What's Happening?

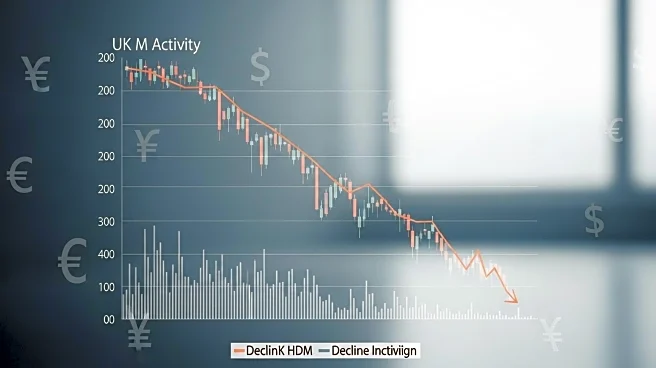

The UK mergers and acquisitions (M&A) market has experienced a notable decline in activity during the first half of 2025, according to a report by PwC. The total deal value reached £57.3 billion, marking a 12.3% decrease from the previous year's £65.3 billion. The number of transactions also fell by 19.1%, with 1,478 deals compared to 1,828 in the same period last year. This downturn is attributed to global economic volatility, particularly influenced by trade policies from major economies and geopolitical tensions in Europe. Despite the overall reduction in deal volume, the average deal size increased to £169.2 million, indicating a shift towards fewer but more strategic transactions. Key sectors such as industrials, services, consumer markets, and technology continue to attract investment, driven by long-term strategic priorities.

Why It's Important?

The decline in M&A activity reflects broader economic challenges that could impact various industries and stakeholders. The reduced deal volume suggests a cautious approach by investors amid uncertain economic conditions. However, the increase in average deal size indicates a focus on strategic investments, which could lead to significant developments in sectors like technology and financial services. This trend highlights the importance of adaptability and strategic planning for businesses looking to navigate the current economic landscape. The ongoing volatility may affect job creation, innovation, and economic growth, emphasizing the need for stability and resolution of geopolitical issues.

What's Next?

Looking ahead, the UK M&A market may see growth in the second half of 2025, contingent on macroeconomic stability and geopolitical resolutions. If major economies ease trade tensions and geopolitical conflicts are resolved, there could be a resurgence in deal-making activities. Investors are likely to continue focusing on sectors driven by digital transformation, energy transition, and healthcare innovation. The availability of capital and clear strategic imperatives suggest a potential stable environment for future deal-making, provided external conditions improve.

Beyond the Headlines

The current M&A landscape underscores the importance of strategic investments in sectors aligned with megatrends such as digital transformation and energy transition. These investments are not only about operational improvements but also about generating real value by supporting management teams and understanding asset integration within broader ecosystems. The focus on fewer but larger deals may lead to significant shifts in industry dynamics, influencing competitive landscapes and long-term growth strategies.