What is the story about?

What's Happening?

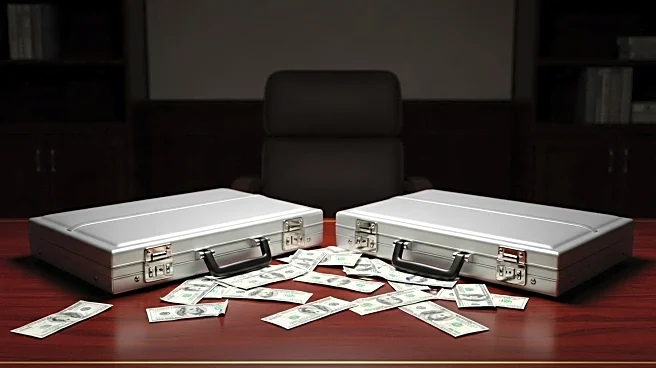

Twin brothers Adam and Daniel Kaplan from Long Island have been accused of defrauding clients out of more than $5 million. The charges include forging bank records and checks, and intimidating witnesses. The Kaplans allegedly charged clients higher commissions than agreed upon and used fraudulent businesses to steal money. Adam Kaplan faces additional charges for attempting to intimidate witnesses and destroy evidence. The trial is underway in the US District Court in Central Islip, with co-conspirator Ron Roth testifying against the brothers.

Why It's Important?

This case highlights significant issues in financial advisory practices, including fraud and unethical behavior. The alleged actions of the Kaplan brothers could undermine trust in financial advisors and impact investor confidence. The case also emphasizes the importance of regulatory oversight and legal accountability in the financial sector. If convicted, the Kaplans could face severe penalties, which may serve as a deterrent to similar fraudulent activities.

What's Next?

The trial is ongoing, with Ron Roth's testimony being a critical component. The defense is challenging the credibility of Roth, who has pleaded guilty and agreed to testify. The outcome of the trial could influence future regulatory measures and legal standards for financial advisors. Stakeholders in the financial industry are likely to monitor the case closely for its implications on advisory practices and investor protection.