What's Happening?

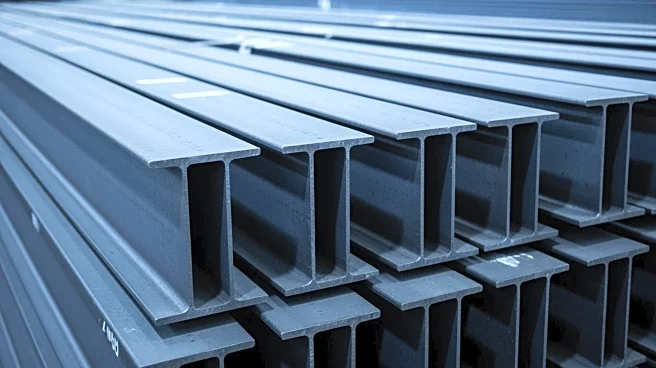

China has announced plans to maintain strict control over its steel production and exports from 2026 to 2030. This decision is part of the country's Five-Year Development Plan aimed at reducing CO2 emissions and addressing the ongoing decline in domestic

demand due to a real estate market crisis and chronic oversupply. In 2025, China's steel production fell by 4% year-on-year, with annual production expected to drop below 1 billion tons for the first time in six years. To manage the imbalance between supply and demand, China will introduce a licensing system for the export of approximately 300 steel products starting in 2026. This move comes as China has been increasing steel exports since 2023 to offset weak domestic demand, leading to trade restrictions in various countries.

Why It's Important?

China's decision to regulate steel production and exports is significant for the global steel market, which has been grappling with excess supply and trade tensions. The introduction of a licensing system aims to control product quality, but its effectiveness in limiting export volumes and supporting price recovery remains uncertain. The Japan Iron and Steel Federation has expressed skepticism about the impact of these measures, noting that government subsidies continue to contribute to global oversupply. For U.S. stakeholders, including steel manufacturers and policymakers, China's regulatory actions could influence trade dynamics and affect domestic steel prices and availability. The U.S. has already implemented trade barriers, such as increased tariffs, which have impacted profits for companies like Nippon Steel.

What's Next?

The global steel market will closely monitor China's implementation of the licensing system and its impact on export volumes and prices. Countries affected by China's steel exports may consider additional trade measures to protect their domestic industries. The effectiveness of China's regulations in reducing CO2 emissions and addressing supply-demand imbalances will also be scrutinized. As the U.S. continues to navigate trade relations with China, further adjustments to tariffs and trade policies may be considered to mitigate the impact on American steel producers and consumers.

Beyond the Headlines

China's regulatory approach to steel production and exports highlights broader challenges in balancing economic growth with environmental sustainability. The country's efforts to reduce CO2 emissions align with global climate goals, but the reliance on government subsidies and the potential for continued oversupply raise questions about the long-term viability of these measures. Additionally, the geopolitical implications of China's trade policies could influence international relations and economic partnerships, particularly with major steel-producing nations.