What is the story about?

What's Happening?

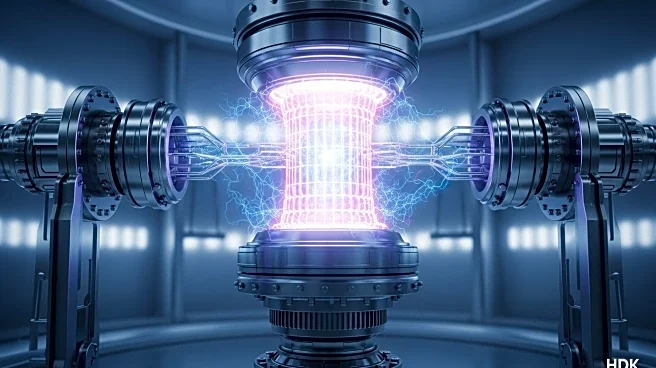

Representative Carol D. Miller has introduced the Fusion Advanced Manufacturing Parity Act, a legislative proposal aimed at amending the Internal Revenue Code to provide tax incentives for the production of fusion energy components. The bill seeks to expand the existing advanced manufacturing production credit to include a 25% tax credit for manufacturers producing eligible fusion energy components. These components include high-temperature superconducting magnets, fusion chambers, and high-energy lasers, among others. The legislation also outlines a phased reduction of the tax credit, starting in 2032, with a complete phase-out by the end of 2034. The amendments are set to take effect for components produced and sold after December 31, 2025.

Why It's Important?

The introduction of this bill is significant as it aims to accelerate the development and commercialization of fusion energy technologies, which are considered a potential clean energy source. By providing financial incentives, the bill could stimulate investment in the fusion energy sector, encouraging innovation and reducing production costs. This could have a broader impact on the energy industry, potentially influencing the market dynamics for alternative energy technologies. Companies involved in related technologies, such as Plug Power and Ballard Power Systems, may benefit from advancements in fusion energy, which could complement their existing product lines. The bill reflects a strategic move to position the U.S. as a leader in the emerging fusion energy market.

What's Next?

If passed, the bill will require manufacturers to adjust their production strategies to take advantage of the new tax incentives. The phased reduction of the credit suggests a push for rapid development and adoption of fusion technologies. Stakeholders, including energy companies and investors, will likely monitor the bill's progress closely, as its passage could signal increased government support for fusion energy. The legislative process will involve discussions and potential amendments before any final decision is made. The outcome could influence future policy directions in the energy sector, particularly concerning clean energy initiatives.

Beyond the Headlines

The bill's focus on fusion energy highlights a growing interest in sustainable and clean energy solutions. Fusion energy, if successfully developed, could provide a virtually limitless and environmentally friendly power source. The legislation also raises questions about the role of government incentives in driving technological innovation and the balance between public support and market-driven advancements. The gradual phase-out of the tax credit suggests an expectation that the fusion energy sector will become self-sustaining over time, reducing reliance on government subsidies.