What's Happening?

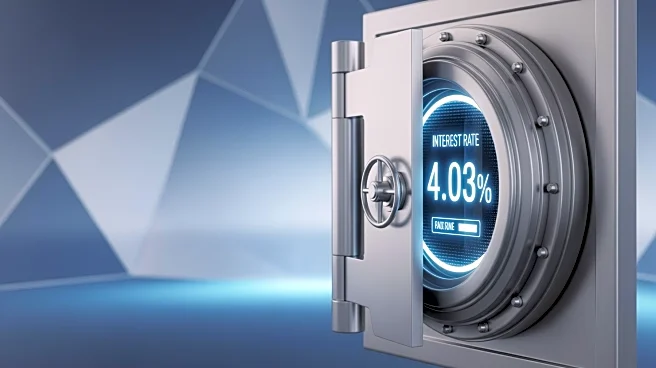

The U.S. Department of the Treasury has announced a new interest rate of 4.03% for Series I bonds, effective from November 1 through April 30. This rate is an increase from the previous 3.98% and includes

a variable portion based on inflation data and a fixed portion. The fixed rate has decreased from 1.10% to 0.90%. Series I bonds, which are government-backed and nearly risk-free, have seen fluctuating rates in response to changing inflation and economic conditions. The bonds are popular among investors seeking stable returns, especially during periods of economic uncertainty.

Why It's Important?

The adjustment in Series I bond rates reflects ongoing economic conditions, particularly inflation trends. These bonds offer a safe investment option for individuals looking to hedge against inflation, providing a stable return in uncertain times. The rate change may influence investment decisions, as higher rates can attract more investors seeking low-risk opportunities. The Treasury's rate adjustments are closely watched by financial markets, as they provide insights into government expectations for inflation and economic performance.

What's Next?

Investors will monitor future inflation data and Treasury announcements for further rate adjustments. The fixed portion of the I bond rate, which remains constant for the bond's life, is a key factor for long-term investors. As economic conditions evolve, the Treasury's rate decisions will continue to impact investor strategies and market dynamics.