What's Happening?

On February 3, 2026, Asian markets experienced a significant rebound, led by South Korea's Kospi and Japan's Nikkei 225, following a steep decline the previous day. This recovery was bolstered by a new

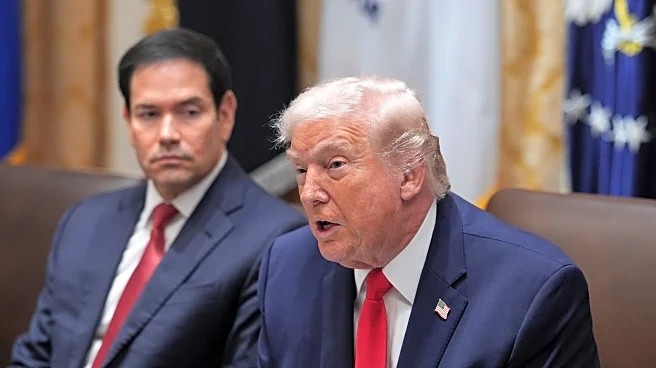

trade agreement between the United States and India, announced by President Trump. The deal involves the U.S. reducing reciprocal tariffs on India from 25% to 18%, with India committing to increase its purchase of American goods and cease oil imports from Russia, opting instead for U.S. and potentially Venezuelan oil. This agreement has positively impacted India's Nifty 50 index, which surged by 5% at its opening. Additionally, the prices of precious metals like gold and silver saw a sharp increase, with gold rising by 4.8% and silver by 7.3%. The U.S. stock market also saw gains, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closing higher on Monday.

Why It's Important?

The trade agreement between the U.S. and India is a significant development in international trade relations, potentially boosting economic growth for both nations. For the U.S., the reduction in tariffs could lead to increased exports to India, benefiting American manufacturers and exporters. India's commitment to 'BUY AMERICAN' and shift its oil imports from Russia to the U.S. could strengthen bilateral ties and reduce India's energy dependency on Russia. The rebound in Asian markets and the rise in precious metal prices reflect investor optimism and a potential shift in global economic dynamics. This development could also influence global commodity markets, particularly in the energy and precious metals sectors, as India adjusts its import strategies.

What's Next?

The trade deal is likely to lead to further negotiations and adjustments in trade policies between the U.S. and India. Stakeholders in both countries, including businesses and policymakers, will be closely monitoring the implementation of the agreement and its impact on trade balances. The shift in India's oil import strategy may prompt reactions from other major oil-exporting countries, potentially affecting global oil prices. Additionally, the rise in precious metal prices could attract more investors, leading to increased market volatility. Observers will also be watching for any further trade agreements or economic policies that could arise from this new U.S.-India partnership.

Beyond the Headlines

This trade agreement may have broader geopolitical implications, as it represents a strategic alignment between the U.S. and India, potentially countering China's influence in the region. The decision to reduce oil imports from Russia could also be seen as a move to align with Western sanctions and policies against Russia. Furthermore, the rise in precious metal prices could indicate a shift in investor sentiment towards safer assets amid global economic uncertainties. The agreement may also set a precedent for future trade negotiations, emphasizing the importance of strategic partnerships in global trade.