What is the story about?

What's Happening?

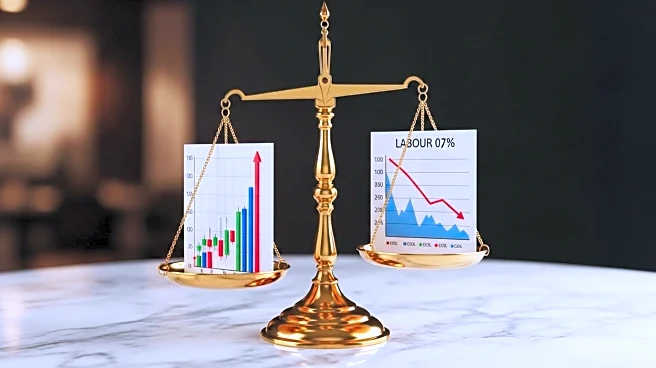

The U.S. labor market has shown signs of weakening, as evidenced by the August 2025 nonfarm payrolls report, which revealed the addition of only 22,000 jobs, significantly below the expected 75,000. This has resulted in an increase in the unemployment rate to 4.3%, the highest since 2021. The disappointing job figures have heightened expectations for the Federal Reserve to implement rate cuts, with traders now pricing in a 100% probability of a 25-basis-point cut in September. The potential for further rate reductions is also being considered, with a 12% chance of a half-point cut. This economic backdrop has led to significant movements in financial markets, particularly affecting equities and gold. Gold prices have surged to $3,585 per ounce, reflecting its role as a hedge against inflation and central bank uncertainty. Meanwhile, the equity market is experiencing sector-specific rotations, with financials historically outperforming during rate-cut cycles.

Why It's Important?

The anticipated rate cuts by the Federal Reserve are significant as they could reshape the economic landscape, impacting various sectors differently. Financial institutions may benefit from steeper yield curves, which enhance net interest margins, although a flat yield curve could pose challenges. Defensive sectors like consumer staples and healthcare are expected to maintain stability due to their consistent demand, even amidst economic volatility. The rise in gold prices underscores its appeal as a safe haven asset, particularly in times of economic uncertainty and low real interest rates. The broader implications of these developments include potential shifts in asset allocation strategies, with investors seeking to balance growth opportunities with risk mitigation. The Fed's policy decisions will be crucial in determining the trajectory of the U.S. economy, influencing inflation rates, trade policies, and overall market sentiment.

What's Next?

As the Federal Reserve's September meeting approaches, market participants will closely monitor any signals regarding the extent and timing of rate cuts. The Fed's decisions will likely influence investor strategies, prompting potential reallocations towards sectors poised to benefit from lower borrowing costs. Additionally, the ongoing trade policy uncertainties and inflationary pressures will remain key factors in shaping economic forecasts. Stakeholders, including businesses and policymakers, will need to navigate these dynamics carefully to mitigate risks and capitalize on emerging opportunities. The outcome of the Fed's policy actions will have far-reaching effects on the U.S. economy, potentially affecting consumer spending, corporate investment, and overall economic growth.

Beyond the Headlines

The current economic environment highlights the delicate balance the Federal Reserve must maintain between supporting growth and managing inflation. Prolonged periods of low interest rates could lead to asset price inflation, increasing the risk of future market corrections. Moreover, geopolitical tensions and concerns about the Fed's independence may add layers of complexity to the economic outlook. Investors and policymakers alike will need to consider these factors as they make decisions in an increasingly uncertain global landscape.