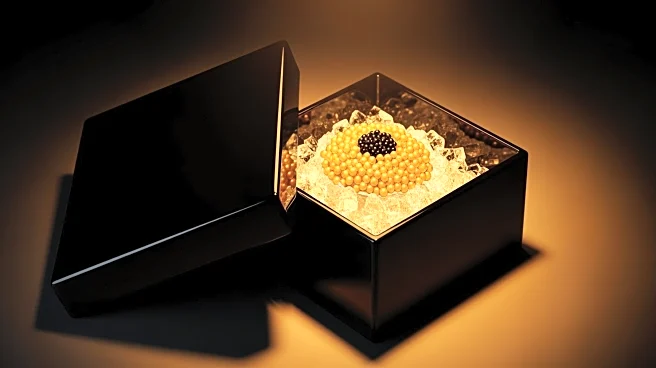

The global precious metals market is experiencing a significant shift in 2025, with gold, silver, and mining equities entering a multi-year bull market. Gold has consolidated above $3,300 per ounce, supported by central bank purchases and demand from Asian markets. Silver has surged past $36 per ounce, driven by short squeezes and industrial demand. Analysts project gold prices could reach $4,000 and silver prices could exceed $50, supported by structural deficits and solar demand.

Why It's Important?

The breakout in precious metals prices signals a structural shift in the market, driven by technical and macroeconomic factors. As central banks continue to purchase gold, its role as a strategic reserve asset is reinforced, impacting global economic stability. Silver's industrial demand, particularly in solar panel production, highlights its significance in emerging technologies. This trend may influence investment strategies, affecting commodity markets and related industries.