What's Happening?

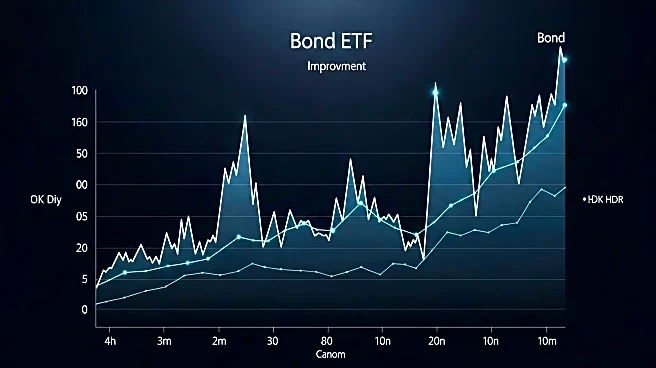

Katie Stockton, a market analyst, reports that the iShares 20+ Year Treasury Bond ETF (TLT) is showing signs of improvement amid increased market volatility. The ETF has stabilized since reaching a bear cycle low in late 2023, offering an attractive yield of 4.14%. Technical indicators, such as the DeMARK Indicators, suggest an intermediate-term counter-trend 'buy' signal, with TLT outperforming the S&P 500 Index in recent months. Despite a declining 40-week moving average, TLT has broken above its 40-week MA, and its weekly MACD has turned positive, indicating promising intermediate-term developments.

Why It's Important?

The improvement in TLT's performance amid market volatility highlights the role of bonds as a safe haven asset, providing stability to portfolios during uncertain times. As traditional equity markets face challenges, investors may increasingly turn to bonds for reliable returns. The technical analysis suggests potential short-term bullish developments, which could attract more investors to bond ETFs, impacting the broader financial market dynamics. The positive momentum in TLT may also influence investment strategies, encouraging diversification into fixed-income assets.

What's Next?

Should TLT experience a breakout above its September peak, it could target secondary resistance levels, further enhancing its appeal to investors seeking stability. The ETF's performance may prompt financial advisors to recommend increased exposure to bonds, particularly as market volatility persists. Investors will likely monitor technical indicators closely to assess the potential for continued outperformance relative to equities.

Beyond the Headlines

The evolving performance of bond ETFs like TLT may signal a shift in investment strategies, with more emphasis on fixed-income assets as a counterbalance to equity market volatility. This trend could lead to broader changes in portfolio management practices, emphasizing risk mitigation and long-term stability.