What's Happening?

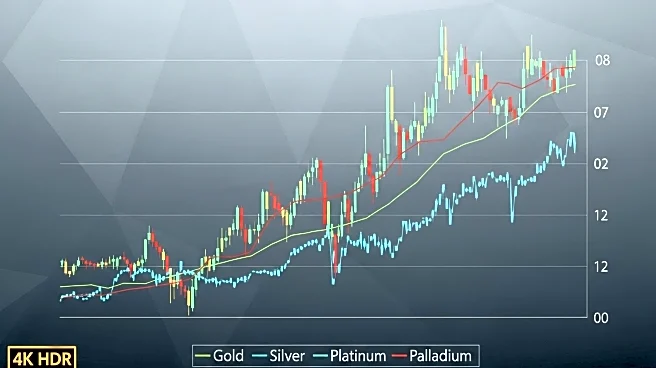

Gold prices have reached a record high, while silver has hit a 14-year peak, as bull markets continue to surge. Jim Wyckoff, a seasoned financial journalist and market analyst, has been closely monitoring these developments. Wyckoff, who has extensive experience in the stock, financial, and commodity markets, provides analytical and educational insights through his service, 'Jim Wyckoff on the Markets.' His background includes roles as a technical analyst for Dow Jones Newswires and senior market analyst with TraderPlanet.com. Wyckoff's analysis is highly regarded, and he consults for the 'Pro Farmer' agricultural advisory service. The current market trends reflect significant movements in precious metals, influenced by various economic indicators such as the U.S. dollar index and the 10-year U.S. Treasury yield.

Why It's Important?

The surge in gold and silver prices is significant for investors and the broader economy. Precious metals are often seen as safe-haven assets, particularly during times of economic uncertainty. The record highs suggest increased investor confidence in these commodities, potentially driven by concerns over inflation and currency fluctuations. This trend could impact various stakeholders, including mining companies, investors, and financial markets. As gold and silver prices rise, mining companies may see increased profitability, while investors might adjust their portfolios to capitalize on these gains. Additionally, the movement in precious metals can influence monetary policy decisions, as central banks may respond to inflationary pressures.

What's Next?

The future trajectory of gold and silver prices will likely depend on several factors, including economic data releases, monetary policy decisions, and geopolitical developments. Investors and analysts will be closely watching upcoming reports, such as the U.S. ADP jobs report, which could provide insights into the labor market and economic health. Any changes in the U.S. dollar index or Treasury yields could also affect precious metal prices. Stakeholders, including financial institutions and policymakers, may need to adapt their strategies in response to these market dynamics.

Beyond the Headlines

The rise in gold and silver prices may have deeper implications for global economic stability and investor behavior. As traditional currencies face challenges, the appeal of precious metals as alternative stores of value could grow. This shift might lead to increased interest in commodities trading and investment strategies focused on hedging against economic volatility. Additionally, the environmental and ethical considerations of mining practices could come under scrutiny as demand for these metals increases.