What's Happening?

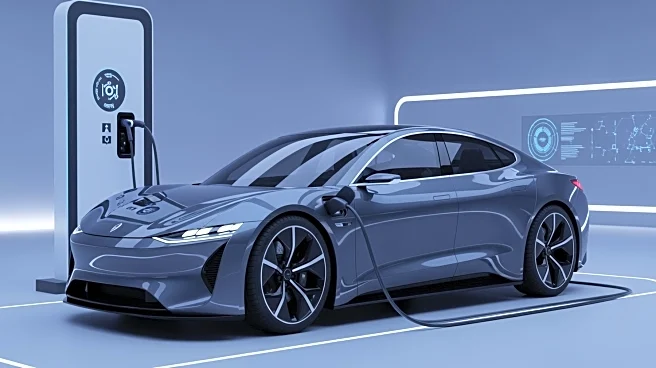

Tesla Inc. reported a significant drop in profit due to rising costs, despite achieving record electric vehicle sales in the latest quarter. The company's adjusted earnings fell to 50 cents per share,

a 31% decrease from the previous year, missing analysts' expectations of 54 cents. Revenue, however, exceeded forecasts at $28.1 billion. The increase in operating expenses, which rose by 50% to $3.4 billion, and anticipated $400 million in U.S. tariff impacts, contributed to the profit decline. CEO Elon Musk emphasized future growth through artificial intelligence and self-driving technology, but the immediate financial results have raised concerns about Tesla's cost management and competitive positioning.

Why It's Important?

Tesla's financial performance highlights the challenges faced by the electric vehicle industry amid rising production costs and competitive pressures. The company's ability to manage expenses while scaling production is critical for sustaining profitability and investor confidence. The decline in profit, despite strong sales, underscores the impact of external factors such as tariffs and increased competition. As Tesla continues to invest in AI and autonomous technology, the financial strain could affect its ability to innovate and maintain market leadership. The results also reflect broader industry trends, where automakers are grappling with cost pressures while transitioning to electric and autonomous vehicles.

What's Next?

Tesla's future performance will depend on its ability to navigate cost challenges and execute its strategic vision for AI and autonomous vehicles. The company plans to expand its robotaxi business, pending regulatory approvals, which could open new revenue streams. However, the timeline and costs associated with these initiatives remain uncertain. Investors will be watching for updates on Tesla's cost management strategies and progress in autonomous technology development. The company's ability to adapt to changing market conditions and regulatory environments will be crucial for its long-term success.