What is the story about?

What's Happening?

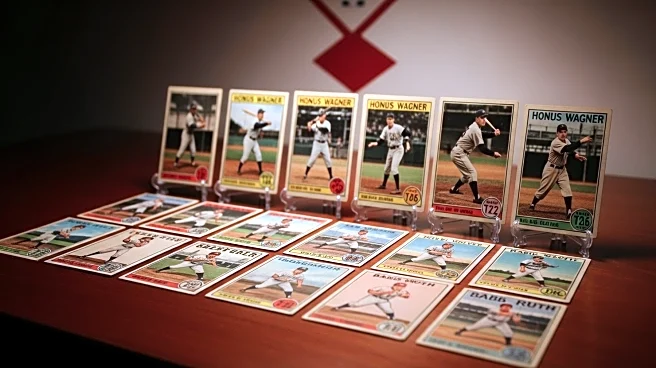

Baseball cards have emerged as a lucrative investment option, outperforming the S&P 500 since 2020. The pandemic led to a surge in interest as collectors rediscovered their old collections, driving prices up significantly. Iconic cards such as the 1933 Goudey Babe Ruth and the 1952 Topps Mickey Mantle have seen substantial price increases, with some cards appreciating by over 5,000%. This trend reflects a broader interest in alternative investments, as collectors and investors alike seek value beyond traditional financial markets.

Why It's Important?

The rise in baseball card values highlights a shift in investment strategies, with individuals seeking alternative assets that offer high returns. This trend is significant for the collectibles market, which has gained legitimacy as a viable investment avenue. The appreciation of these cards suggests a growing interest in tangible assets, potentially influencing market dynamics and investment portfolios. Collectors and investors who have held onto rare cards are seeing substantial financial gains, underscoring the potential for collectibles to serve as a store of value.

What's Next?

As the market for baseball cards continues to evolve, investors may increasingly view collectibles as a strategic component of their portfolios. The sustained interest could lead to further price increases, especially for rare and iconic cards. Market participants might explore new opportunities within the collectibles space, potentially expanding into other sports or memorabilia. The ongoing demand could also prompt more structured investment vehicles focused on collectibles, offering investors diversified exposure to this burgeoning market.

Beyond the Headlines

The surge in baseball card values raises questions about the sustainability of such investments and the potential for market volatility. Ethical considerations may arise regarding the commodification of cultural artifacts and the impact on traditional collectors. Additionally, the trend reflects broader cultural shifts, as nostalgia and historical significance drive interest in tangible assets. This development could influence how future generations perceive and value collectibles, potentially reshaping the landscape of alternative investments.