What's Happening?

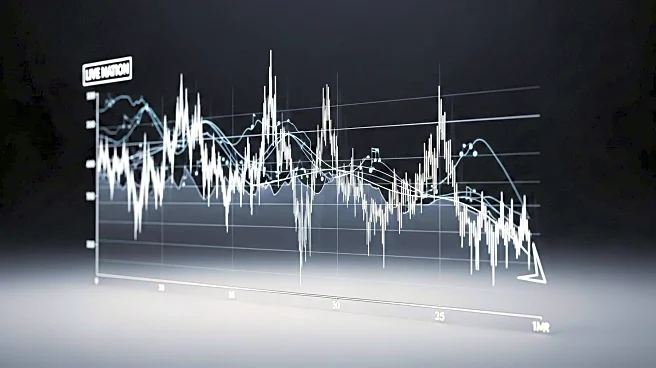

Live Nation's stock experienced a decline of 1.9%, closing at $163.42, which reduced its year-to-date gain to 26.2%. This movement comes amidst a mixed performance in the music industry, as reported in the Billboard Global Music Index (BGMI). The index itself rose by 1.7% to 3,301.18, marking a year-to-date gain of 42.7%. While some companies like Sphere Entertainment and Spotify saw significant gains, others, including Tencent Music Entertainment and LiveOne, faced declines. The broader market also showed mixed results, with the Nasdaq composite index rising by 2.6% and the S&P 500 gaining 0.2%, despite a disappointing jobs report from the Bureau of Labor Statistics.

Why It's Important?

The decline in Live Nation's stock is significant as it reflects broader trends and investor sentiment within the music industry. As a major player in live events and ticketing, Live Nation's performance can be indicative of consumer confidence and spending in entertainment sectors. The mixed results in the BGMI suggest varying investor confidence across different music companies, influenced by factors such as market conditions and company-specific developments. The overall market's reaction to economic indicators, like the jobs report, also plays a role in shaping investor behavior, impacting companies like Live Nation that are sensitive to economic cycles.

What's Next?

Investors and industry stakeholders will likely monitor upcoming economic reports and company earnings to gauge future performance. For Live Nation, upcoming concert tours and events could influence stock performance, depending on consumer demand and economic conditions. Additionally, broader market trends and economic policies will continue to impact investor sentiment and stock valuations across the music industry.

Beyond the Headlines

The stock movements within the music industry highlight the ongoing challenges and opportunities in adapting to post-pandemic consumer behaviors. Companies like Live Nation may need to innovate and diversify their offerings to maintain growth amidst changing market dynamics. The industry's response to economic fluctuations and consumer preferences will be crucial in shaping its future trajectory.